BlackBerry (TSX:BB): Has Its Recent Momentum Pushed Valuation Too High?

Reviewed by Kshitija Bhandaru

See our latest analysis for BlackBerry.

BlackBerry has picked up momentum lately, with its share price gaining over 16% in the past month and now sitting at $6.29. While the stock is showing renewed strength, keep in mind that the one-year total shareholder return stands at a robust 83%. This highlights a long-term upswing despite some earlier volatility.

If you’re interested in finding more stocks with strong trajectories, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with this impressive rebound, investors are left wondering: are BlackBerry shares now trading at a bargain, or is the market already reflecting all of the company’s expected growth ahead?

Price-to-Earnings of 134.2x: Is it justified?

BlackBerry’s recent rally puts its price-to-earnings (P/E) ratio at a striking 134.2 times earnings, well above peers and sector averages. Even with the momentum, the current share price bakes in a premium that puts valuation front and center for potential investors seeking value in the software space.

The P/E multiple is a core measure for software firms, capturing just how much investors are willing to pay for a slice of future profits. A figure this high reflects massive expectations for future growth or profitability, but it also signals that the market is pricing in lots of upside already and leaves less room for error if results disappoint.

Relative to the Canadian Software industry, where the typical company trades at just 55.3x earnings, BlackBerry’s P/E sits in a league of its own. Compared to a fair P/E ratio estimate of 40.5x, the markup appears even steeper, suggesting the stock may be priced ahead of fundamentals unless growth exceeds every prediction.

Explore the SWS fair ratio for BlackBerry

Result: Price-to-Earnings of 134.2x (OVERVALUED)

However, slowing revenue growth and a share price that is now above analyst targets are clear risks that could quickly reverse BlackBerry’s positive momentum.

Find out about the key risks to this BlackBerry narrative.

Another View: What Does the SWS DCF Model Say?

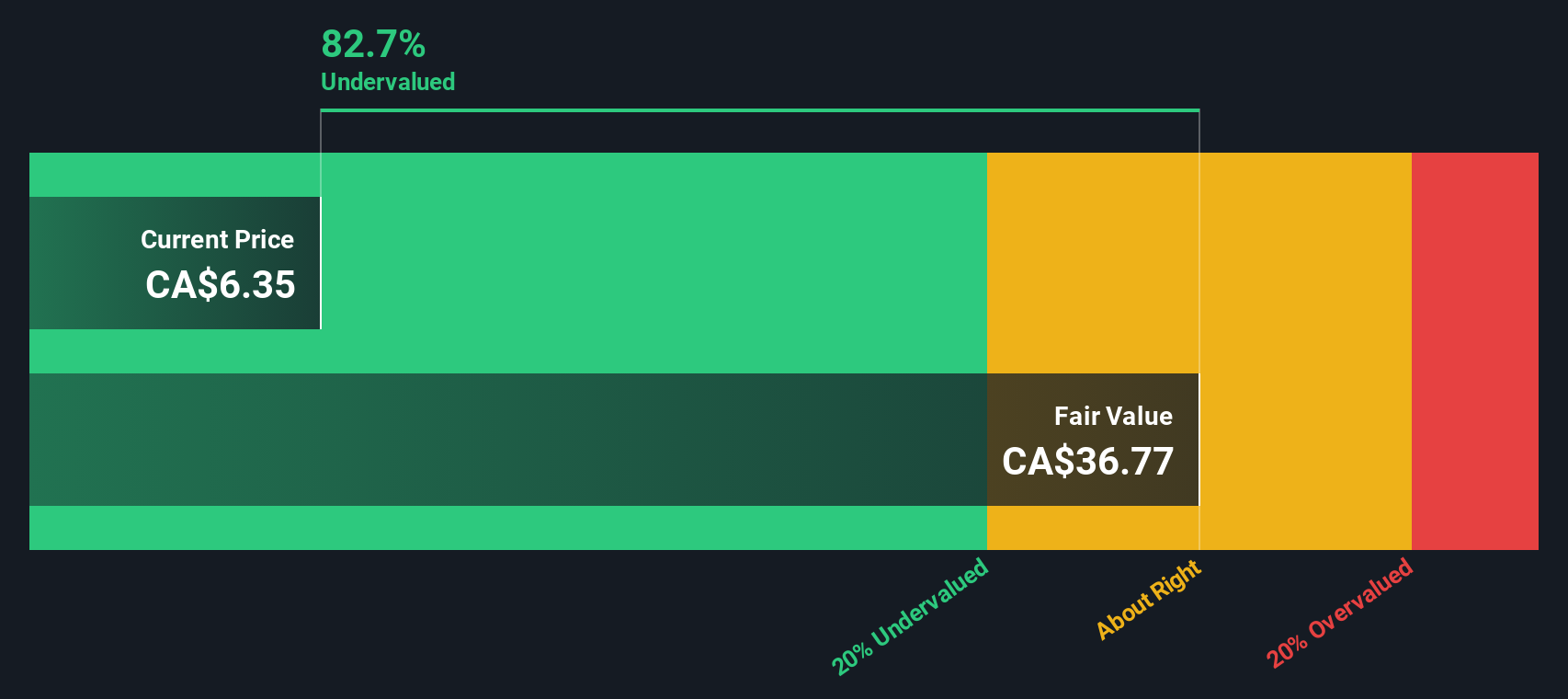

While the high price-to-earnings ratio paints BlackBerry as overvalued, the SWS DCF model reaches a notably different conclusion. According to our DCF analysis, BlackBerry is actually trading well below its estimated fair value, which suggests there could be upside that the P/E ratio alone does not capture. Could this deep discount signal a genuine value opportunity, or is the market cautious for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackBerry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackBerry Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own view of BlackBerry in just a few minutes with Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by searching beyond the obvious. Level up your portfolio insights and make sure you spot the next big opportunity before others do.

- Tap into breakthrough medical innovation by checking out these 33 healthcare AI stocks, which highlights advancements in healthcare through artificial intelligence.

- Catch high-yield potential in your income strategy with these 18 dividend stocks with yields > 3%, featuring companies offering impressive dividends above 3%.

- Get in early on tomorrow’s technological frontrunners among these 25 AI penny stocks, where artificial intelligence is powering market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives