- Canada

- /

- Retail REITs

- /

- TSX:PLZ.UN

This Is Why Plaza Retail REIT's (TSE:PLZ.UN) CEO Compensation Looks Appropriate

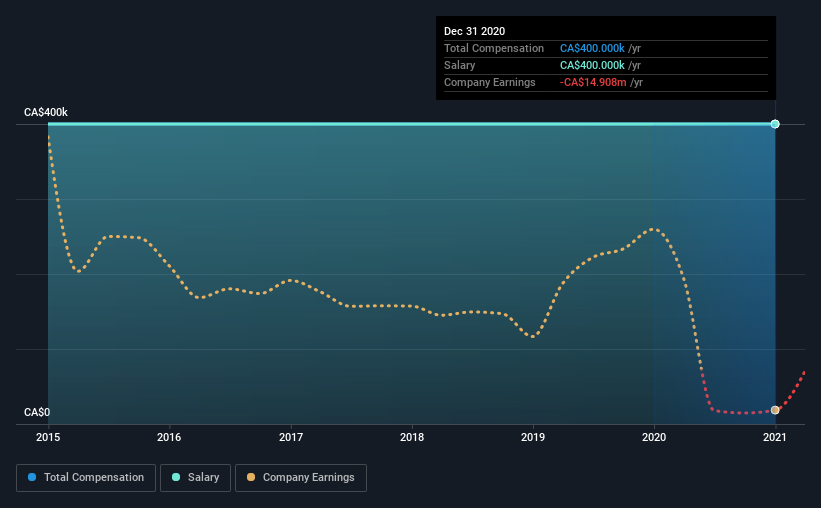

CEO Michael Zakuta has done a decent job of delivering relatively good performance at Plaza Retail REIT (TSE:PLZ.UN) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 27 May 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Plaza Retail REIT

Comparing Plaza Retail REIT's CEO Compensation With the industry

Our data indicates that Plaza Retail REIT has a market capitalization of CA$412m, and total annual CEO compensation was reported as CA$400k for the year to December 2020. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$400k.

On comparing similar companies from the same industry with market caps ranging from CA$241m to CA$964m, we found that the median CEO total compensation was CA$506k. This suggests that Plaza Retail REIT remunerates its CEO largely in line with the industry average. Furthermore, Michael Zakuta directly owns CA$18m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$400k | CA$400k | 100% |

| Other | - | - | - |

| Total Compensation | CA$400k | CA$400k | 100% |

Speaking on an industry level, nearly 34% of total compensation represents salary, while the remainder of 66% is other remuneration. Speaking on a company level, Plaza Retail REIT prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Plaza Retail REIT's Growth

Plaza Retail REIT's funds from operations (FFO) grew 1.7% per yearover the last three years. Its revenue is down 5.3% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest FFO growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Plaza Retail REIT Been A Good Investment?

With a total shareholder return of 16% over three years, Plaza Retail REIT shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Plaza Retail REIT rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Plaza Retail REIT (2 can't be ignored!) that you should be aware of before investing here.

Important note: Plaza Retail REIT is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PLZ.UN

Plaza Retail REIT

Plaza is an open-ended real estate investment trust and is a leading retail property owner and developer, focused on Ontario, Quebec and Atlantic Canada.

6 star dividend payer with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)