- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Top TSX Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

In the last week, the Canadian market has been flat, but it is up 19% over the past year with earnings forecast to grow by 15% annually. In such a robust environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 70.7% |

| Allied Gold (TSX:AAUC) | 21.9% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.7% |

We'll examine a selection from our screener results.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$5.49 billion.

Operations: The company's revenue from apparel amounts to CA$2.37 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 60.4% p.a.

Aritzia has seen substantial insider buying over the past 3 months, indicating confidence in its growth potential. While earnings are forecast to grow significantly at 60.36% per year, revenue growth is expected to be slower at 12.2% annually but still above the Canadian market average of 6.9%. Despite a recent decline in profit margins from 7.5% to 3.3%, Aritzia's return on equity is projected to remain high at 25.7%.

- Unlock comprehensive insights into our analysis of Aritzia stock in this growth report.

- Our comprehensive valuation report raises the possibility that Aritzia is priced higher than what may be justified by its financials.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$25.42 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

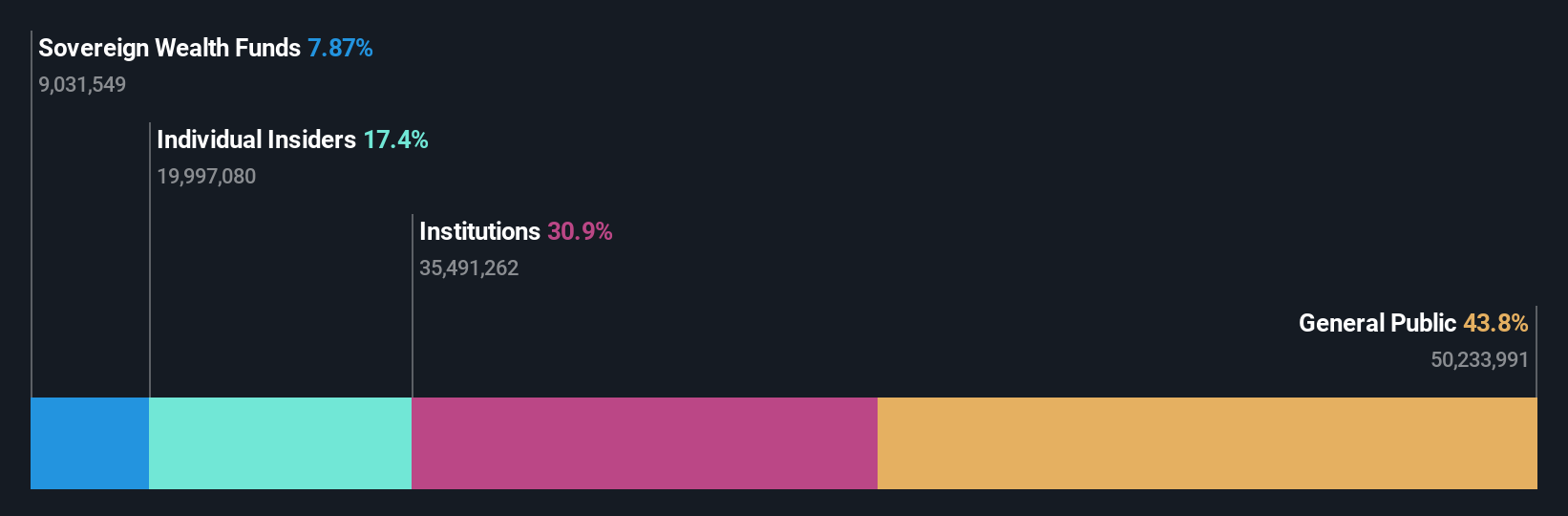

Insider Ownership: 12.3%

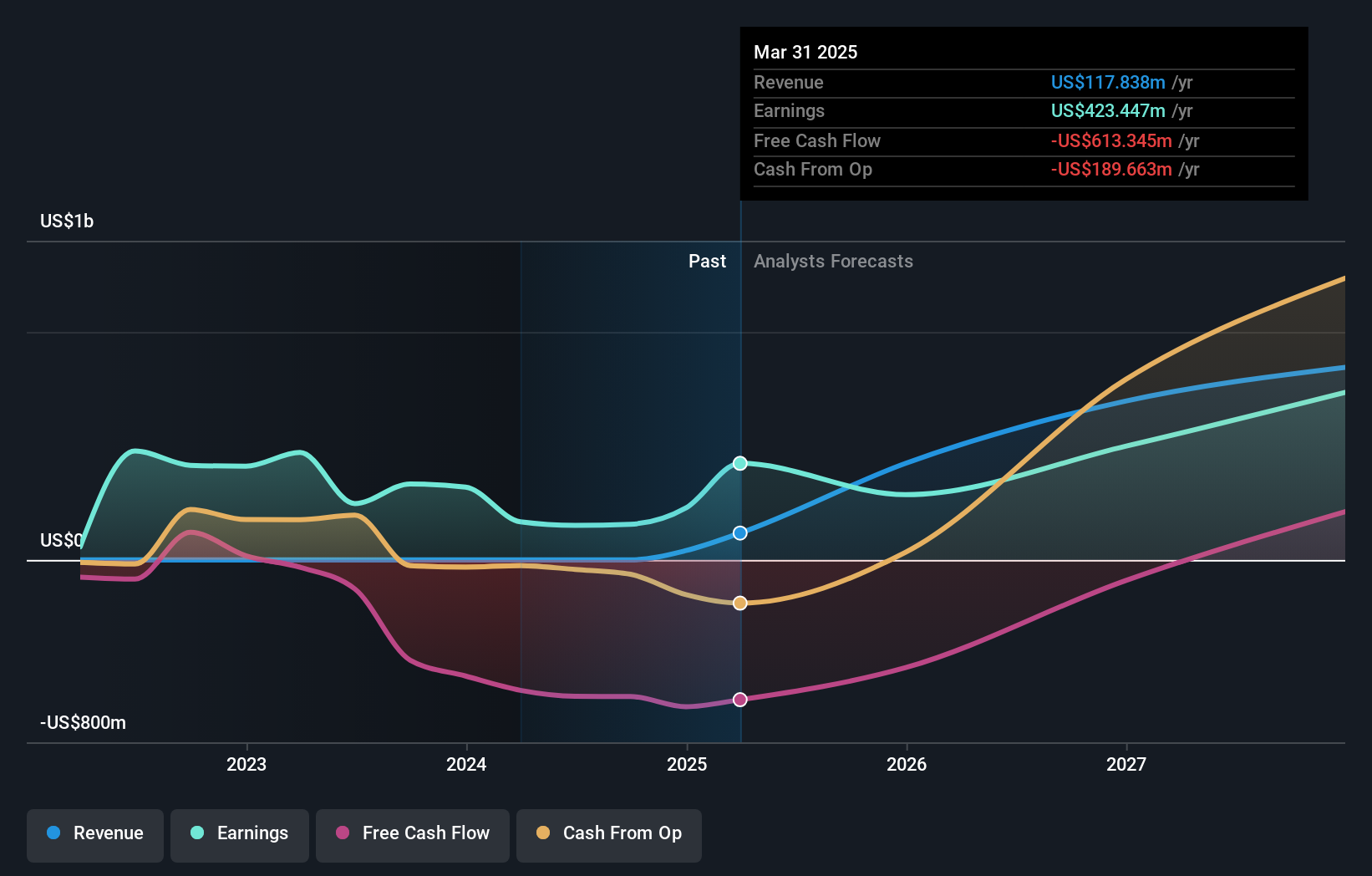

Earnings Growth Forecast: 71.5% p.a.

Ivanhoe Mines has high insider ownership and is focused on significant growth, with earnings forecasted to grow 71.51% annually, outpacing the Canadian market. Recent developments include a memorandum of understanding with Zambia's Ministry of Mines to co-develop mineral projects and record copper production at its Kamoa-Kakula Copper Complex in the DRC. However, shareholders have experienced dilution over the past year, and return on equity is expected to be modest at 17.5%.

- Delve into the full analysis future growth report here for a deeper understanding of Ivanhoe Mines.

- The valuation report we've compiled suggests that Ivanhoe Mines' current price could be quite moderate.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.09 billion.

Operations: Propel Holdings generates revenue of $382.44 million from providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 40%

Earnings Growth Forecast: 37.2% p.a.

Propel Holdings, with high insider ownership, is experiencing robust growth. Recent earnings for Q2 2024 showed a substantial increase in sales to US$106.75 million from US$71.69 million the previous year, and net income rose to US$11.12 million from US$5.71 million. The company was added to the S&P Global BMI Index and expanded its credit facility by $80 million to support growth strategies. However, there has been significant insider selling recently despite strong financial performance and dividend increases.

- Click here and access our complete growth analysis report to understand the dynamics of Propel Holdings.

- The valuation report we've compiled suggests that Propel Holdings' current price could be inflated.

Where To Now?

- Gain an insight into the universe of 39 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and slightly overvalued.