We're Keeping An Eye On Scope Carbon's (CSE:SCPE) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, Scope Carbon (CSE:SCPE) shareholders have done very well over the last year, with the share price soaring by 390%. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given its strong share price performance, we think it's worthwhile for Scope Carbon shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Scope Carbon

Does Scope Carbon Have A Long Cash Runway?

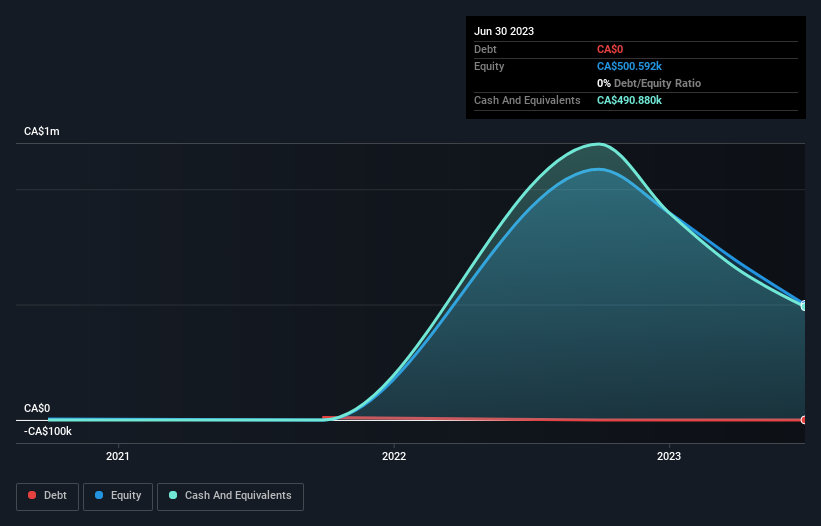

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2023, Scope Carbon had CA$491k in cash, and was debt-free. In the last year, its cash burn was CA$960k. So it had a cash runway of approximately 6 months from June 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is Scope Carbon's Cash Burn Changing Over Time?

Scope Carbon didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Remarkably, it actually increased its cash burn by 382% in the last year. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. Scope Carbon makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Scope Carbon To Raise More Cash For Growth?

Given its cash burn trajectory, Scope Carbon shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Scope Carbon's cash burn of CA$960k is about 1.3% of its CA$76m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Scope Carbon's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Scope Carbon's cash burn relative to its market cap was relatively promising. Summing up, we think the Scope Carbon's cash burn is a risk, based on the factors we mentioned in this article. On another note, Scope Carbon has 4 warning signs (and 2 which are concerning) we think you should know about.

Of course Scope Carbon may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:SCPE

Scope Technologies

Provides quantum security and machine learning solutions in data security, quantum encryption, and neural networks in Canada.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026