- Canada

- /

- Real Estate

- /

- TSX:CIGI

High Growth TSX Companies With At Least 14% Insider Ownership

Reviewed by Simply Wall St

The Canadian market has shown resilience, maintaining a steady pace over the last week and achieving an 11% increase over the past year, with expectations of earnings growing by 15% annually. In this context, stocks with high insider ownership can be particularly compelling as they often indicate that company leaders have a vested interest in the business's success and future growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

| goeasy (TSX:GSY) | 21.5% | 15.5% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.4% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 67.3% |

| Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

| Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

| Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

| Almonty Industries (TSX:AII) | 17.7% | 105% |

Here's a peek at a few of the choices from the screener.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

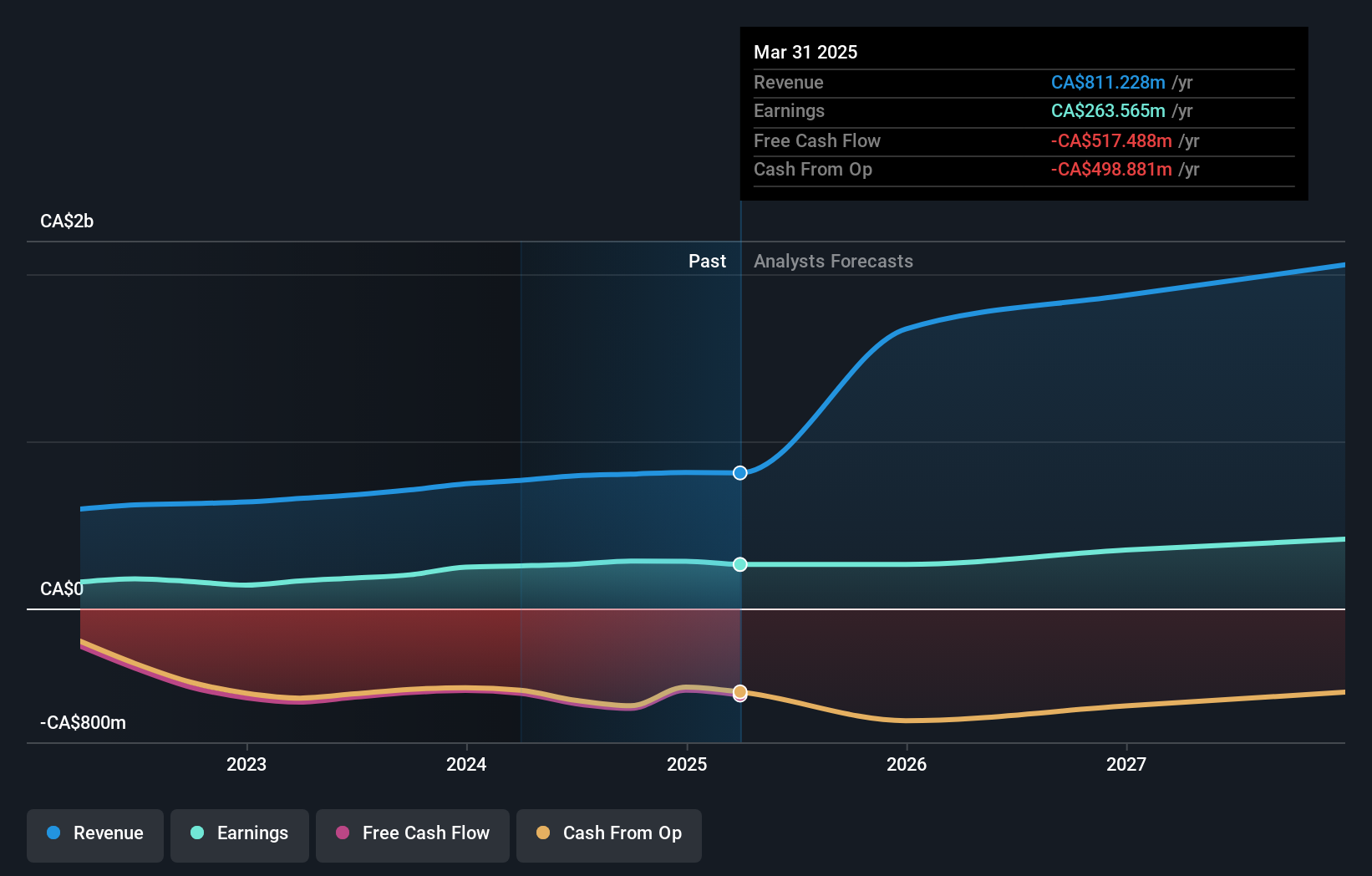

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market cap of approximately CA$8.94 billion.

Operations: The company generates revenue primarily from the Americas with CA$2.53 billion, followed by Europe, the Middle East & Africa (EMEA) at CA$730.10 million, Asia Pacific at CA$616.58 million, and Investment Management services contributing CA$489.23 million.

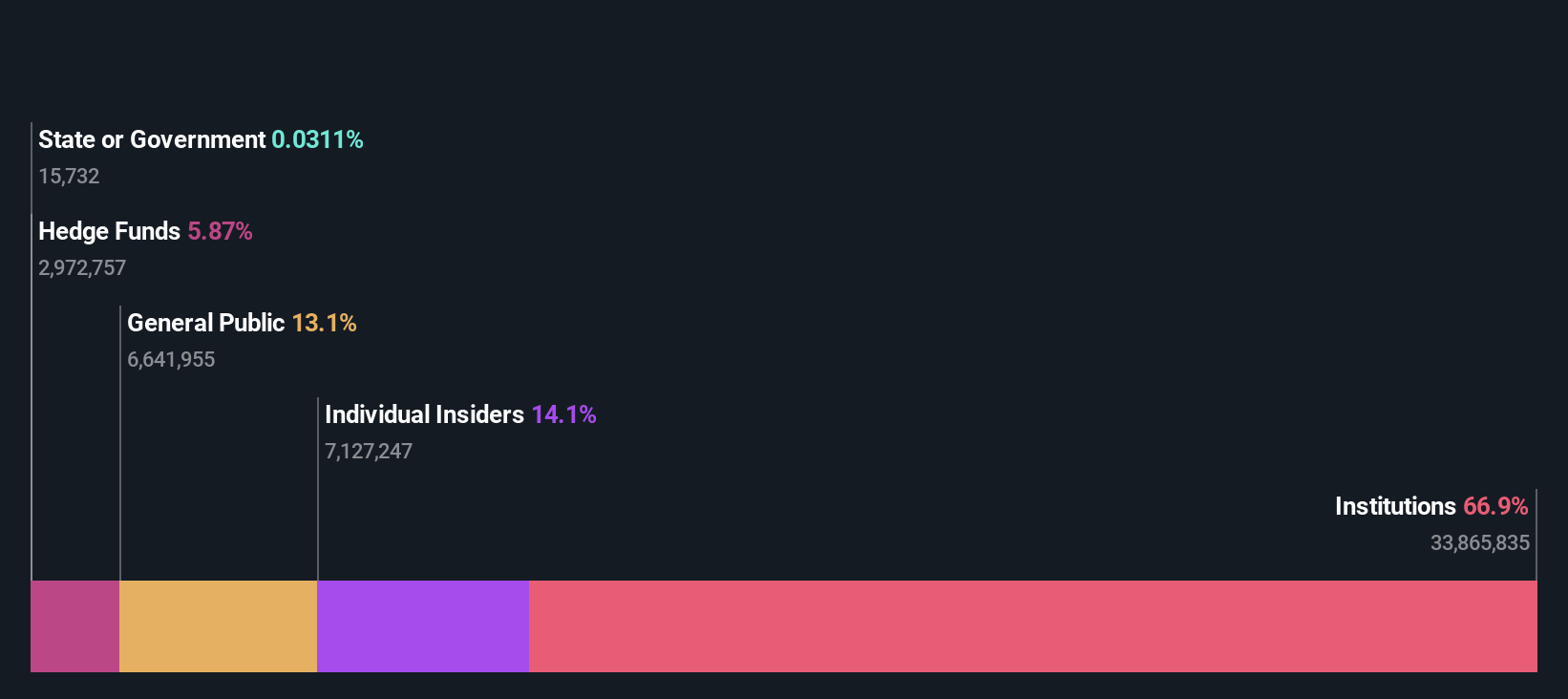

Insider Ownership: 14.2%

Colliers International Group is trading at 51.7% below its estimated fair value, reflecting potential undervaluation. Despite a slower forecasted revenue growth rate of 9.5% per year compared to the industry's higher benchmarks, its earnings have increased by 119.8% over the past year and are expected to grow by 38.34% annually over the next three years—outpacing the Canadian market projection of 14.7%. Recent strategic expansions, including a partnership with SPGI Zurich AG to strengthen its European operations and involvement in marketing significant real estate projects in Mississippi, underscore proactive management actions aimed at sustaining growth and market presence.

- Unlock comprehensive insights into our analysis of Colliers International Group stock in this growth report.

- Our expertly prepared valuation report Colliers International Group implies its share price may be lower than expected.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

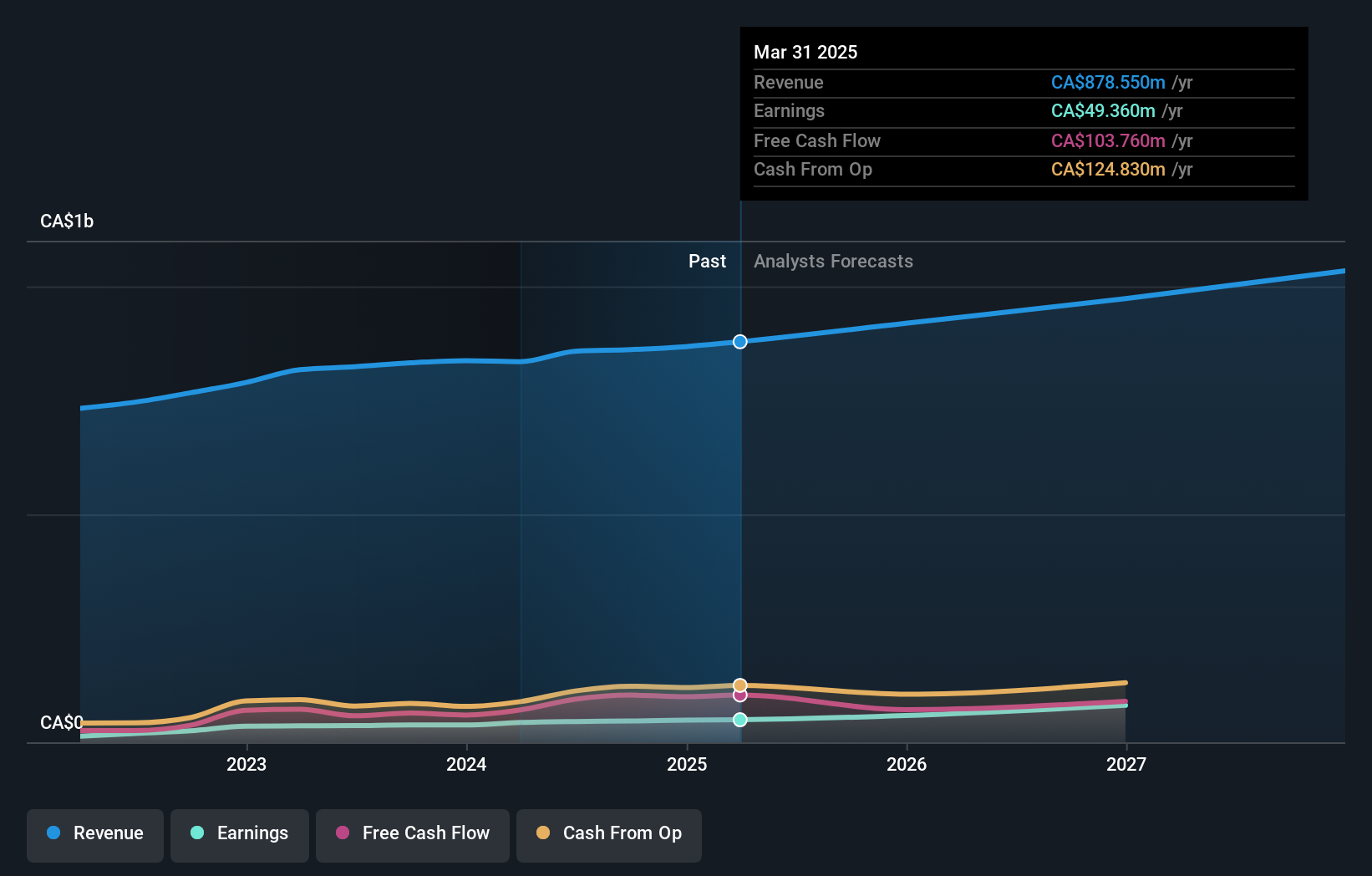

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market cap of approximately CA$3.15 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.5%

goeasy Ltd. is positioned as a growth company with high insider ownership, though it faces challenges like a dividend coverage issue and substantial debt. Earnings have grown by 54.3% over the past year with forecasts suggesting a further annual increase of 15.53%. Revenue growth is also robust, expected at 32.5% per year, outpacing the Canadian market significantly. Recent executive transitions, including the upcoming CEO change and new brand leadership appointments, indicate strategic shifts aiming to sustain this momentum.

- Dive into the specifics of goeasy here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of goeasy shares in the market.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation operates in providing accessibility solutions for the elderly and physically challenged, serving markets in Canada, the United States, Europe, and internationally, with a market cap of approximately CA$1.35 billion.

Operations: Savaria's revenue segments include CA$183.82 million from Patient Care.

Insider Ownership: 19.6%

Savaria, a Canadian company with high insider ownership, shows mixed signals in its growth trajectory. Despite no substantial insider buying recently and some shareholder dilution over the past year, it maintains a steady dividend policy and has seen earnings grow by 13.1% annually over the past five years. Analysts expect significant earnings growth of 24.87% per year moving forward, outpacing the Canadian market forecast of 14.7%. Additionally, Savaria's revenue is projected to hit CA$1 billion by 2025, slightly above market trends.

- Delve into the full analysis future growth report here for a deeper understanding of Savaria.

- The valuation report we've compiled suggests that Savaria's current price could be quite moderate.

Key Takeaways

- Explore the 29 names from our Fast Growing TSX Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)