- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

Evaluating RioCan (TSX:REI.UN): Is the Recent $200 Million Debt Move Reflected in Its Valuation?

Reviewed by Kshitija Bhandaru

RioCan Real Estate Investment Trust (TSX:REI.UN) has wrapped up a $200 million issuance of senior unsecured debentures, a move aimed at paying down existing debt and strengthening its balance sheet. This type of financing directly impacts how investors view RioCan’s financial flexibility and stability.

See our latest analysis for RioCan Real Estate Investment Trust.

RioCan’s $200 million debt issuance is just the latest in a flurry of activity, including executive updates and new housing developments in Toronto. While the share price has seen only modest recent movement, the REIT’s five-year total shareholder return of 71.6% signals that long-term momentum is still very much alive.

If RioCan’s strategy has you watching for the next standout opportunity, this could be the perfect moment to widen your search and discover fast growing stocks with high insider ownership

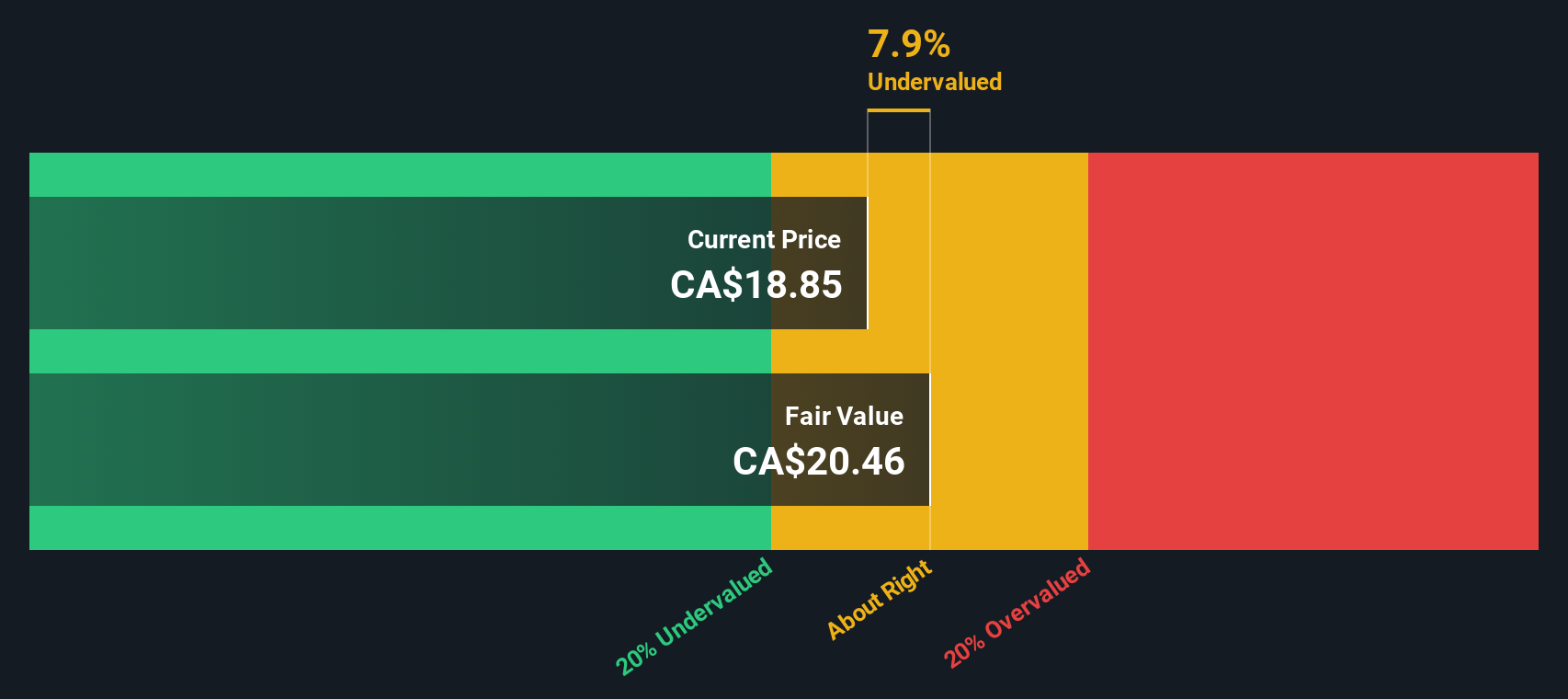

Despite recent capital moves and steady returns, is RioCan currently trading below its fair value, offering investors a potential bargain? Or is the optimism about future growth already fully reflected in its current share price?

Price-to-Earnings of 19.9x: Is it justified?

RioCan is trading at a price-to-earnings (P/E) ratio of 19.9x, slightly higher than similar companies but below broader industry averages. With a recent closing price of CA$19.17, investors are paying a premium compared to some peers in the retail REIT sector.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of reported earnings. For real estate investment trusts like RioCan, P/E offers a lens into market expectations for future profitability and stability.

At 19.9x, RioCan appears more expensive than the average of its peer group (17.5x). However, it remains attractively valued compared to the North American retail REITs industry average of 24x. Notably, the market has priced RioCan below its estimated fair P/E of 21x, suggesting room for a possible upward re-rating if earnings momentum persists.

Explore the SWS fair ratio for RioCan Real Estate Investment Trust

Result: Price-to-Earnings of 19.9x (UNDERVALUED)

However, slower revenue growth and market volatility could challenge RioCan’s current momentum. These factors could potentially limit further upside for investors in the near term.

Find out about the key risks to this RioCan Real Estate Investment Trust narrative.

Another View: What Does the SWS DCF Model Say?

While the price-to-earnings ratio paints RioCan as modestly undervalued, the SWS DCF model offers a separate perspective. According to this model, RioCan's current share price is about 5.8% below its estimated fair value. An undervalued signal from both methods may indicate a market discount, but it also raises questions about whether there is something the models might be missing.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RioCan Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RioCan Real Estate Investment Trust Narrative

Feel like the numbers point a different way, or want to put your personal analysis to the test? You can easily craft your own perspective in just a few minutes: Do it your way

A great starting point for your RioCan Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by checking out timely investment opportunities from innovative sectors and proven market winners available right now on Simply Wall Street.

- Capitalize on tomorrow's financial giants by reviewing these 3563 penny stocks with strong financials, where strong fundamentals meet growth potential at accessible prices.

- Catch the momentum in technology with these 24 AI penny stocks, ideal for investors who want to back the pioneers of artificial intelligence and automation.

- Boost your income strategy with steady performers through these 19 dividend stocks with yields > 3%, featuring stocks offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based and mixed-use properties in densely populated communities.

Solid track record average dividend payer.

Market Insights

Community Narratives