Could Aduro Clean Technologies' (CNSX:ACT) Conference Activity Reveal Shifts in Industry Positioning?

Reviewed by Simply Wall St

- Aduro Clean Technologies Inc. recently participated in two prominent industry events, presenting at Pyroliq III 2025 on September 11 in Italy and the Chemical Recycling Europe Forum 2025 on September 16 in Belgium, where Head of Corporate Development & Investor Relations Abe Dyck addressed attendees.

- These high-profile appearances highlight Aduro's increasing visibility within the chemical recycling sector and underscore the company's potential to attract industry partnerships and showcase technological progress.

- We’ll explore how the company’s active engagement at key conferences may influence its investment narrative and broader industry positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Aduro Clean Technologies' Investment Narrative?

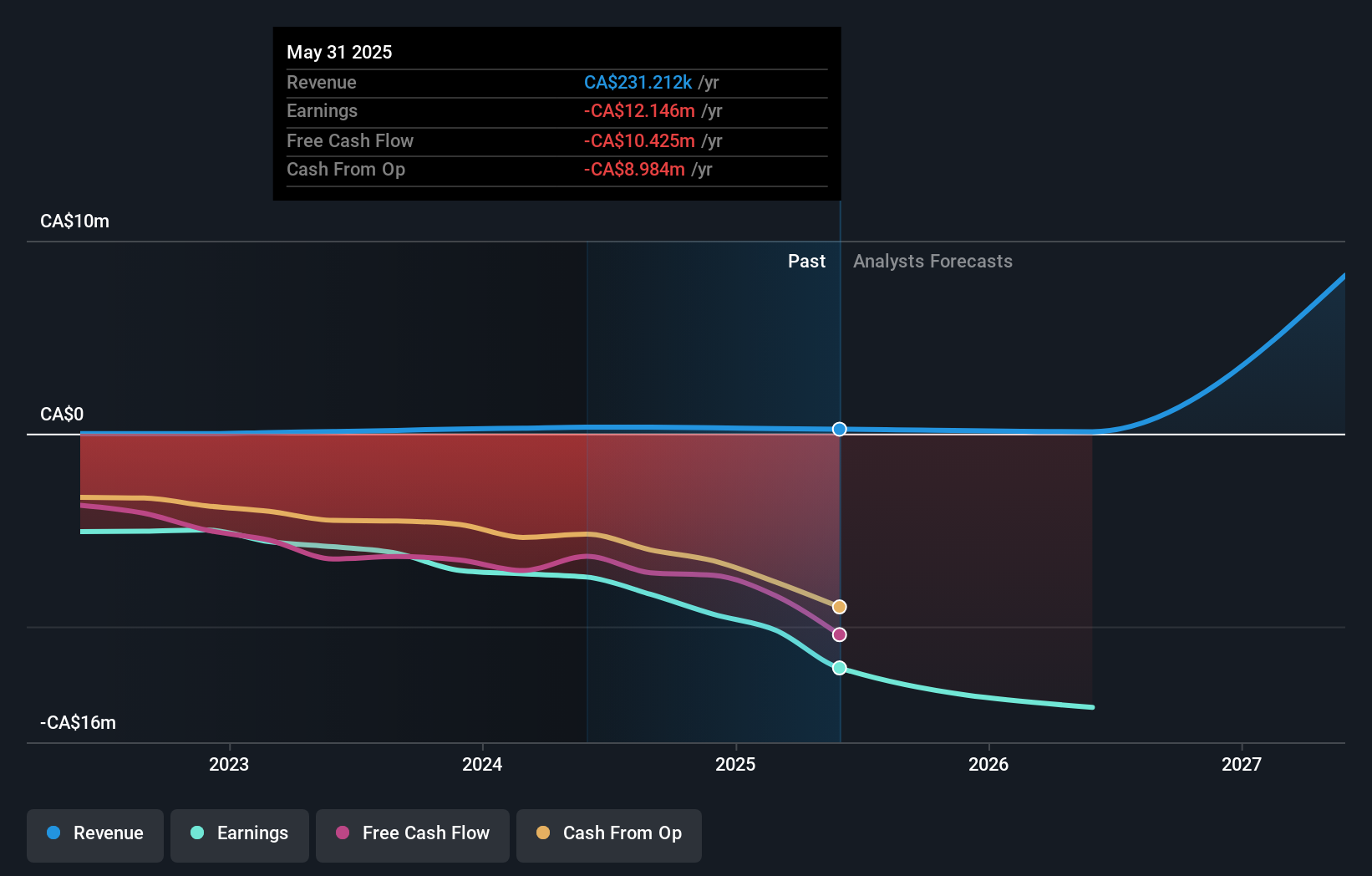

For anyone considering Aduro Clean Technologies, the big picture hinges on believing in the future of chemical recycling and the potential for Hydrochemolytic Technology to become a differentiated solution for converting challenging waste streams into valuable products. The recent appearances at Pyroliq III and Chemical Recycling Europe Forum shine a light on Aduro’s efforts to raise its profile and forge connections with influential industry players, which could matter for short-term catalysts like commercial partnerships, pilot project validation and feedstock agreements. While the financials remain a significant concern, sales are modest at CA$231,212 and losses have grown to CA$12.15 million, the real shift would come if conference exposure accelerates tangible opportunities or strategic investment. If not, the news may end up being just another visibility boost amid ongoing execution risks and steep competition.

But exposure at conferences doesn’t eliminate the need to prove the technology works at scale. The valuation report we've compiled suggests that Aduro Clean Technologies' current price could be inflated.Exploring Other Perspectives

Explore 2 other fair value estimates on Aduro Clean Technologies - why the stock might be worth over 5x more than the current price!

Build Your Own Aduro Clean Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aduro Clean Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aduro Clean Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aduro Clean Technologies' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)