- Canada

- /

- Office REITs

- /

- TSX:D.UN

Here's Why Dream Office Real Estate Investment Trust's (TSE:D.UN) CEO Is Unlikely to Expect A Pay Rise This Year

Share price growth at Dream Office Real Estate Investment Trust (TSE:D.UN) has remained rather flat over the last few years and it may be because earnings has struggled to grow at all. Some of these issues will occupy shareholders' minds as the AGM rolls around on 07 June 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Dream Office Real Estate Investment Trust

Comparing Dream Office Real Estate Investment Trust's CEO Compensation With the industry

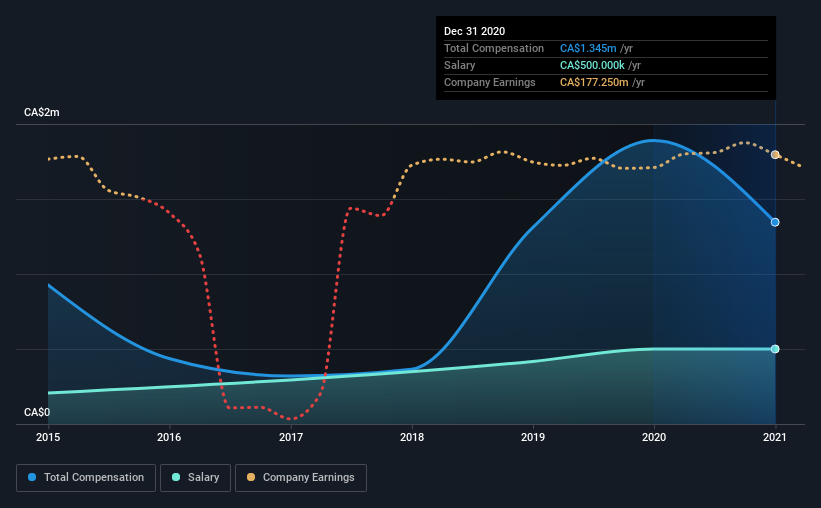

According to our data, Dream Office Real Estate Investment Trust has a market capitalization of CA$1.1b, and paid its CEO total annual compensation worth CA$1.3m over the year to December 2020. That's a notable decrease of 29% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$500k.

In comparison with other companies in the industry with market capitalizations ranging from CA$483m to CA$1.9b, the reported median CEO total compensation was CA$1.3m. This suggests that Dream Office Real Estate Investment Trust remunerates its CEO largely in line with the industry average. Furthermore, Michael Cooper directly owns CA$5.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$500k | CA$500k | 37% |

| Other | CA$845k | CA$1.4m | 63% |

| Total Compensation | CA$1.3m | CA$1.9m | 100% |

On an industry level, around 36% of total compensation represents salary and 64% is other remuneration. There isn't a significant difference between Dream Office Real Estate Investment Trust and the broader market, in terms of salary allocation in the overall compensation package. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Dream Office Real Estate Investment Trust's Growth

Over the last three years, Dream Office Real Estate Investment Trust has shrunk its funds from operations (FFO) by 19% per year. It saw its revenue drop 7.0% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Dream Office Real Estate Investment Trust Been A Good Investment?

Dream Office Real Estate Investment Trust has not done too badly by shareholders, with a total return of 1.9%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Dream Office Real Estate Investment Trust that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:D.UN

Dream Office Real Estate Investment Trust

Dream Office REIT is an unincorporated, open-ended real estate investment trust.

Fair value with moderate growth potential.