Absolute Software (TSE:ABST) Has Affirmed Its Dividend Of CA$0.08

Absolute Software Corporation (TSE:ABST) has announced that it will pay a dividend of CA$0.08 per share on the 27th of August. This means the annual payment is 1.9% of the current stock price, which is above the average for the industry.

View our latest analysis for Absolute Software

Absolute Software Doesn't Earn Enough To Cover Its Payments

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, the company was paying out 131% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 28%. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

EPS is set to fall by 77.9% over the next 12 months. If the dividend continues along the path it has been on recently, the company could be paying out more than double what it is earning, which is definitely a bit high to be sustainable going forward.

Absolute Software Doesn't Have A Long Payment History

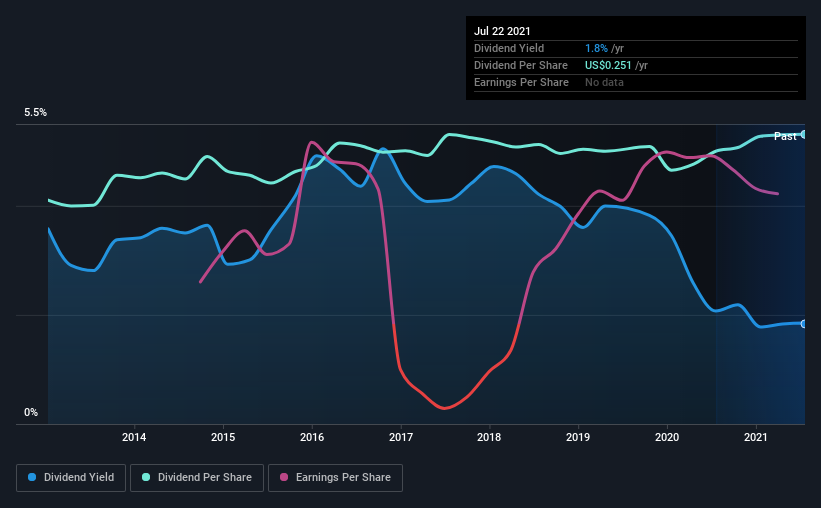

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2012, the first annual payment was US$0.19, compared to the most recent full-year payment of US$0.25. This works out to be a compound annual growth rate (CAGR) of approximately 2.9% a year over that time. Absolute Software hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. In the last five years, Absolute Software's earnings per share has shrunk at approximately 4.3% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

The company has also been raising capital by issuing stock equal to 16% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Absolute Software's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Absolute Software's payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Absolute Software that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ABST

Absolute Software

Absolute Software Corporation develops, markets, and provides software services that support the management and security of computing devices, applications, data, and networks for various organizations.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)