- Canada

- /

- Real Estate

- /

- TSXV:IEI

Shareholders Will Probably Not Have Any Issues With Imperial Equities Inc.'s (CVE:IEI) CEO Compensation

Key Insights

- Imperial Equities to hold its Annual General Meeting on 14th of March

- Salary of CA$374.4k is part of CEO Sine Chadi's total remuneration

- The overall pay is comparable to the industry average

- Imperial Equities' total shareholder return over the past three years was 26% while its EPS grew by 20% over the past three years

Under the guidance of CEO Sine Chadi, Imperial Equities Inc. (CVE:IEI) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14th of March. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Imperial Equities

Comparing Imperial Equities Inc.'s CEO Compensation With The Industry

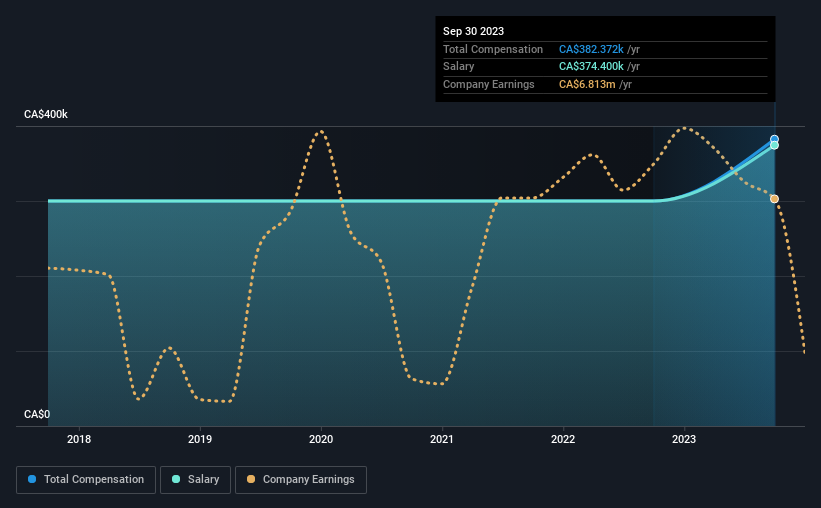

Our data indicates that Imperial Equities Inc. has a market capitalization of CA$43m, and total annual CEO compensation was reported as CA$382k for the year to September 2023. That's a notable increase of 27% on last year. Notably, the salary which is CA$374.4k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Canadian Real Estate industry with market capitalizations below CA$269m, we found that the median total CEO compensation was CA$296k. So it looks like Imperial Equities compensates Sine Chadi in line with the median for the industry. Furthermore, Sine Chadi directly owns CA$12m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$374k | CA$300k | 98% |

| Other | CA$8.0k | - | 2% |

| Total Compensation | CA$382k | CA$300k | 100% |

Speaking on an industry level, nearly 45% of total compensation represents salary, while the remainder of 55% is other remuneration. Investors will find it interesting that Imperial Equities pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Imperial Equities Inc.'s Growth

Imperial Equities Inc.'s earnings per share (EPS) grew 20% per year over the last three years. It achieved revenue growth of 6.2% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Imperial Equities Inc. Been A Good Investment?

Imperial Equities Inc. has served shareholders reasonably well, with a total return of 26% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Imperial Equities pays its CEO a majority of compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 2 which are concerning) in Imperial Equities we think you should know about.

Switching gears from Imperial Equities, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:IEI

Imperial Equities

Engages in the acquisition, development, redevelopment, leasing, and sale of industrial, agricultural, and commercial properties primarily in Canada.

Moderate risk and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026