- Canada

- /

- Consumer Finance

- /

- TSX:PRL

Top TSX Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 19% over the past year with earnings forecasted to grow by 15% annually. In such a robust environment, growth companies with high insider ownership can offer unique investment opportunities due to their potential for sustained performance and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 70.7% |

| Allied Gold (TSX:AAUC) | 21.9% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

Let's uncover some gems from our specialized screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., with a market cap of CA$5.49 billion, designs, develops, and sells apparel and accessories for women in the United States and Canada.

Operations: The company generates CA$2.37 billion in revenue from its apparel segment.

Insider Ownership: 18.9%

Aritzia has seen substantial insider buying over the past three months, signaling confidence in its growth prospects. The company reported Q1 2024 sales of C$498.63 million and provided strong revenue guidance for Q2 and Fiscal Year 2025, expecting up to C$2.62 billion in annual revenue. Despite a decrease in profit margins from last year, Aritzia's earnings are forecast to grow significantly faster than the Canadian market, with an expected annual profit growth rate of 60.4%.

- Click here to discover the nuances of Aritzia with our detailed analytical future growth report.

- According our valuation report, there's an indication that Aritzia's share price might be on the expensive side.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of approximately CA$25.42 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

Insider Ownership: 12.3%

Ivanhoe Mines, a growth company with high insider ownership, recently signed an MOU with Zambia's Ministry of Mines to explore and develop mineral resources. The Kamoa-Kakula Copper Complex achieved record copper production in August, signaling strong operational performance. Despite past shareholder dilution, Ivanhoe's earnings are forecast to grow significantly faster than the Canadian market at 71.5% annually. Analysts expect the stock price to rise by 26.2%, indicating positive market sentiment.

- Delve into the full analysis future growth report here for a deeper understanding of Ivanhoe Mines.

- According our valuation report, there's an indication that Ivanhoe Mines' share price might be on the cheaper side.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.09 billion.

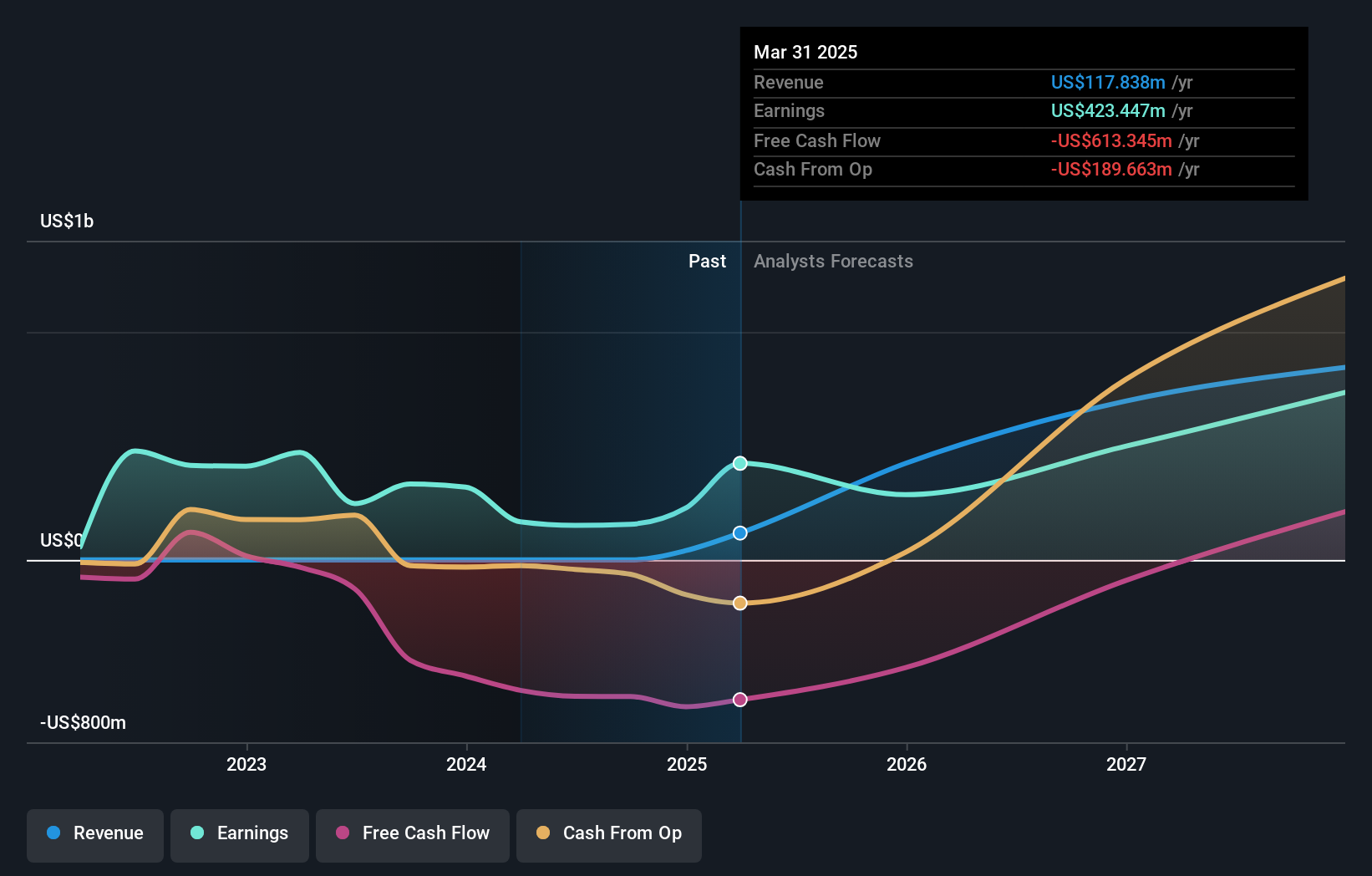

Operations: Propel Holdings generates revenue of $382.44 million by providing lending-related services to borrowers, banks, and other institutions.

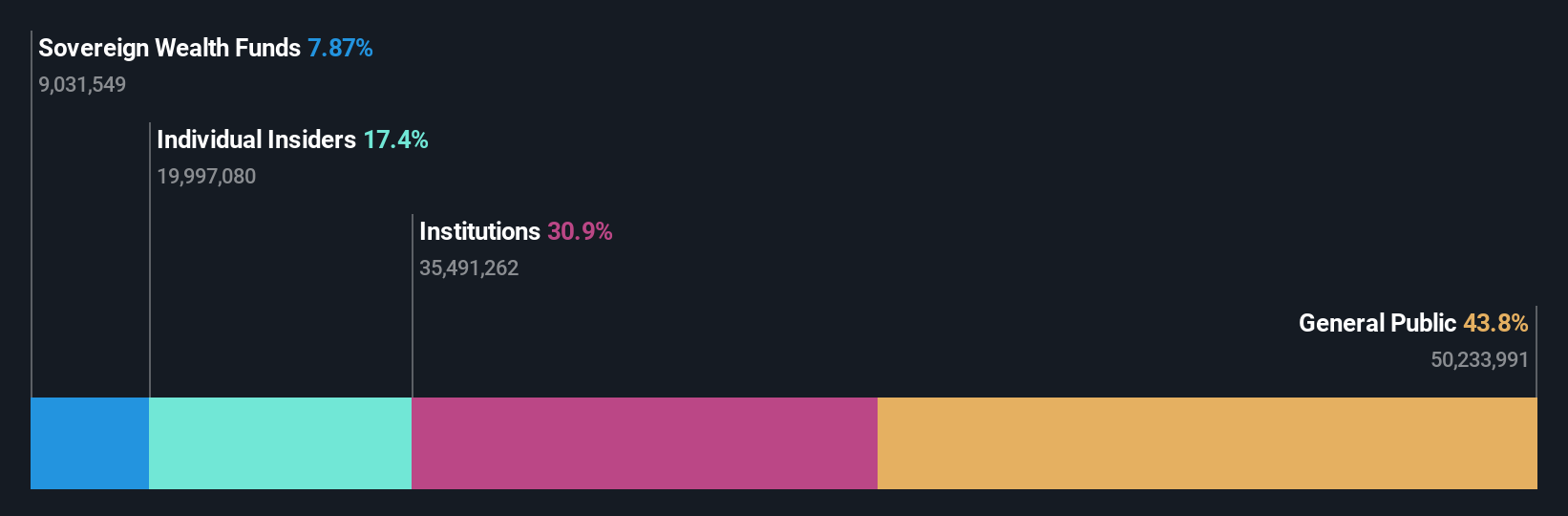

Insider Ownership: 40%

Propel Holdings' earnings are forecast to grow significantly at 37.25% per year, outpacing the Canadian market's 14.9%. Despite substantial insider selling in the past three months, the company has shown strong financial performance with Q2 sales of US$106.75 million and net income of US$11.12 million, both up from a year ago. Propel was recently added to the S&P Global BMI Index and increased its credit facility to $330 million, supporting further growth initiatives.

- Take a closer look at Propel Holdings' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Propel Holdings' current price could be inflated.

Key Takeaways

- Discover the full array of 39 Fast Growing TSX Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential with proven track record.