- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Undiscovered Gems in Canada to Explore This October 2024

Reviewed by Simply Wall St

As we head into the fourth quarter of 2024, the Canadian market has experienced a volatile start despite a strong performance earlier in the year, with key indices like the TSX up over 14%. This turbulence stems from uncertainties around global geopolitical tensions and economic indicators, yet solid fundamentals and potential interest rate cuts offer a promising backdrop for small-cap stocks. In this environment, identifying undiscovered gems involves looking for companies that demonstrate resilience and growth potential amidst shifting market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Mandalay Resources | 11.86% | 9.48% | 37.58% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Westshore Terminals Investment | NA | -2.67% | -9.77% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Dundee | 5.93% | -38.65% | 39.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★★★★

Overview: Headwater Exploration Inc. is a Canadian company focused on the exploration, development, and production of petroleum and natural gas, with a market cap of CA$1.59 billion.

Operations: Headwater generates revenue primarily from its petroleum and natural gas operations, amounting to CA$484.24 million.

Headwater Exploration, a Canadian energy player, is making waves with its impressive financials. The company reported CAD 164.28 million in sales for Q2 2024, up from CAD 118.97 million the previous year, and net income of CAD 53.87 million compared to CAD 30.95 million a year ago. With earnings growth of 41% over the past year and no debt on its books for five years, Headwater appears financially robust and is trading at nearly 80% below estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of Headwater Exploration.

Evaluate Headwater Exploration's historical performance by accessing our past performance report.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

Overview: Silvercorp Metals Inc. is a company that focuses on the acquisition, exploration, development, and mining of mineral properties, with a market capitalization of CA$1.34 billion.

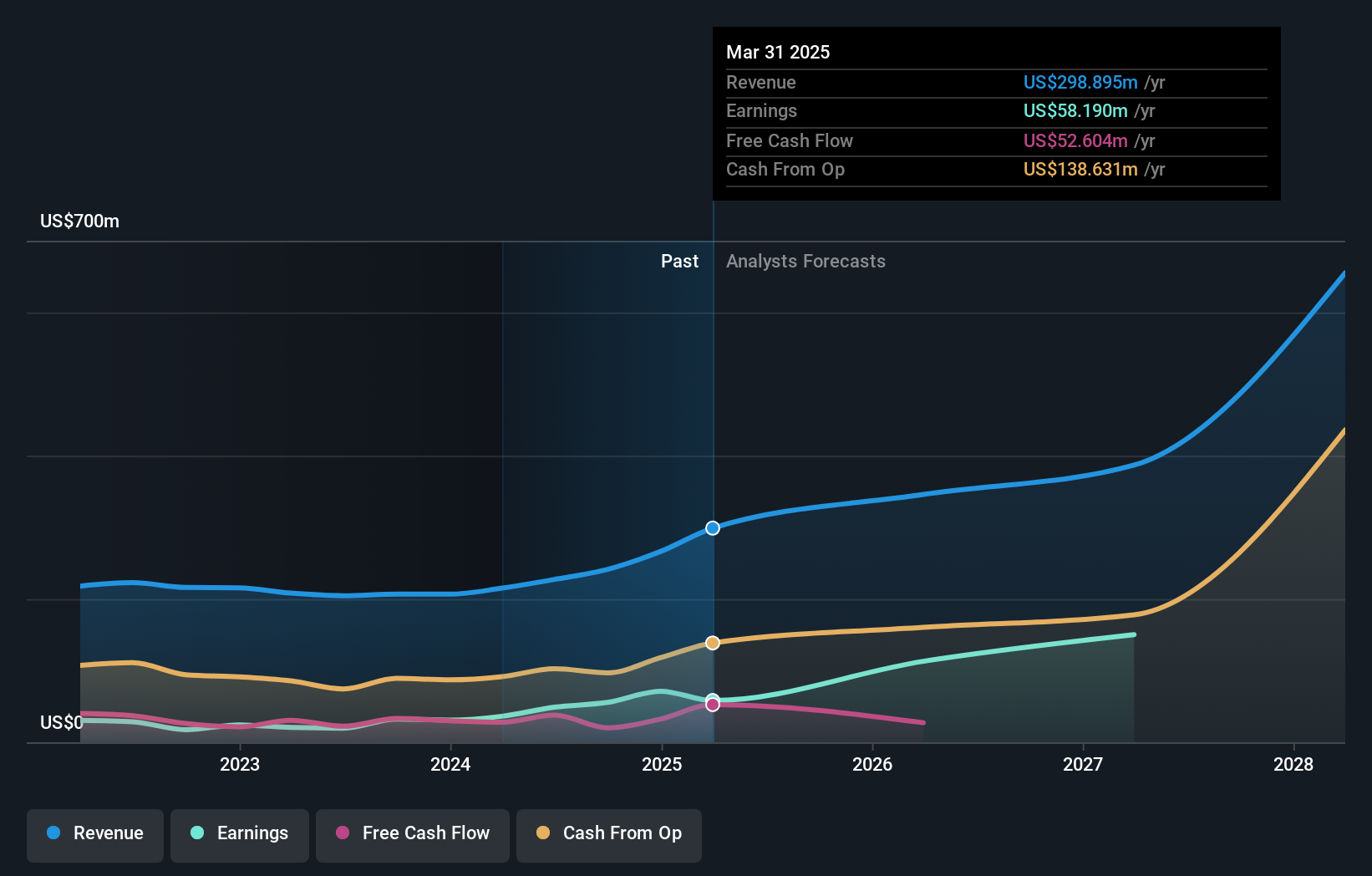

Operations: Silvercorp Metals generates revenue primarily from its mining operations in Henan Luoning and Guangdong, with the Henan Luoning segment contributing $200 million and Guangdong $27.35 million. The company's financial performance is influenced by these key revenue streams.

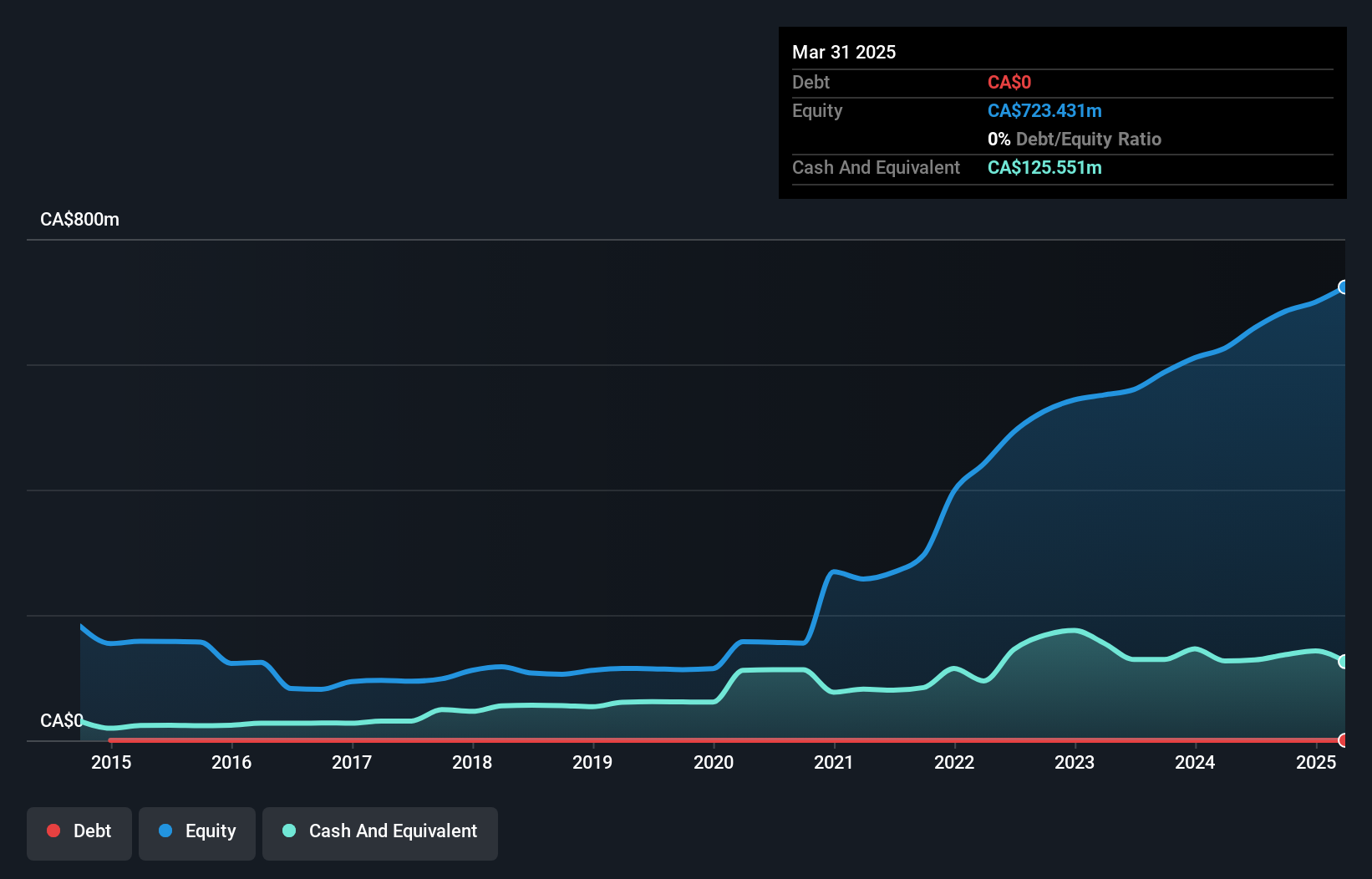

Silvercorp Metals, a nimble player in the mining sector, has seen its earnings surge by 149% over the past year, outpacing industry averages. Trading at a significant 89% below estimated fair value and boasting debt-free operations, it presents an intriguing prospect. Recent moves include announcing a share repurchase program to buy back up to 8.67 million shares, enhancing shareholder value. Despite some insider selling recently, Silvercorp's robust financial health and strategic expansions signal potential growth ahead.

- Click to explore a detailed breakdown of our findings in Silvercorp Metals' health report.

Assess Silvercorp Metals' past performance with our detailed historical performance reports.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. is engaged in the exploration, development, and processing of lithium brine properties in the United States with a market capitalization of CA$413.46 million.

Operations: Standard Lithium Ltd. currently does not report any revenue segments, indicating that it may still be in the exploration and development phase without significant commercial operations contributing to revenue streams.

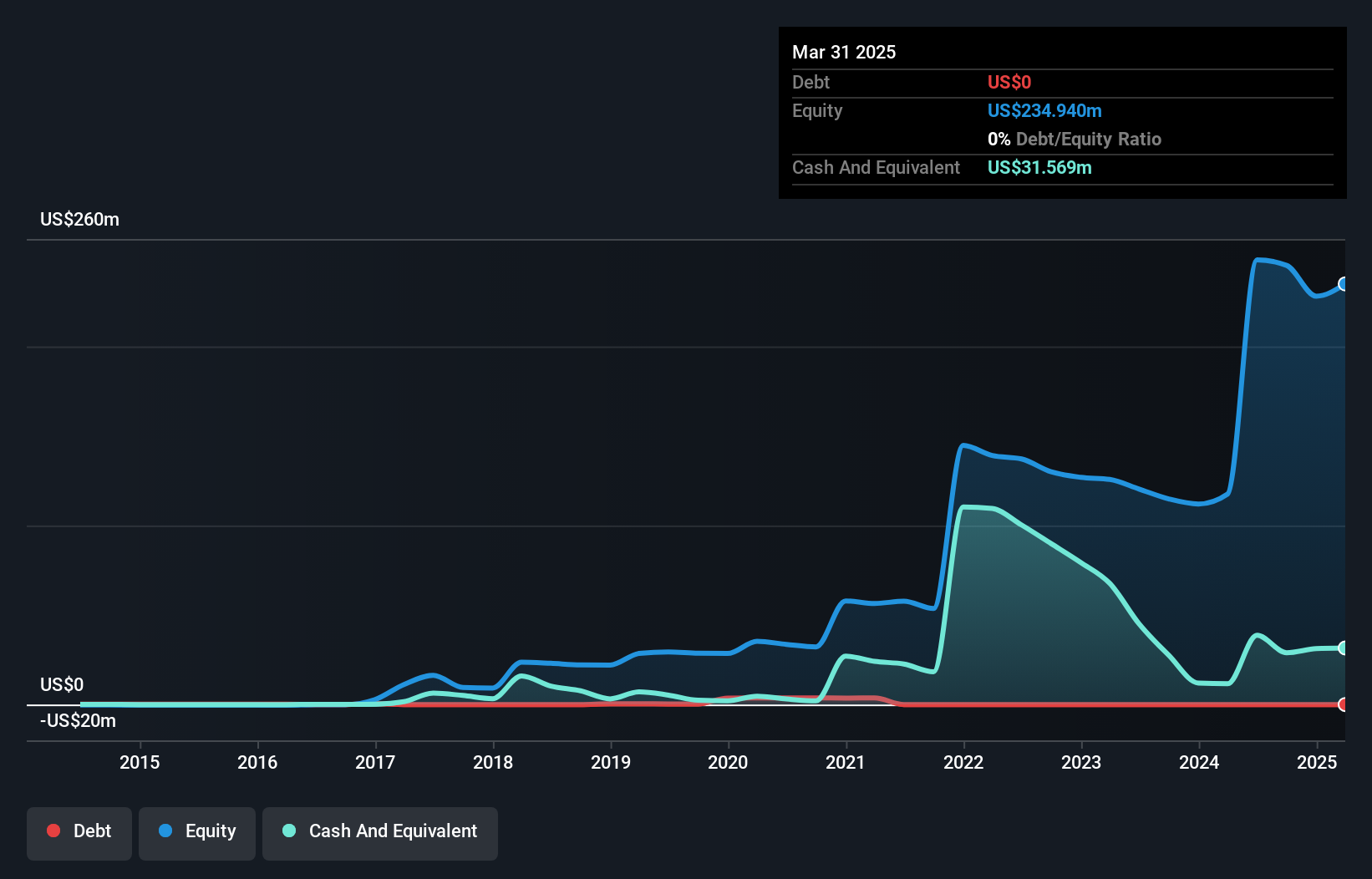

Standard Lithium, a notable player in the lithium sector, has turned profitable with net income of CA$147 million compared to a CA$42 million loss last year. The company is debt-free and boasts a low price-to-earnings ratio of 3.2x against the Canadian market's 15.4x. Recently, it secured up to US$225 million from the U.S. DOE for its South West Arkansas project, aiming to produce 45,000 tonnes of lithium carbonate annually using innovative technology.

Where To Now?

- Explore the 48 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives