- Canada

- /

- Real Estate

- /

- TSX:CIGI

Colliers (TSX:CIGI): Assessing Valuation After Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

See our latest analysis for Colliers International Group.

After some short-term fluctuations, Colliers’ share price has posted a modest gain in 2024. Its three-year total shareholder return of 76% still signals underlying strength. The recent movement hints that while momentum has softened, the longer-term growth story is intact.

If you’re inspired by Colliers’ multi-year performance, now could be a great time to discover fast growing stocks with high insider ownership.

With Colliers’ growth and recent performance in mind, the key question is whether its current share price understates the company’s potential or if the market has already factored in the future upside, potentially leaving little room for a bargain.

Most Popular Narrative: 3% Undervalued

Colliers International Group’s widely followed narrative sets a fair value above the last close, suggesting that analyst expectations remain slightly higher than current market pricing. The stage is set for a deeper dive into what is driving this premium valuation.

Digital transformation and targeted acquisitions are boosting productivity, market share, and profitability, driving sustained growth in commercial real estate and investment management. Heavy dependence on industrial leasing, acquisitions, and traditional brokerage services exposes Colliers to market volatility, integration risks, and technological disruptions, threatening growth and profitability.

How can a company with shifting market momentum attract a premium? The heart of this narrative is bold revenue and earnings expansion, plus margin gains, but there is a twist to the story the full narrative reveals. Want to see which financial levers insiders believe will carry Colliers into the next growth cycle?

Result: Fair Value of $223.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing fundraising challenges and uncertain industrial leasing demand could still challenge Colliers' bullish growth outlook and test its current premium valuation.

Find out about the key risks to this Colliers International Group narrative.

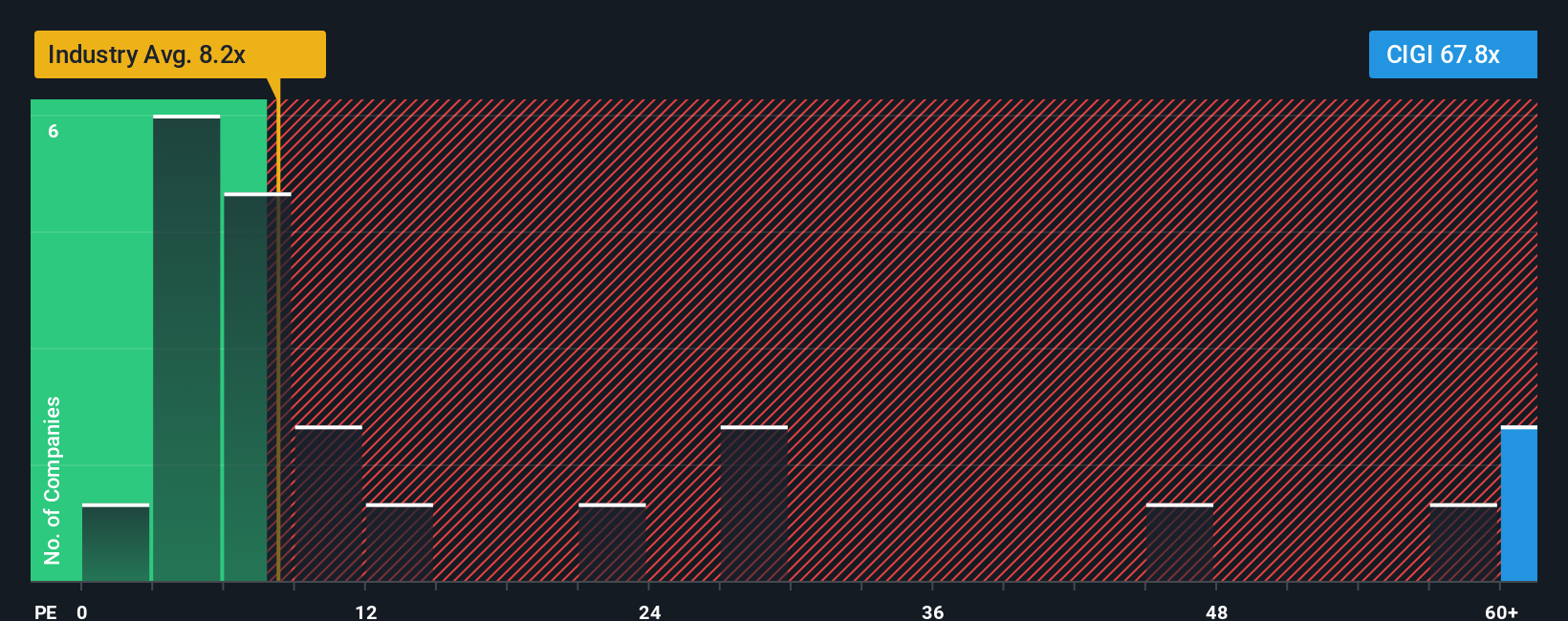

Another View: Market Multiples Raise Caution

While analysts see Colliers as modestly undervalued, its price-to-earnings ratio stands out. Trading at 70.5x, the figure is far above both the Canadian real estate sector average of 8.3x and its peer average of 53.8x. It is also considerably higher than the fair ratio of 42.8x. Such a wide gap suggests investors are pricing in strong future growth, but it also introduces sizeable valuation risk if that growth fails to materialize. Can Colliers justify its premium, or is the market overlooking hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Colliers International Group Narrative

If you see the numbers differently or prefer to chart your own course, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Colliers International Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock the next wave of potential winners. Simply Wall St’s powerful Screeners help you spot standout opportunities that could supercharge your portfolio if you act now.

- Tap into digital disruption and cutting-edge innovation by tracking these 24 AI penny stocks featuring unmistakable advancements in artificial intelligence and automation.

- Build your passive income strategy instantly by selecting companies offering strong yields with these 19 dividend stocks with yields > 3% and stable dividend potential.

- Jump on tomorrow’s growth leaders before the crowd with these 3567 penny stocks with strong financials packed with emerging companies making big moves on strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives