- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

Aritzia (TSX:ATZ) Valuation Check After S&P/TSX Composite Entry and Rising Apparel Market Focus

Reviewed by Simply Wall St

Aritzia (TSX:ATZ) just joined the S&P/TSX Composite Index, and that index promotion is drawing fresh attention to a stock already riding shifting Canadian apparel trends and steady brand execution.

See our latest analysis for Aritzia.

The index inclusion has landed at a time when Aritzia already had the wind at its back, with an 18 percent 1 month share price return and a 1 year total shareholder return of roughly 126 percent, signalling building momentum rather than a one day pop.

If Aritzia’s run has you thinking about what else might be gaining traction, this could be a good moment to explore fast growing stocks with high insider ownership.

With Aritzia now in the benchmark spotlight and its shares sitting just above consensus targets despite strong fundamental growth, the real question is whether investors still have upside to capture or if the market has already priced in future gains.

Most Popular Narrative Narrative: 6.4% Overvalued

With Aritzia closing at CA$113.82 versus a narrative fair value of CA$107, the current share price is running slightly ahead of that roadmap.

Analysts are assuming Aritzia's revenue will grow by 13.8% annually over the next 3 years.

Analysts assume that profit margins will increase from 8.1% today to 12.5% in 3 years time.

Curious how a fashion retailer earns a valuation profile usually reserved for market darlings? The secret lies in aggressive revenue scaling and a sharp profitability reset. Want to see which earnings bridge and future multiple have to line up for this to work? The full narrative breaks down the exact steps.

Result: Fair Value of $107 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained success hinges on flawless U.S. expansion and resilient consumer demand, as weaker store performance or macro headwinds could quickly pressure margins and growth expectations.

Find out about the key risks to this Aritzia narrative.

Another View: Cash Flows Tell a Different Story

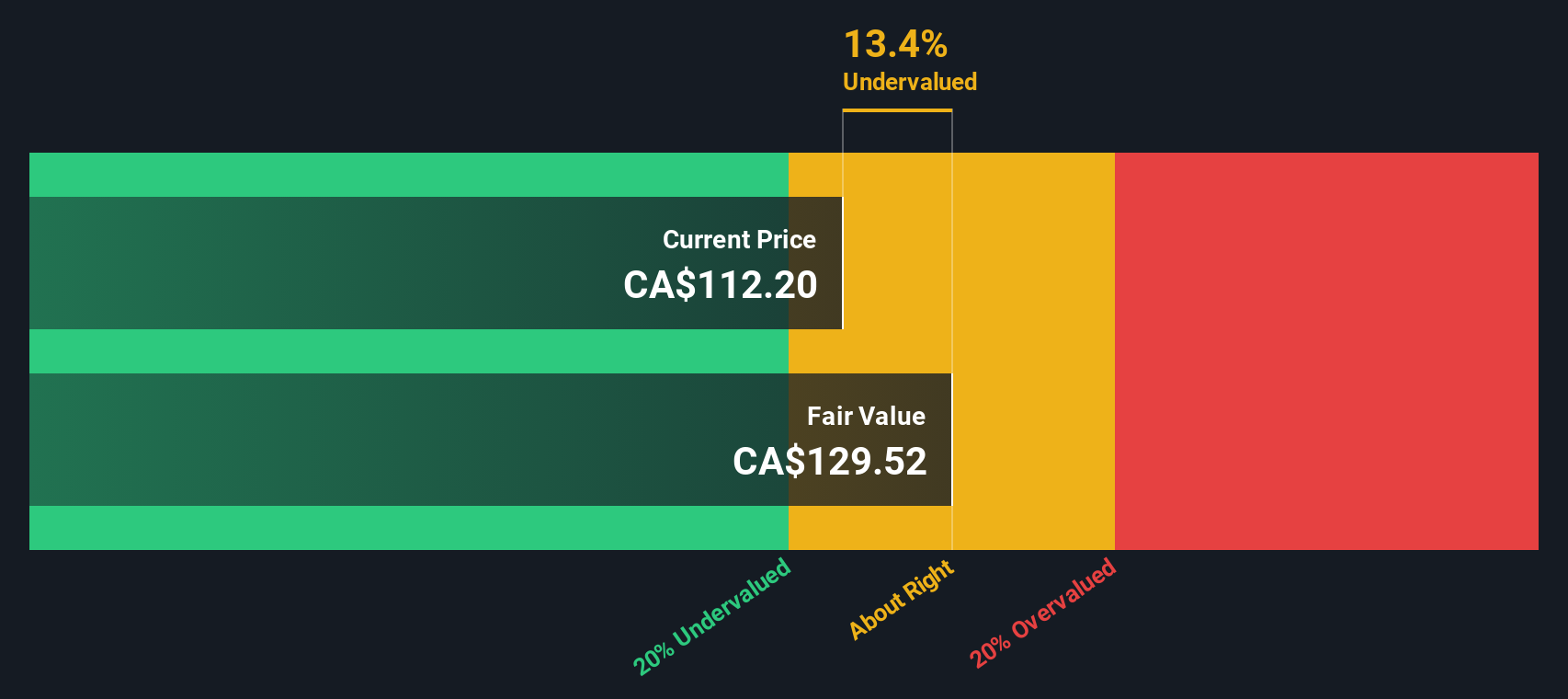

While the narrative framework suggests Aritzia is 6.4 percent overvalued at CA$113.82 versus fair value of CA$107, our DCF model points the other way and implies fair value closer to CA$132.35, or roughly 14 percent upside. Which lens should carry more weight in your process?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aritzia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aritzia Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aritzia.

Ready for your next investing edge?

Before momentum in Aritzia fully plays out, you may want to expand your opportunity set with fresh, data backed ideas from the Simply Wall St screener so you are not chasing yesterday’s winners.

- Capture potential multi baggers early by scanning these 3610 penny stocks with strong financials with the financial strength to back up their growth stories.

- Position ahead of structural change by targeting these 30 healthcare AI stocks that are transforming diagnostics, treatment pathways, and operational efficiency.

- Seek income potential while markets stay volatile by focusing on these 13 dividend stocks with yields > 3% that can support steady payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)