- Canada

- /

- Metals and Mining

- /

- TSXV:WRLG

TSX Growth Companies With High Insider Ownership October 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by robust employment figures and moderated expectations for interest rate cuts, investors are turning their attention to sectors that promise growth amid broader economic uncertainties. In this environment, companies with high insider ownership can offer unique insights into potential success, as insiders' stakes often align their interests with those of shareholders, making them particularly appealing in times of market flux.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 23.1% | 93.4% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.4% |

| PowerBank (NEOE:SUNN) | 15.5% | 66.2% |

| Orla Mining (TSX:OLA) | 10.7% | 74.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Heliostar Metals (TSXV:HSTR) | 16.4% | 41% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.5% | 64.9% |

We'll examine a selection from our screener results.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★★☆

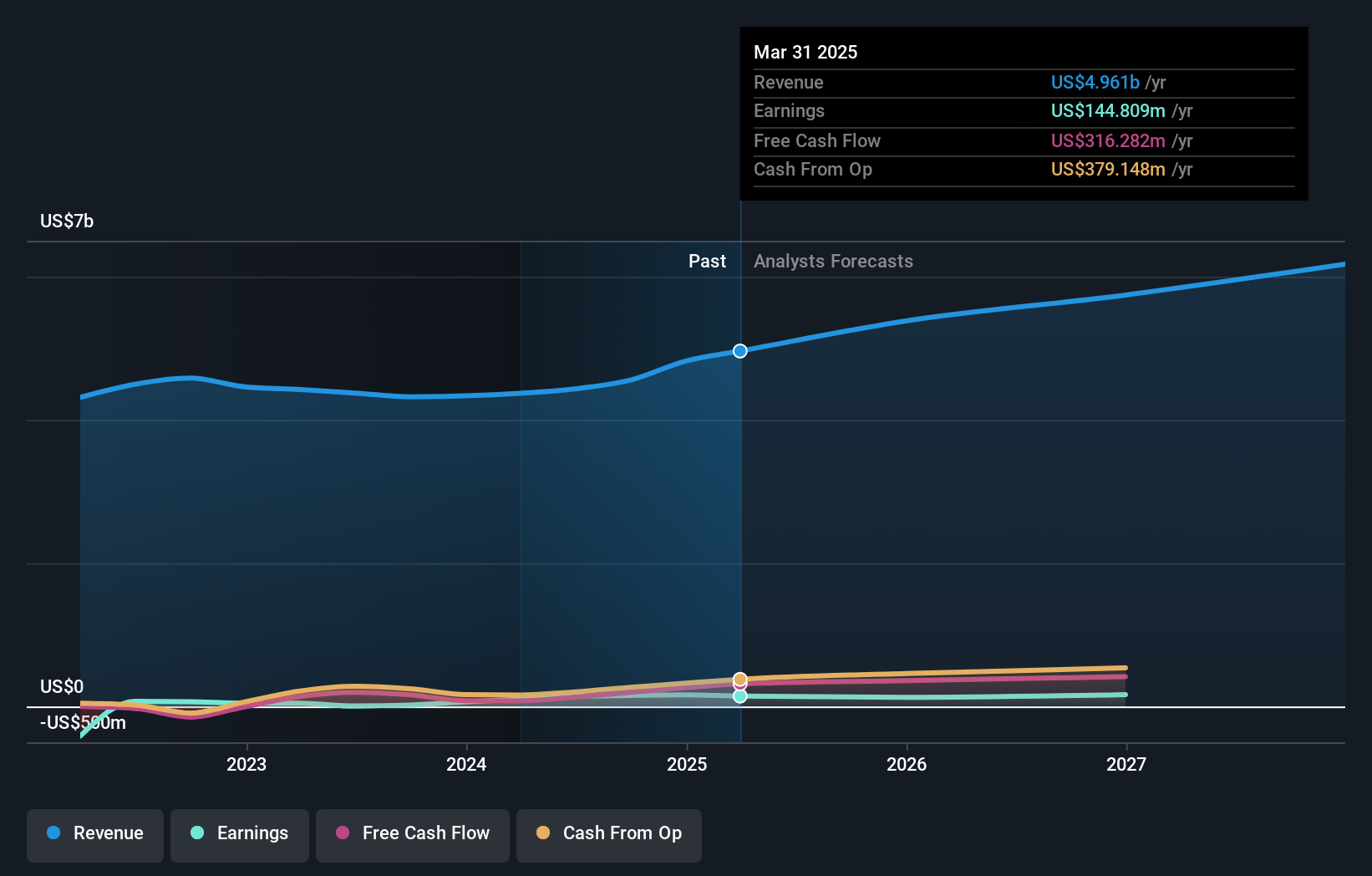

Overview: Colliers International Group Inc. offers commercial real estate services to corporate and institutional clients across various regions including the United States, Canada, Europe, Australia, and more, with a market cap of CA$10.65 billion.

Operations: The company's revenue segments include Engineering at $1.55 billion, Real Estate Services at $3.10 billion, and Investment Management at $516.36 million.

Insider Ownership: 14.0%

Colliers International Group shows potential as a growth company with high insider ownership, despite mixed financial results. Earnings are forecast to grow significantly at 27.2% annually, outpacing the Canadian market. However, recent earnings reports reveal a decline in net income and profit margins compared to last year. Insider activity indicates more shares were bought than sold recently, suggesting confidence in future prospects. The company is expanding its investment management division and has raised its earnings guidance for 2025.

- Navigate through the intricacies of Colliers International Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Colliers International Group is trading beyond its estimated value.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of CA$1 billion.

Operations: Propel Holdings generates revenue of $528.37 million from providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 30.6%

Propel Holdings shows strong growth potential, with earnings expected to rise 32.4% annually, surpassing the Canadian market average. Revenue is also forecasted to grow significantly at 24.9% per year. Recent earnings reports highlight a substantial increase in revenue and net income compared to the previous year. Despite high insider ownership, there has been significant insider selling recently. The company trades below analyst price targets but faces challenges with debt coverage and dividend sustainability from free cash flows.

- Unlock comprehensive insights into our analysis of Propel Holdings stock in this growth report.

- According our valuation report, there's an indication that Propel Holdings' share price might be on the cheaper side.

West Red Lake Gold Mines (TSXV:WRLG)

Simply Wall St Growth Rating: ★★★★★★

Overview: West Red Lake Gold Mines Ltd. is engaged in acquiring, exploring, evaluating, and developing gold properties in Canada, with a market capitalization of CA$412.04 million.

Operations: West Red Lake Gold Mines Ltd. does not currently report any revenue segments.

Insider Ownership: 11.2%

West Red Lake Gold Mines demonstrates strong growth potential, with revenue expected to increase by 64.9% annually, outpacing the Canadian market. Insider ownership is significant, with more shares bought than sold recently. Despite past shareholder dilution, the company is on track to become profitable within three years. Recent developments at Madsen Mine show promising high-grade gold drill results and operational improvements, supporting future growth prospects amid ongoing mine ramp-up activities and strategic investments in equipment.

- Delve into the full analysis future growth report here for a deeper understanding of West Red Lake Gold Mines.

- Upon reviewing our latest valuation report, West Red Lake Gold Mines' share price might be too optimistic.

Taking Advantage

- Click this link to deep-dive into the 41 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if West Red Lake Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WRLG

West Red Lake Gold Mines

Acquires, explores, evaluates, and develops gold properties in Canada.

Exceptional growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives