Bitfarms (TSX:BITF) Reports Q1 2025 Sales Increase From US$50M To US$67M

Reviewed by Simply Wall St

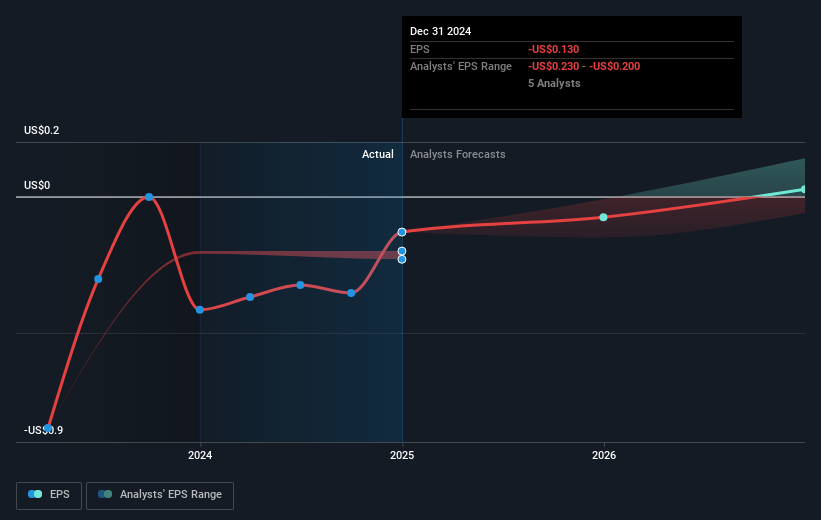

Bitfarms (TSX:BITF) recently reported a significant increase in sales for Q1 2025, rising to USD 67 million from USD 50 million the previous year, yet the company also announced a net loss of USD 36 million. This period revealed a lower Bitcoin production and a class action lawsuit related to financial reporting missteps. Despite a generally strong market with the S&P 500 showing positive momentum, Bitfarms' share price fell by 11% over the past month, likely influenced by these challenges. The legal issues and operational setbacks may have weighed on its performance, countering broader market gains.

The recent news of Bitfarms’ significant sales increase to US$67 million for Q1 2025 contrasts with a net loss of US$36 million, highlighting both operational improvements and financial strains. This mix, along with reduced Bitcoin production and a class action lawsuit, has played a role in the stock's 11% price decline over the past month. Over a longer term, however, Bitfarms delivered a total return of 162.50% over five years, illustrating considerable growth, though recent challenges have hindered its short-term stock performance relative to broader market gains like the S&P 500.

The recent setbacks could also impact future revenue and earnings forecasts. Analysts estimate the company's revenue will grow by 43.9% annually, but Bitfarms must overcome regulatory and operational hurdles to meet these projections. Additionally, current share price of CA$1.4 shows a significant discount to the CA$3.75 price target, indicating potential upside if the company resolves its current challenges.**

Our expertly prepared valuation report Bitfarms implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bitfarms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BITF

Bitfarms

Operates integrated bitcoin data centers in Canada, the United States, Paraguay, and Argentina.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)