- Canada

- /

- Retail REITs

- /

- TSX:PLZ.UN

3 Undervalued Small Caps In Global With Insider Buying To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have been grappling with trade policy uncertainties and inflation concerns, leading to a significant sell-off in U.S. stocks, including the S&P 600 for small-cap companies. Amid this backdrop of volatility and cautious investor sentiment, identifying opportunities in undervalued small-cap stocks can be a strategic move to enhance portfolio diversification. A good stock in such an environment often exhibits strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.4x | 4.9x | 23.95% | ★★★★★★ |

| Security Bank | 4.9x | 1.1x | 30.30% | ★★★★★☆ |

| Puregold Price Club | 9.0x | 0.4x | 26.52% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 26.87% | ★★★★★☆ |

| Nexus Industrial REIT | 11.8x | 3.0x | 23.98% | ★★★★★☆ |

| Gamma Communications | 22.6x | 2.3x | 35.57% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 36.57% | ★★★★☆☆ |

| Calfrac Well Services | 11.3x | 0.2x | -29.60% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | 13.5x | 5.4x | 5.79% | ★★★☆☆☆ |

| Saturn Oil & Gas | 1.7x | 0.5x | -48.70% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

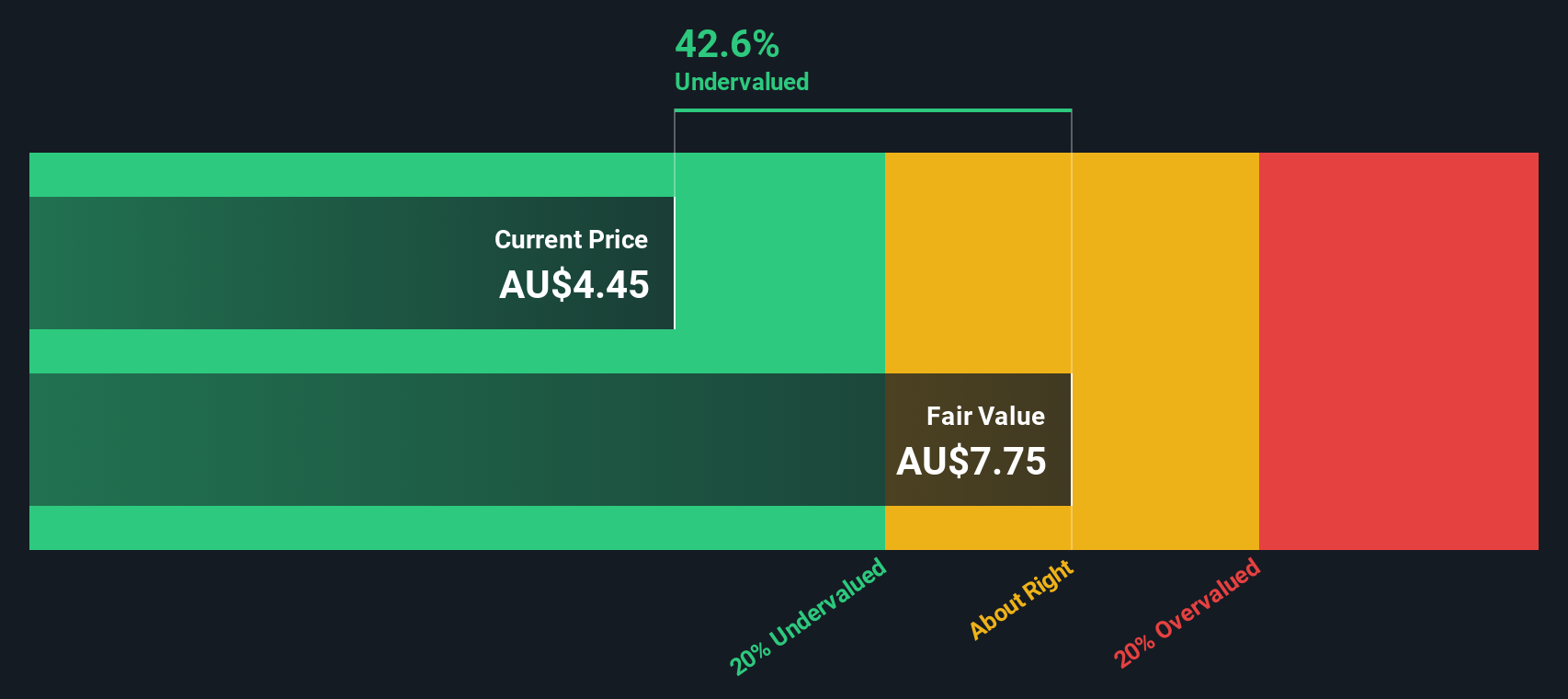

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is an investment company focused on managing a portfolio of high-quality international equities, with operations generating A$1.01 billion from equity investments.

