- Canada

- /

- Oil and Gas

- /

- TSX:POU

Exploring 3 Promising Undervalued Small Caps In Global With Insider Action

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed results, with small- and mid-cap indexes in the U.S. showing resilience by posting gains for the fifth consecutive week amid hopes for tariff de-escalation and new trade agreements. As investors navigate this dynamic environment, identifying promising small-cap stocks that may be undervalued can offer potential opportunities, particularly when insider actions suggest confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.1x | 0.6x | 34.55% | ★★★★★☆ |

| FRP Advisory Group | 12.0x | 2.1x | 16.61% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 43.30% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 47.49% | ★★★★☆☆ |

| Eastnine | 18.2x | 8.8x | 39.40% | ★★★★☆☆ |

| Italmobiliare | 11.4x | 1.5x | -283.79% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.3x | 0.7x | 6.86% | ★★★☆☆☆ |

| Calfrac Well Services | 34.7x | 0.2x | 30.88% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 40.90% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.4x | 44.71% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

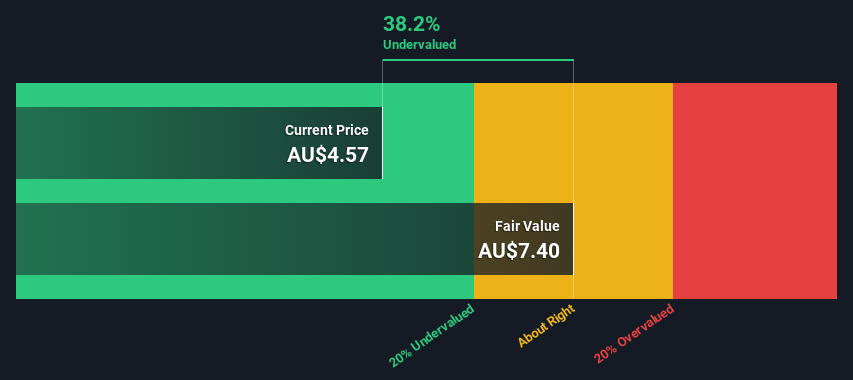

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: HMC Capital is a company engaged in real estate operations with a market capitalization of A$1.23 billion.

Operations: Revenue is primarily derived from real estate activities, with a notable segment adjustment contributing significantly to the overall figures. The gross profit margin has reached 100% in recent periods, indicating that revenue equals gross profit. Operating expenses have shown an upward trend, impacting net income margins which have also improved over time.

PE: 10.8x

HMC Capital, a company with a focus on healthcare real estate, has recently drawn attention due to insider confidence shown by Christopher Roberts, who doubled their holdings with an A$722K purchase. Despite the challenges of managing higher-risk external borrowing and potential earnings decline over the next three years, HMC's interest in acquiring Healthscope could strategically protect its REIT interests. Recent earnings showed significant growth, with net income rising to A$166.9 million from A$17.8 million year-over-year.

- Delve into the full analysis valuation report here for a deeper understanding of HMC Capital.

Evaluate HMC Capital's historical performance by accessing our past performance report.

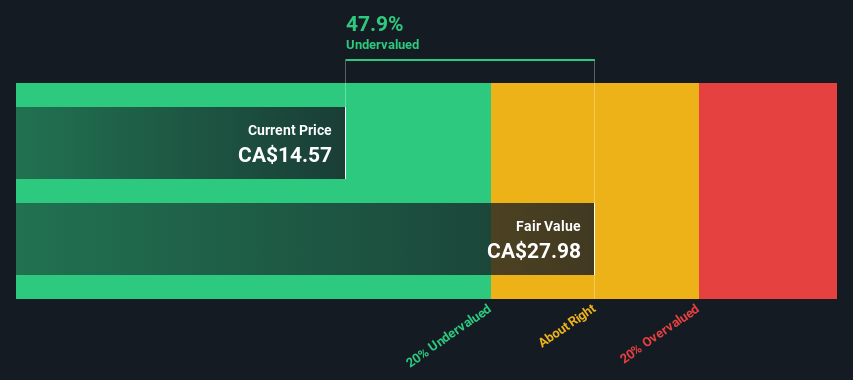

Groupe Dynamite (TSX:GRGD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Groupe Dynamite operates in the fashion retail industry, focusing on apparel, with a market cap of CA$958.53 million.

Operations: Revenue primarily comes from apparel, with the latest figures showing CA$958.53 million. The gross profit margin has seen a gradual increase, reaching 62.87% in recent periods. Operating expenses are significant, with general and administrative costs being a major component at CA$313.16 million recently.

PE: 11.8x

Groupe Dynamite, a smaller company in the retail sector, reported strong financials for the year ending February 2025, with sales climbing to C$958.53 million and net income reaching C$135.77 million. Insider confidence is evident as Chris Arsenault acquired 32,000 shares valued at approximately C$438,910. The company plans to repurchase up to 8.45% of its shares by April 2026, indicating potential value recognition by management despite high-risk funding sources through external borrowing. Looking ahead, they project comparable store sales growth between 5% and 6.5% for this year.

- Navigate through the intricacies of Groupe Dynamite with our comprehensive valuation report here.

Examine Groupe Dynamite's past performance report to understand how it has performed in the past.

Paramount Resources (TSX:POU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Paramount Resources is a Canadian energy company engaged in the exploration, development, and production of oil and natural gas with a market capitalization of approximately CA$4.23 billion.

Operations: Paramount Resources generates revenue primarily from its operations, with a notable gross profit margin reaching 64.67% in mid-2022. The company faces significant costs, including cost of goods sold and operating expenses, which have impacted its net income margins over time. Notably, the net income margin has shown fluctuations, peaking at 6.64% in mid-2017 before experiencing various changes in subsequent periods.

PE: 7.8x

Paramount Resources, a smaller player in the energy sector, recently reported a significant jump in net income for Q1 2025 to CAD 1.29 billion from CAD 68.1 million a year earlier, despite revenue dropping to CAD 358.6 million from CAD 433.8 million. The company has shown insider confidence with share repurchases totaling CAD 177 million between October 2024 and March 2025, reflecting management's belief in its potential value. With earnings expected to grow at an annual rate of nearly 42%, Paramount's financial outlook remains promising amidst market volatility and operational challenges.

Turning Ideas Into Actions

- Get an in-depth perspective on all 157 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POU

Paramount Resources

An energy company, explores for and develops conventional and unconventional petroleum and natural gas reserves and resources in Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives