Dollarama (TSX:DOL): Evaluating Valuation After 255% Share Price Growth and Recent Insider Buying

Reviewed by Kshitija Bhandaru

Dollarama (TSX:DOL) has been turning heads after its share price climbed 255% in the past five years. Recent insider buying has also further highlighted the faith placed in the retailer’s future by those within the company.

See our latest analysis for Dollarama.

Dollarama’s momentum is hard to ignore, with its latest share price closing at $178.57 and a five-year total shareholder return of 250%. The long-term trajectory remains robust, while recent insider buying suggests optimism is still running strong even as price gains have steadied.

If rising insider confidence has you thinking bigger, it might be the perfect moment to search for other fast growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership.

With Dollarama’s shares already soaring and insiders showing clear conviction, investors are left to wonder whether the current price undervalues the company’s long-term growth or if all that future potential is already reflected in the price.

Most Popular Narrative: 10% Undervalued

Dollarama's share price of CA$178.57 sits notably below the most-followed narrative's fair value estimate of CA$198.81. The gap hints at expectations of meaningful expansion beyond what the market currently prices in.

The company's aggressive international expansion, including opening Dollarcity's first store in Mexico and acquiring Australia's largest discount retailer, unlocks new, large addressable markets. This positions Dollarama for multi-year top-line revenue growth through broader geographic and demographic exposure. Sustained consumer focus on value in the current environment of high cost of living and persistent inflation continues to drive higher transaction growth and steady demand for consumables in Canada and Latin America, supporting robust revenue and same-store sales.

What exactly are analysts forecasting to back this bold price target? You might be surprised at the projected pace of international expansion and double-digit financial growth buried in the details. Curious which future profit assumptions make this fair value possible? Only the full narrative reveals the precise numbers moving the market.

Result: Fair Value of $198.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as slower than expected integration in Australia or an economic slowdown could quickly challenge Dollarama’s robust international growth story.

Find out about the key risks to this Dollarama narrative.

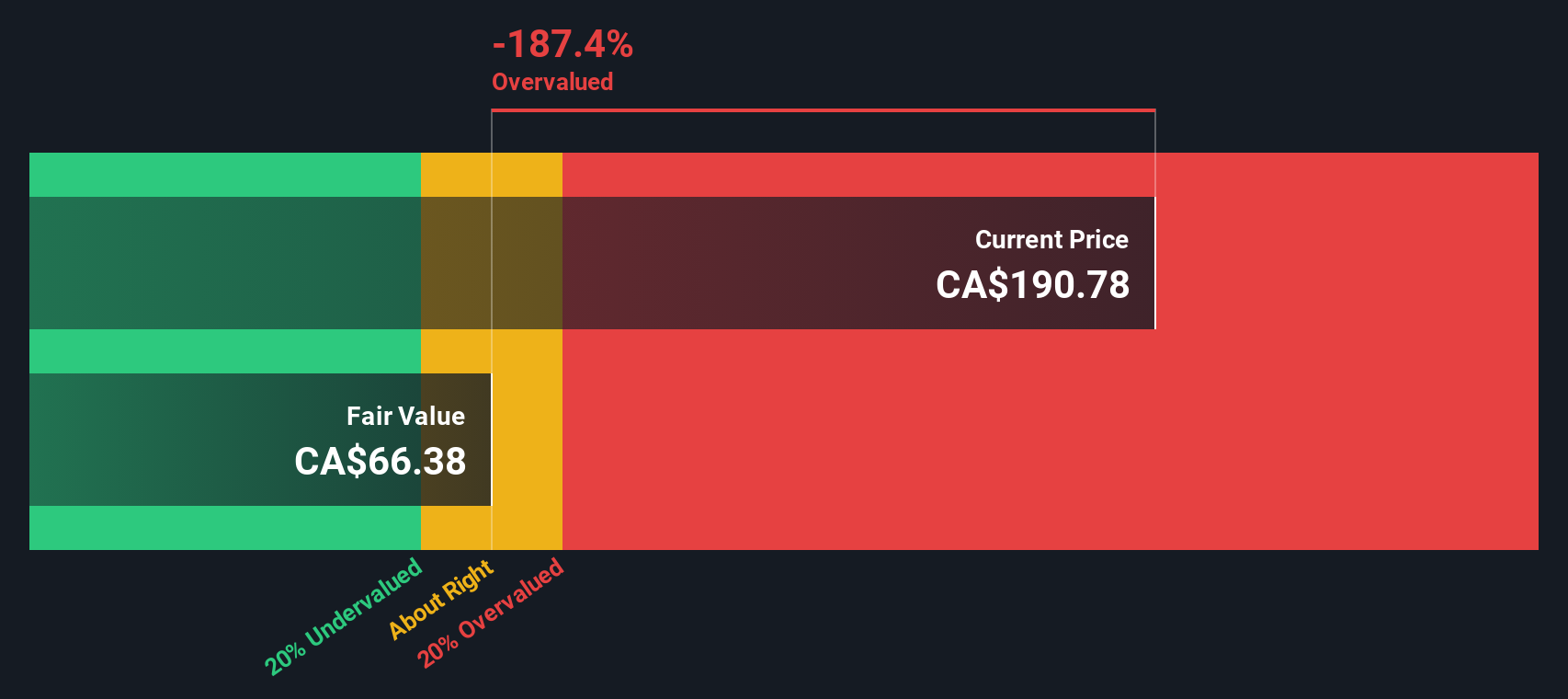

Another View: Our DCF Model Offers a Different Angle

While traditional valuation suggests Dollarama is trading on the expensive side compared to both its industry and peers, our SWS DCF model presents a slightly different perspective. According to this method, the stock is currently priced about 3.7% below its fair value, which indicates a potential margin of safety for long-term investors. The real question is which approach you trust more when making your investment decision.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dollarama Narrative

If you want to challenge these valuations or see things differently, you can dig into the data and build your own story in just minutes. Do it your way.

A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Put your money to work with confidence by scanning for investments that offer high potential, income, or innovation, all tailored to your strategy. The right picks could be within reach. Don’t let this opportunity pass you by.

- Unlock high return potential by targeting these 3574 penny stocks with strong financials that have strong fundamentals and may be flying under the radar.

- Capture income and stability with these 19 dividend stocks with yields > 3% that consistently deliver rich yields above 3%, ideal for building reliable wealth.

- Seize tomorrow’s biggest breakthroughs with these 25 AI penny stocks and tap into the world of artificial intelligence disrupting markets right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives