Enghouse Systems (TSX:ENGH) Margin Compression Challenges Bullish Profitability Narrative After FY 2025 Results

Reviewed by Simply Wall St

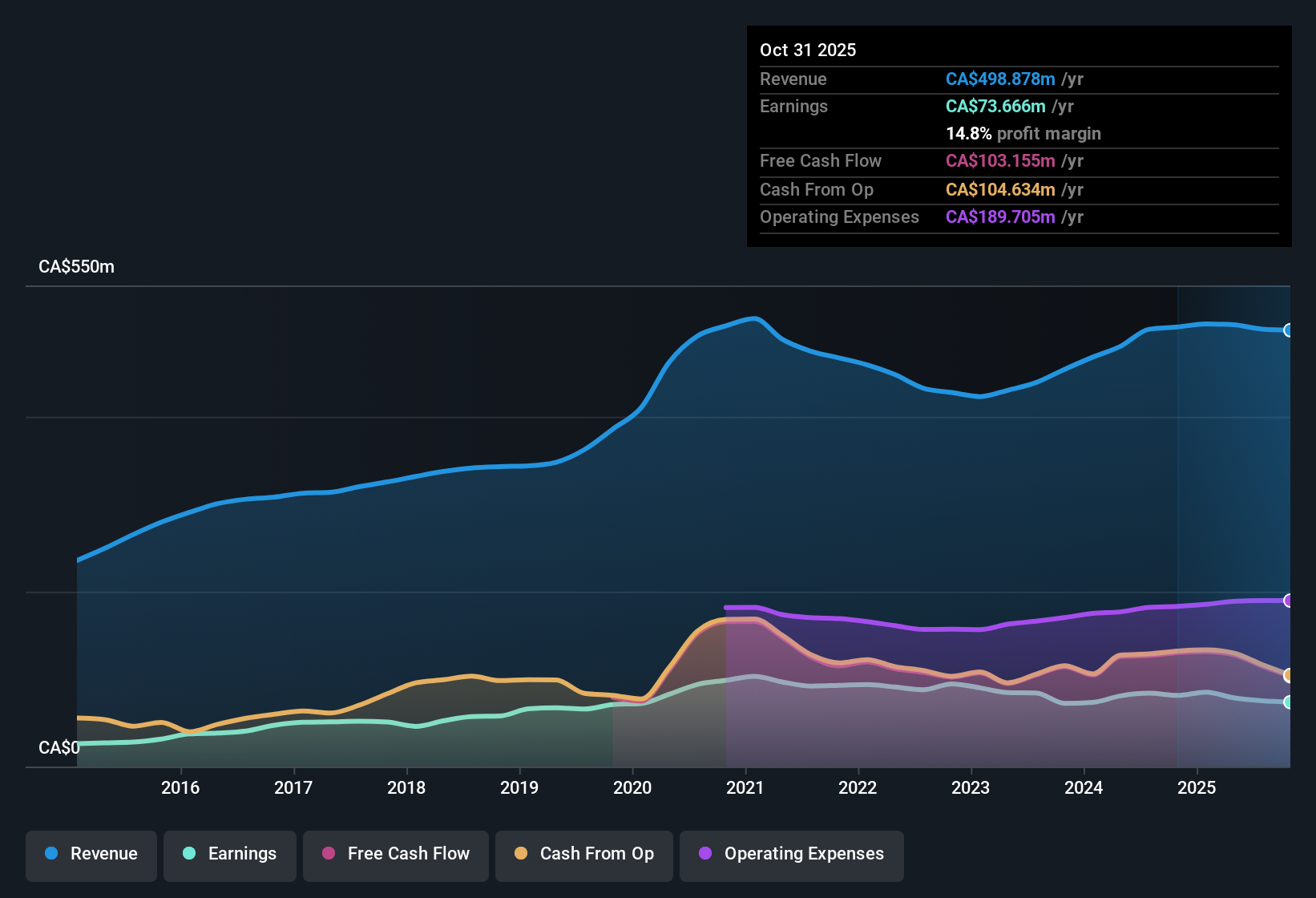

Enghouse Systems (TSX:ENGH) has wrapped up FY 2025 with fourth quarter revenue of CA$124.5 million and basic EPS of CA$0.38, while net income excluding extra items came in at CA$21.1 million, setting the tone for a steady finish to the year. The company has seen quarterly revenue hold in a tight band between CA$124 million and CA$125.8 million over the last four reported quarters, with EPS ranging from CA$0.24 to CA$0.40. This gives investors a clear view of how profitability tracks through the cycle. Against that backdrop, the latest numbers point to a business where the big question is whether margins can hold the line as investors look ahead to the next leg of growth.

See our full analysis for Enghouse Systems.With the headline figures on the table, the next step is to test them against the dominant narratives around Enghouse, from earnings power and margin resilience to how durable its growth story really looks.

See what the community is saying about Enghouse Systems

Margins Ease Back From 16.2 percent To 14.8 percent

- Over the last 12 months, net profit margin sat at 14.8 percent versus 16.2 percent a year earlier, while trailing net income slipped from CA$81.3 million to CA$73.7 million even though trailing revenue stayed close to CA$500 million.

- Consensus narrative expects margin support from acquisitions and efficiency work, yet the current 14.8 percent margin and five year annualized EPS decline of 5.7 percent highlight a challenge to that bullish view.

- Strategies like integrating acquisitions to contribute positively to EBITDA and cutting third party software in businesses such as Lifesize are intended to lift profitability but have not yet shown up as higher trailing margins.

- The move to more cloud services and a dual SaaS or on premise model is expected to improve earnings stability, but the lower margin today suggests this transition carries near term pressure that investors need to factor in.

Share Price At CA$20.94 Versus 21.75 Target

- With the stock at CA$20.94 and an analyst price target of CA$21.75, the implied upside from that target is modest compared with the larger gap to the CA$45.66 DCF fair value and the 15.6 times trailing P or E multiple sitting well below the Canadian software industry’s 49.4 times.

- Bears point to slower growth and margin pressure, and the five year annualized EPS decline of 5.7 percent plus a revenue growth forecast of about 2.9 percent per year relative to a 5.3 percent Canadian market backdrop both feed into that cautious stance.

- Analysts also expect profit margins to shrink from 15.6 percent today to 12.8 percent in around three years, which lines up with concerns that the cloud heavy mix may be less profitable than traditional on premise deployments.

- Projected earnings of CA$72.7 million by roughly 2028, down from CA$78.6 million today, mean that any re rating toward a 23.2 times P or E would be happening against a backdrop of lower absolute profit, giving skeptics a clear data point to focus on.

Steady CA$498.9 Million Revenue, Mixed EPS Trend

- On a trailing basis, Enghouse generated about CA$498.9 million of revenue and CA$73.7 million of net income, giving trailing EPS of CA$1.34 compared with CA$1.54 at the start of the year and CA$1.47 to CA$1.51 in the year before that.

- Analysts’ consensus narrative talks up a stronger, more stable earnings base supported by acquisitions and a dual SaaS or on premise model, but the drift from CA$1.54 to CA$1.34 of trailing EPS alongside modest revenue growth expectations shows that stability has not yet translated into higher per share profits.

- Deals like Aculab and Margento are meant to expand Enghouse’s reach into communications and transit software, yet trailing revenue has hovered around CA$500 million instead of breaking clearly higher.

- At the same time, the company’s strong balance sheet and 5.73 percent dividend yield mean shareholders are still being paid while waiting to see whether the forecast 12.3 percent yearly earnings growth rebuilds EPS above past levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Enghouse Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that angle to shape your own view in just a few minutes and turn it into a full narrative today: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Enghouse Systems.

See What Else Is Out There

Enghouse’s slipping margins, shrinking EPS, and muted revenue growth expectations raise doubts about its ability to deliver the stable, compounding earnings many investors want.

If you would rather focus on companies already demonstrating that consistency, use our stable growth stocks screener (2087 results) to quickly zero in on businesses with steadier revenue and earnings trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enghouse Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENGH

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)