- United Kingdom

- /

- Consumer Finance

- /

- LSE:IPF

August 2025's Undervalued Small Caps With Insider Action In Global Markets

Reviewed by Simply Wall St

As global markets navigate the prospect of potential rate cuts and fluctuating economic indicators, small-cap stocks have shown notable resilience, with indices like the S&P Mid-Cap 400 and Russell 2000 posting strong returns. In this environment, identifying promising small-cap opportunities involves looking for companies that can leverage growth in sectors such as manufacturing and services, which are currently experiencing expansion despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.2x | 0.3x | 4.22% | ★★★★★☆ |

| Bytes Technology Group | 17.8x | 4.5x | 10.13% | ★★★★☆☆ |

| Hemisphere Energy | 5.9x | 2.3x | 9.30% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 18.54% | ★★★★☆☆ |

| BWP Trust | 9.7x | 12.7x | 17.30% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -74.04% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.9x | 6.7x | 15.21% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.86% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 7.0x | 1.9x | 18.85% | ★★★☆☆☆ |

| CVS Group | 47.8x | 1.4x | 34.41% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

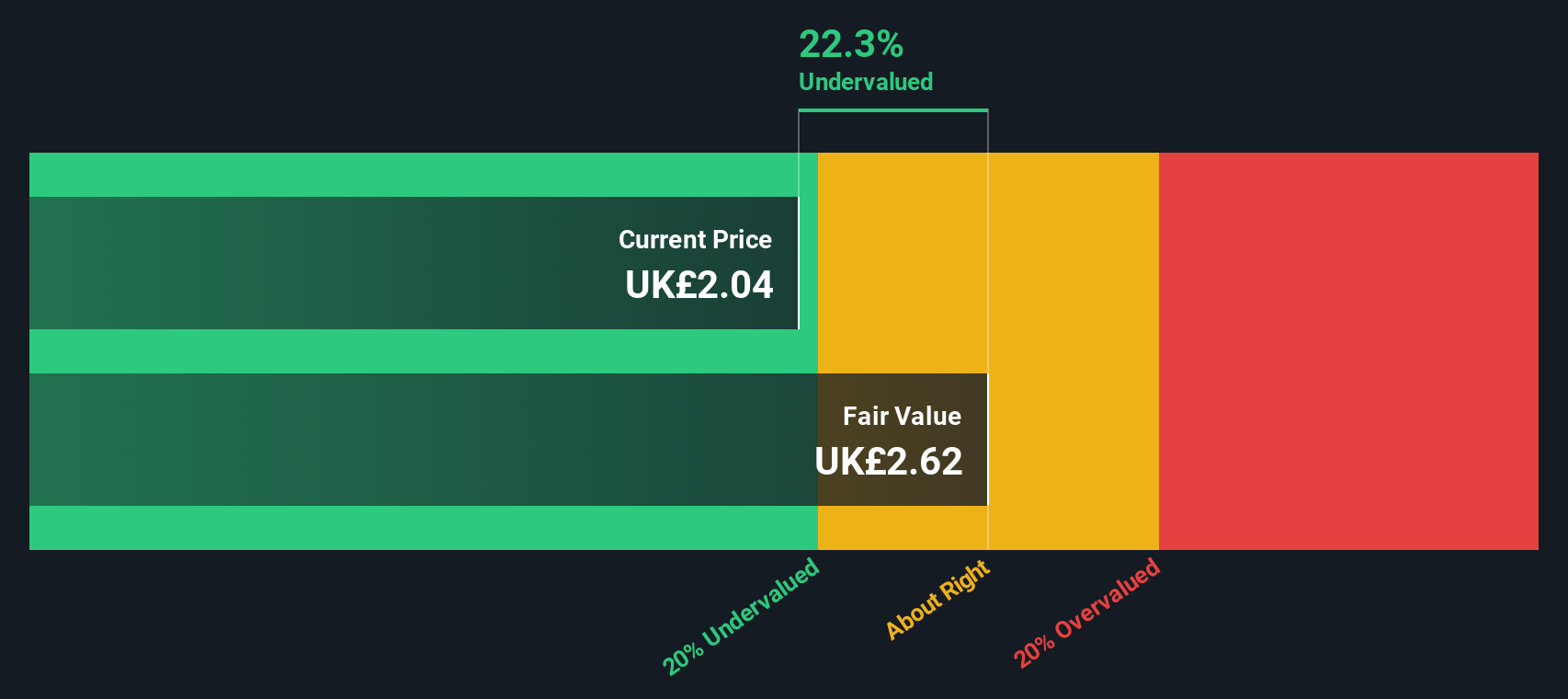

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: International Personal Finance is a financial services company that provides consumer credit through its digital and home credit operations in Europe and Mexico, with a market cap of £0.44 billion.

Operations: IPF generates revenue through its segments: IPF Digital, Mexico Home Credit, and European Home Credit. The company experienced fluctuations in its gross profit margin, which was 74.31% at the end of 2015 and reached a peak of 89.76% by the end of 2021 before declining to 84.41% by mid-2025. Operating expenses are a significant component impacting profitability, with general and administrative expenses consistently representing a major portion of these costs over time.

PE: 6.4x

International Personal Finance (IPF) is currently in advanced discussions for a potential acquisition by BasePoint Capital, offering a total value of £2.238 per share, which includes an interim dividend of £0.038. This offer represents significant premiums over recent share prices, indicating potential undervaluation in the market's eyes. Despite reporting sales of £347.8 million for H1 2025—a decrease from the previous year—net income rose to £31 million from £19.7 million, showcasing improved profitability amidst external borrowing risks and ongoing M&A talks that could influence future growth trajectories if finalized by August 27, 2025.

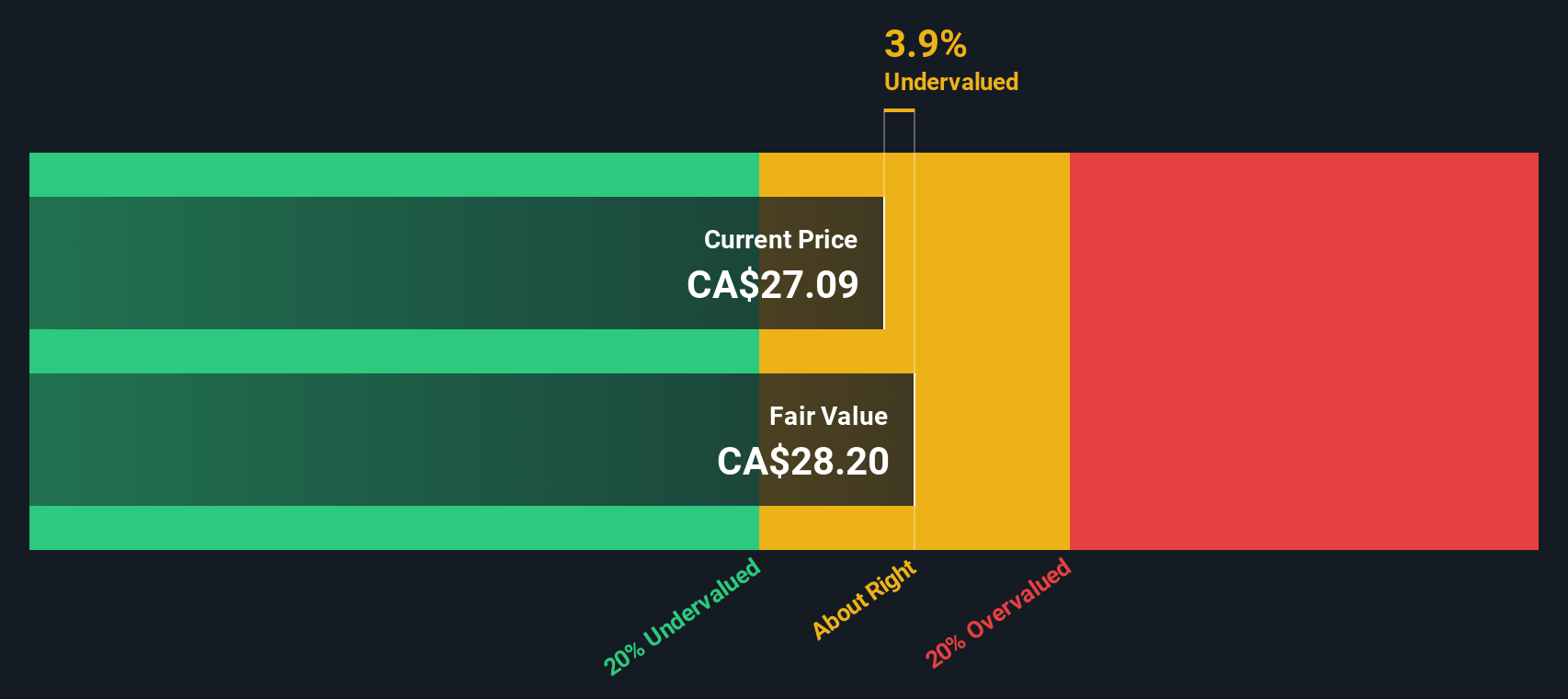

GDI Integrated Facility Services (TSX:GDI)

Simply Wall St Value Rating: ★★★★★☆

Overview: GDI Integrated Facility Services operates as a provider of comprehensive facility management services, including technical and business services across Canada and the USA, with a market cap of CA$1.37 billion.

Operations: GDI Integrated Facility Services generates revenue through its diverse segments, with significant contributions from Technical Services and Business Services in both the USA and Canada. The company has experienced fluctuations in its gross profit margin, which reached 24.41% at the end of 2020 before declining to 18.65% by late 2023. Operating expenses are a notable component of costs, with general and administrative expenses consistently forming a substantial part of these expenditures over time.

PE: 18.2x

GDI Integrated Facility Services, a smaller player in its sector, has seen insider confidence with share purchases over the past year. Despite reporting a net loss of CAD 1 million for Q2 2025 compared to last year's profit, the company achieved CAD 5 million in net income over six months due to improved earnings per share. With earnings forecasted to grow annually by nearly 15%, GDI's future prospects remain promising despite current financial challenges and reliance on external borrowing.

- Navigate through the intricacies of GDI Integrated Facility Services with our comprehensive valuation report here.

Understand GDI Integrated Facility Services' track record by examining our Past report.

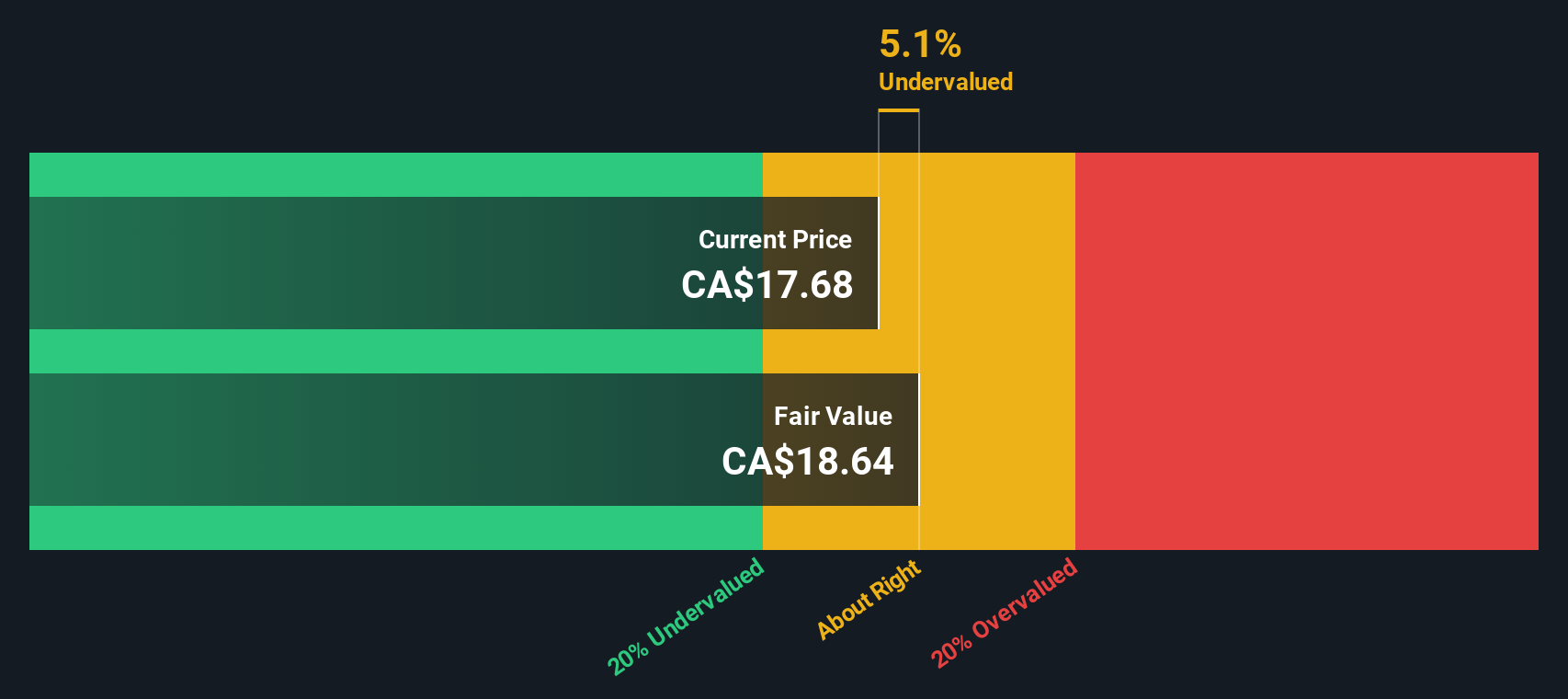

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSR Real Estate Investment Trust focuses on owning and operating a portfolio of residential properties, with a market capitalization of approximately $1.34 billion.

Operations: BSR Real Estate Investment Trust generates revenue primarily from its residential real estate investments, with the latest reported revenue at $161.63 million. The company's cost of goods sold (COGS) was $77.94 million, resulting in a gross profit of $83.69 million and a gross profit margin of 51.78%. Operating expenses stand at $10.04 million, while non-operating expenses are significantly high at $136.44 million, impacting net income negatively to -$62.79 million and leading to a net income margin of -38.85%.

PE: -6.7x

BSR Real Estate Investment Trust, a smaller company in the real estate sector, is making strategic moves with its recent $87.5 million purchase of The Ownsby Apartments in Celina, Texas—a rapidly expanding area. Despite reporting a net loss of $22.48 million for Q2 2025 and having all liabilities from external borrowing, they maintain insider confidence through share purchases earlier this year. Their ongoing cash distributions suggest a commitment to returning value to investors while seeking further acquisitions in Texas' improving property market environment.

Where To Now?

- Navigate through the entire inventory of 93 Undervalued Global Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IPF

International Personal Finance

Engages in financial services business in Europe and Mexico.

Good value with proven track record.

Market Insights

Community Narratives