Operations: The company's primary revenue source is from equity investments, generating A$1.01 billion recently. Operating expenses have shown a downward trend, with the latest figures at A$4.05 million. Net income margin has varied over time, reaching 67.44% in the most recent period analyzed.

PE: 3.7x

MFF Capital Investments, a smaller company in its sector, recently reported significant earnings growth for the half-year ending December 2024, with revenue reaching A$551.81 million and net income at A$381.46 million. This marks a substantial increase from the previous year. The company's decision to raise its interim dividend to 8 cents per share reflects confidence in its financial health despite relying solely on external borrowing for funding. Insider confidence is evident with recent share purchases by insiders, suggesting potential value recognition within the company.

- Dive into the specifics of MFF Capital Investments here with our thorough valuation report.

Explore historical data to track MFF Capital Investments' performance over time in our Past section.

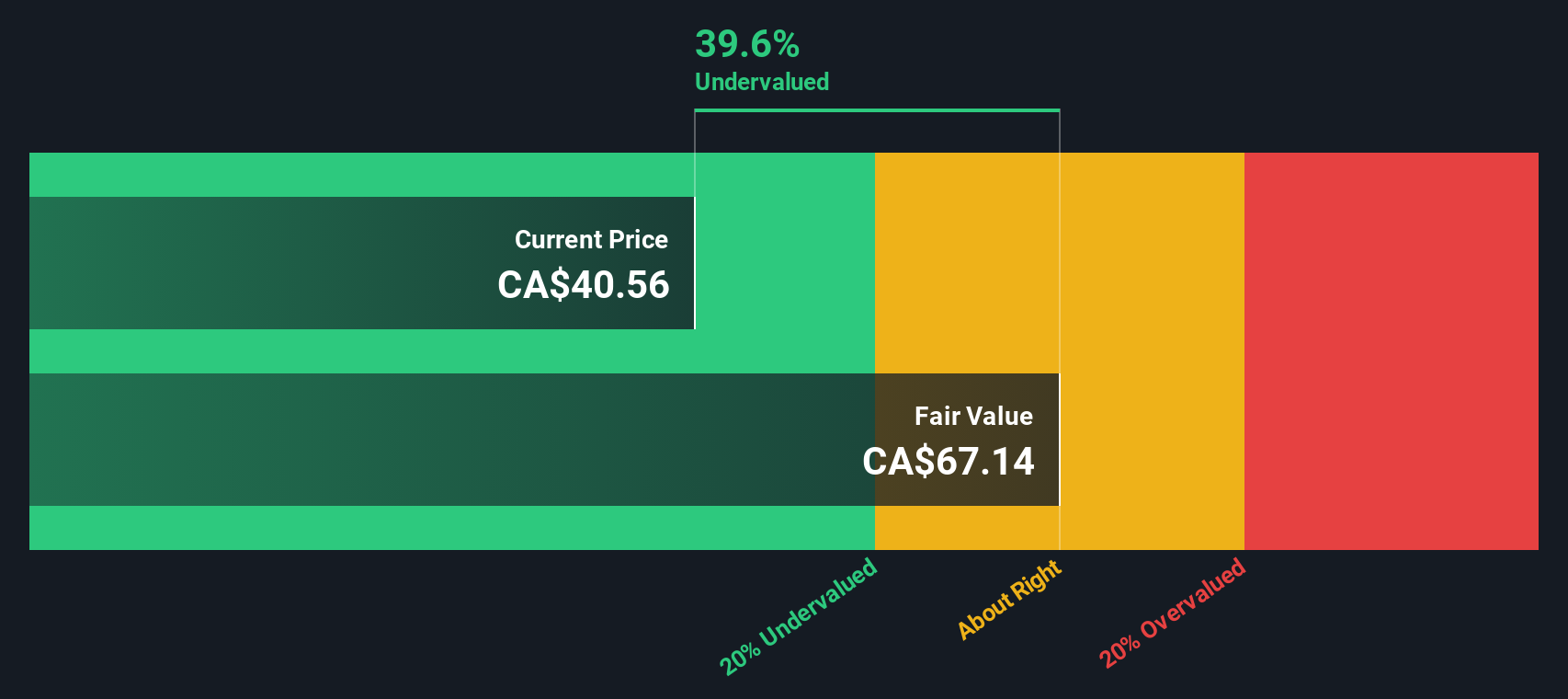

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★★☆

Overview: First National Financial is a Canadian company that specializes in mortgage lending and mortgage servicing, with a market capitalization of approximately CA$2.71 billion.

Operations: First National Financial's revenue primarily comes from its mortgage lending and related services, with significant costs attributed to cost of goods sold (COGS) and operating expenses. The company's gross profit margin has shown variability, peaking at 86.04% in recent periods. Operating expenses, including general and administrative costs, have also been a considerable part of the financial structure.

PE: 12.0x

First National Financial, a smaller player in the financial sector, recently reported a decline in net income to C$203 million for 2024 from C$253 million the previous year. Despite this, insider confidence is evident as Stephen J. Smith purchased 463,300 shares valued at approximately C$20.44 million, marking a 2% increase in their holdings. While earnings are projected to grow annually by over 12%, reliance on external borrowing poses higher risk compared to customer deposits.

- Take a closer look at First National Financial's potential here in our valuation report.

Gain insights into First National Financial's past trends and performance with our Past report.

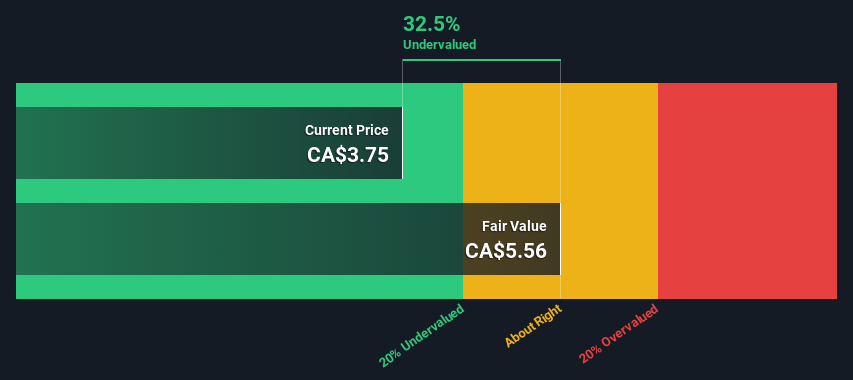

Plaza Retail REIT (TSX:PLZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Plaza Retail REIT is a Canadian company focused on the ownership and development of retail real estate, with operations generating CA$124.54 million in revenue.

Operations: The company generates revenue primarily from retail real estate ownership and development, with the latest reported figure at CA$124.54 million. The gross profit margin has shown some variability, reaching 66.37% in mid-2021 before settling around 62.85% by late 2024. Operating expenses have gradually increased over time, impacting net income margins which fluctuated significantly, peaking at 95.56% in early 2022 and dropping to approximately 20.11% by the end of 2024.

PE: 15.8x

Plaza Retail REIT, a smaller player in the real estate investment trust sector, recently posted solid financial results with sales of C$121.28 million and net income of C$25.05 million for 2024, showing growth from the previous year. Despite relying solely on external borrowing for funding, which poses higher risks compared to customer deposits, Plaza maintains steady monthly distributions of C$0.02333 per unit. Insider confidence is evident with recent share purchases by company insiders in early 2025, suggesting potential value recognition within the firm’s operations and prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Plaza Retail REIT.

Evaluate Plaza Retail REIT's historical performance by accessing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 125 Undervalued Global Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PLZ.UN

Plaza Retail REIT

Plaza is an open-ended real estate investment trust and is a leading retail property owner and developer, focused on Ontario, Quebec and Atlantic Canada.

6 star dividend payer and good value.