If EPS Growth Is Important To You, CanadaBis Capital (CVE:CANB) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CanadaBis Capital (CVE:CANB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for CanadaBis Capital

How Fast Is CanadaBis Capital Growing Its Earnings Per Share?

Over the last three years, CanadaBis Capital has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, CanadaBis Capital's EPS grew from CA$0.012 to CA$0.032, over the previous 12 months. It's not often a company can achieve year-on-year growth of 179%. That could be a sign that the business has reached a true inflection point.

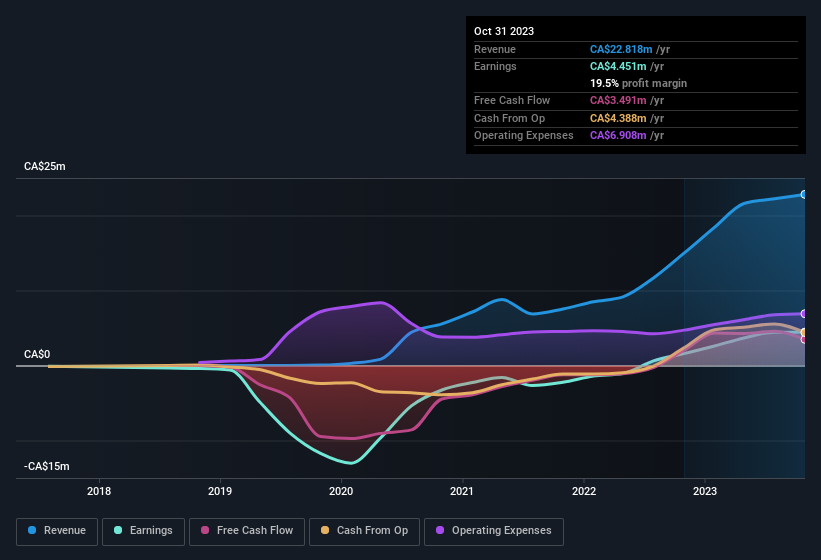

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. CanadaBis Capital shareholders can take confidence from the fact that EBIT margins are up from 13% to 21%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

CanadaBis Capital isn't a huge company, given its market capitalisation of CA$35m. That makes it extra important to check on its balance sheet strength.

Are CanadaBis Capital Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in CanadaBis Capital in the previous 12 months. Add in the fact that Shane Chana, the Director of the company, paid CA$19k for shares at around CA$0.12 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in CanadaBis Capital.

And the insider buying isn't the only sign of alignment between shareholders and the board, since CanadaBis Capital insiders own more than a third of the company. To be exact, company insiders hold 55% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only CA$35m CanadaBis Capital is really small for a listed company. So this large proportion of shares owned by insiders only amounts to CA$19m. That might not be a huge sum but it should be enough to keep insiders motivated!

Does CanadaBis Capital Deserve A Spot On Your Watchlist?

CanadaBis Capital's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest CanadaBis Capital belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for CanadaBis Capital that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CanadaBis Capital, you'll probably love this curated collection of companies in CA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CANB

CanadaBis Capital

Engages in the production and sale of recreational cannabis and cannabis extracts in Canada.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives