Is Taal Distributed Information Technologies (CSE:TAAL) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Taal Distributed Information Technologies (CSE:TAAL) stock is up 128% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given its strong share price performance, we think it's worthwhile for Taal Distributed Information Technologies shareholders to consider whether its cash burn is concerning. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Taal Distributed Information Technologies

Does Taal Distributed Information Technologies Have A Long Cash Runway?

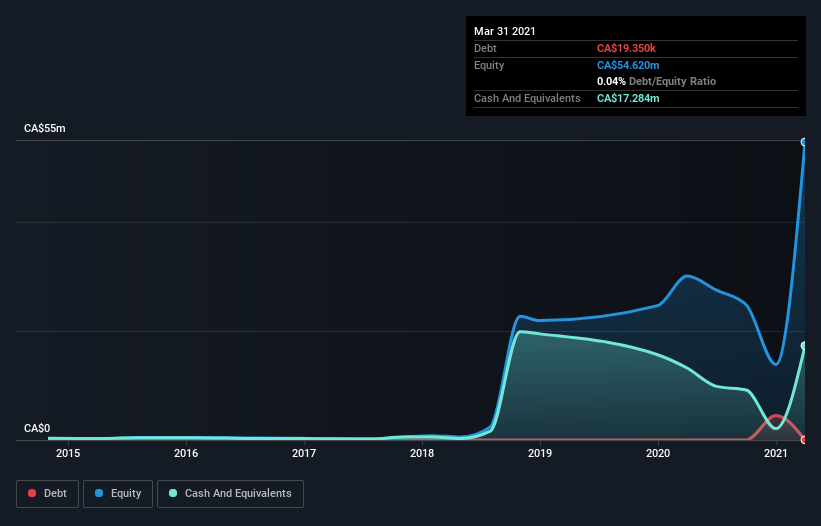

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2021, Taal Distributed Information Technologies had cash of CA$17m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was CA$12m over the trailing twelve months. That means it had a cash runway of around 17 months as of March 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Taal Distributed Information Technologies Growing?

One thing for shareholders to keep front in mind is that Taal Distributed Information Technologies increased its cash burn by 277% in the last twelve months. If that's not bad enough, it actually saw operating revenue decrease by a whopping 87% over the last year, suggesting the company is going through some sort of dangerous transition. Considering these two factors together makes us nervous about the direction the company seems to be heading. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Taal Distributed Information Technologies Raise More Cash Easily?

Since Taal Distributed Information Technologies can't yet boast improving growth metrics, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Taal Distributed Information Technologies' cash burn of CA$12m is about 7.1% of its CA$173m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Taal Distributed Information Technologies' Cash Burn Situation?

On this analysis of Taal Distributed Information Technologies' cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Taal Distributed Information Technologies that investors should know when investing in the stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taal Distributed Information Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:TAAL

Taal Distributed Information Technologies

TAAL Distributed Information Technologies Inc.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)