Top 3 Undervalued Small Caps With Insider Buying In Canada For September 2024

Reviewed by Simply Wall St

The Canadian market has experienced a recent dip, with the TSX down about 3% amid broader economic uncertainties and interest rate adjustments. In this environment, identifying undervalued small-cap stocks with insider buying can offer intriguing opportunities for investors looking to capitalize on potential market rebounds.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.5x | 0.2x | 38.42% | ★★★★★★ |

| Trican Well Service | 7.5x | 0.9x | 14.96% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 22.96% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.8x | 46.06% | ★★★★★☆ |

| VersaBank | 9.5x | 3.9x | 14.96% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.2x | 13.51% | ★★★★☆☆ |

| Rogers Sugar | 15.3x | 0.6x | 48.55% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -41.48% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.8x | 3.1x | 42.29% | ★★★★☆☆ |

| Tiny | NA | 1.1x | -166.21% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

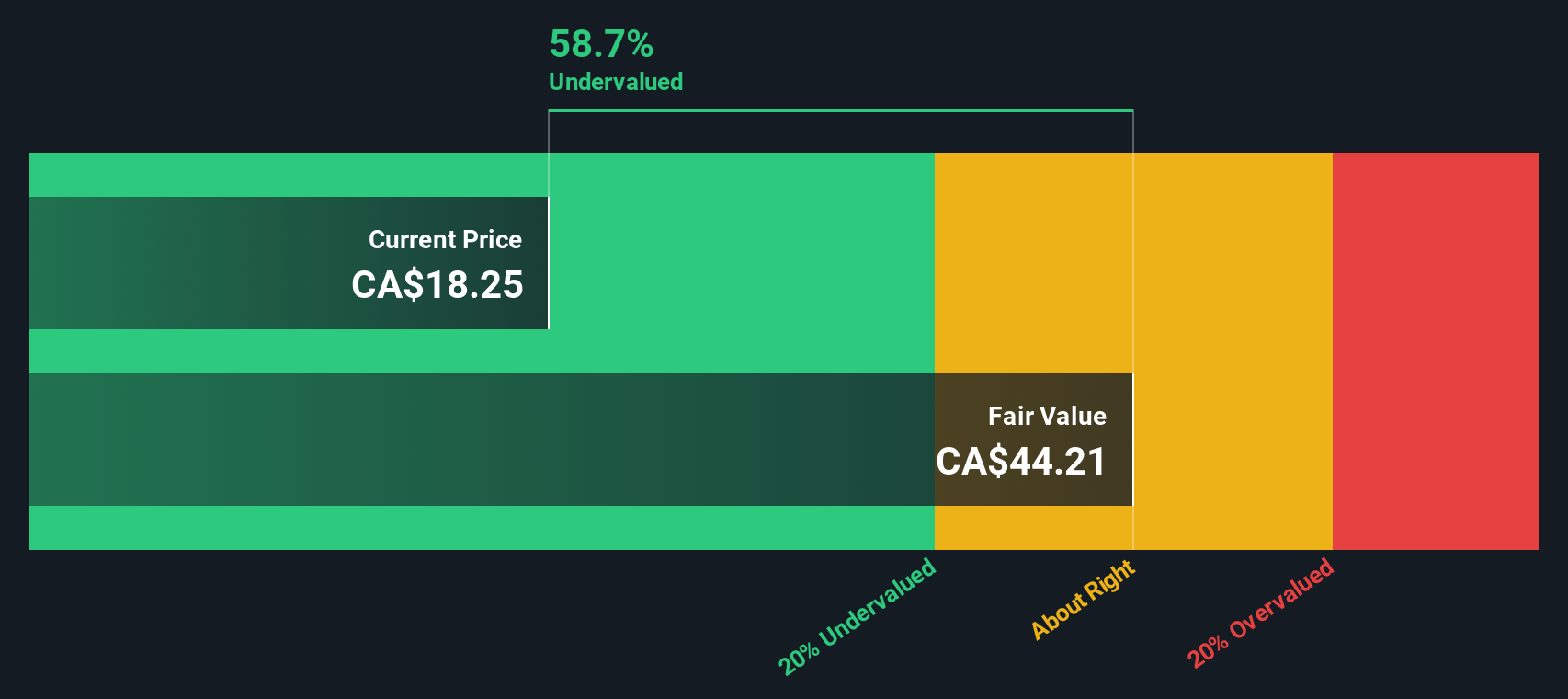

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential REIT sector with a focus on manufactured housing communities, and has a market cap of approximately C$0.38 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential real estate investments, with recent quarterly revenue reaching $78.07 million. The company's gross profit margin has shown a range between 63.89% and 66.82%, indicating the efficiency of its core operations relative to cost of goods sold (COGS).

PE: 3.6x

Flagship Communities Real Estate Investment Trust, a smaller Canadian stock, has shown promising insider confidence with recent share purchases. Despite earnings forecasted to decline by 46.1% annually over the next three years, revenue is expected to grow by 8.9% per year. For Q2 2024, Flagship reported USD 21.23 million in sales and USD 43.46 million in net income, doubling from last year’s figures. The company consistently offers a monthly cash distribution of USD 0.0492 per REIT unit.

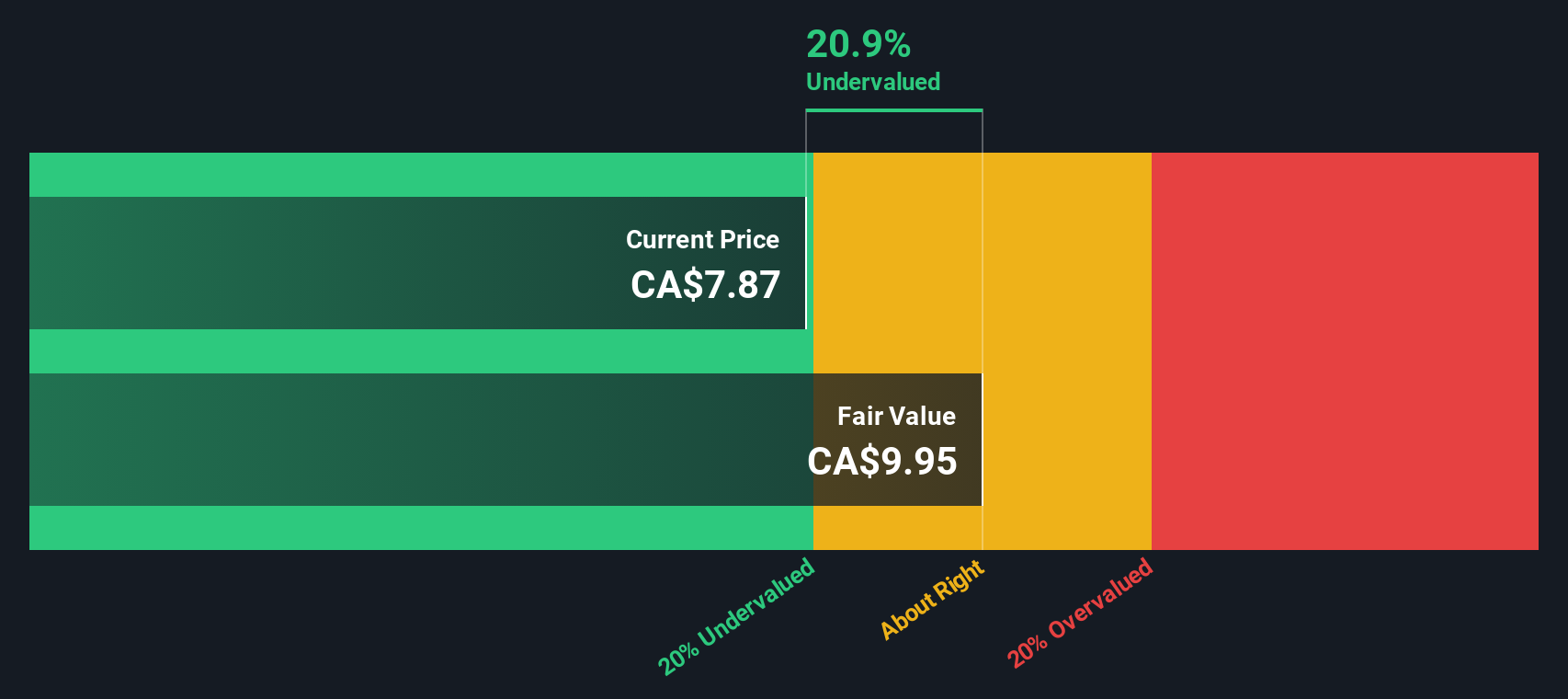

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust that focuses on owning and managing industrial properties, with a market cap of approximately CA$1.02 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with a recent quarterly revenue of CA$167.21 million and a gross profit margin of 71.56%. The company incurs costs of goods sold (COGS) amounting to CA$47.55 million and operating expenses totaling CA$8.65 million, resulting in a net income margin of 99.45%.

PE: 3.6x

Nexus Industrial REIT, a smaller player in the Canadian market, recently declared distributions of C$0.05333 per unit for September and October 2024. Despite reporting increased sales of C$43.91 million for Q2 2024 compared to C$38.42 million last year, net income fell to C$43.53 million from C$77.22 million due to one-off items impacting results. Insider confidence is evident as key individuals have been purchasing shares throughout the past year, signaling potential future growth despite forecasts predicting a decline in earnings over the next three years by an average of 46.2%.

- Unlock comprehensive insights into our analysis of Nexus Industrial REIT stock in this valuation report.

Explore historical data to track Nexus Industrial REIT's performance over time in our Past section.

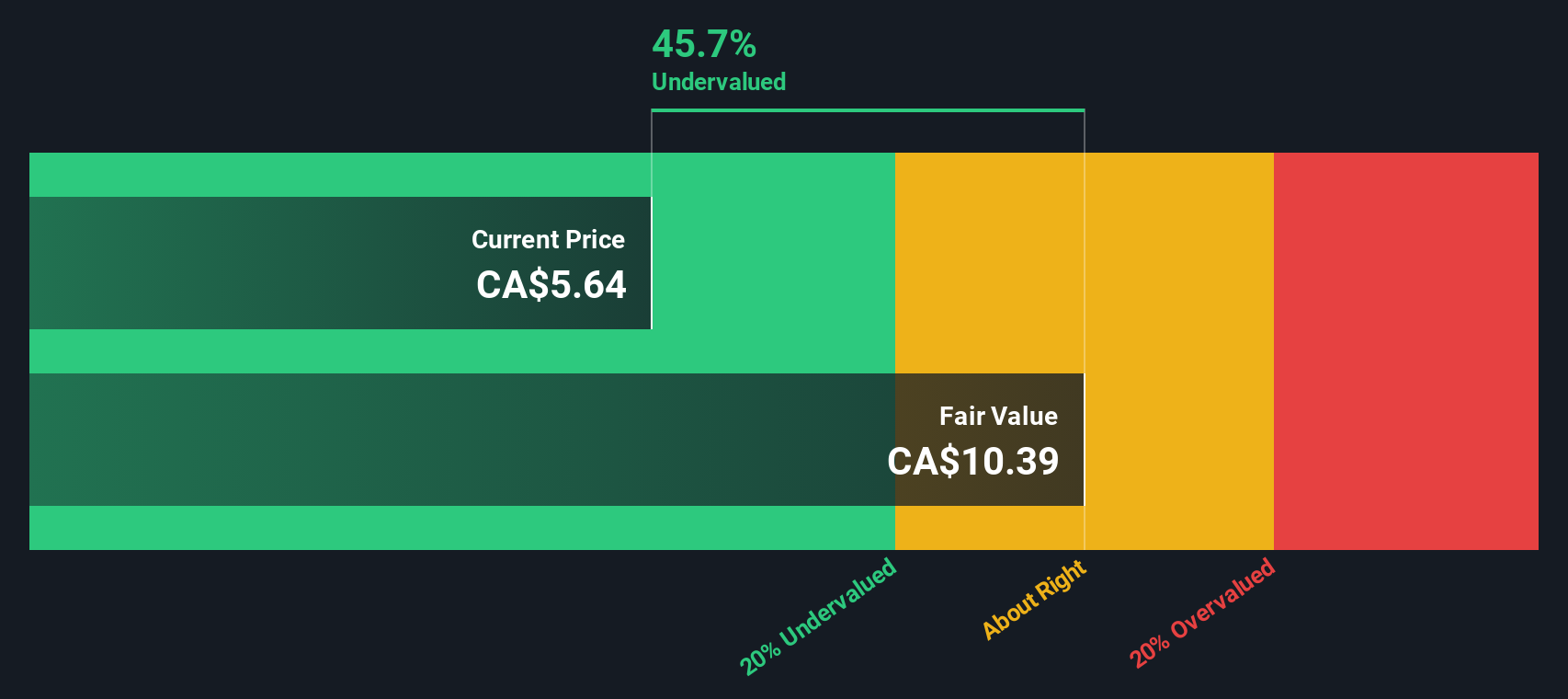

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rogers Sugar operates in the production and distribution of sugar and maple products, with a market cap of approximately CA$0.54 billion.

Operations: Rogers Sugar generates revenue primarily from its Sugar and Maple Products segments, with recent revenues of CA$1.21 billion. The company's gross profit margin has varied, reaching 21.42% in July 2016 and recently recorded at 13.87% in June 2024.

PE: 15.3x

Rogers Sugar, a key player in Canada's sugar industry, reported CAD 309.09 million in Q3 sales for 2024, up from CAD 262.29 million the previous year, though net income dropped to CAD 7.38 million from CAD 14.18 million. Despite external borrowing risks and shareholder dilution over the past year, insider confidence is evident with recent share purchases by executives in July and August 2024. The company declared a quarterly dividend of $0.09 per share on August 8, signaling steady returns for investors amidst fluctuating earnings.

- Take a closer look at Rogers Sugar's potential here in our valuation report.

Understand Rogers Sugar's track record by examining our Past report.

Key Takeaways

- Explore the 24 names from our Undervalued TSX Small Caps With Insider Buying screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RSI

Rogers Sugar

Engages in refining, packaging, marketing, and distribution of sugar, maple, and related products in Canada, the United States, Europe, and internationally.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives