There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Charlotte's Web Holdings (TSE:CWEB) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Charlotte's Web Holdings

How Long Is Charlotte's Web Holdings' Cash Runway?

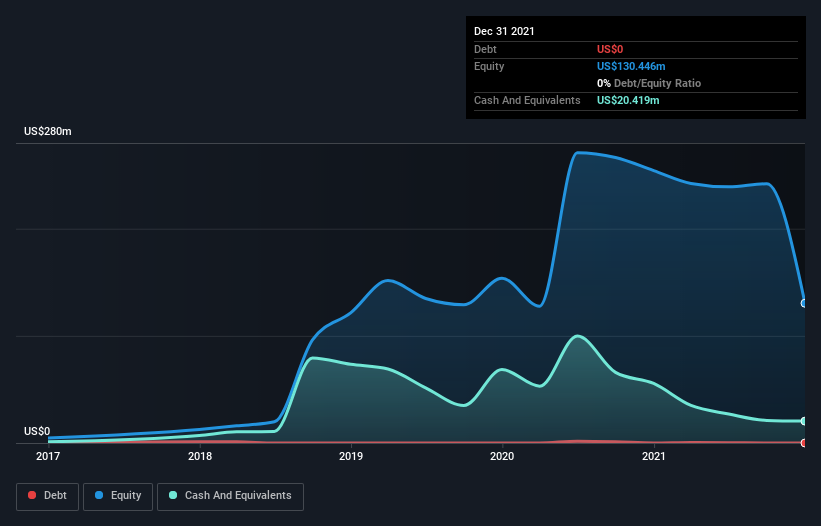

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2021, Charlotte's Web Holdings had US$20m in cash, and was debt-free. Importantly, its cash burn was US$34m over the trailing twelve months. So it had a cash runway of approximately 7 months from December 2021. Notably, analysts forecast that Charlotte's Web Holdings will break even (at a free cash flow level) in about 2 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Charlotte's Web Holdings Growing?

Charlotte's Web Holdings managed to reduce its cash burn by 57% over the last twelve months, which suggests it's on the right flight path. Mundanely, though, operating revenue growth was flat. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Charlotte's Web Holdings Raise Cash?

Given Charlotte's Web Holdings' revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Charlotte's Web Holdings' cash burn of US$34m is about 32% of its US$106m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is Charlotte's Web Holdings' Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Charlotte's Web Holdings' cash burn reduction was relatively promising. One real positive is that analysts are forecasting that the company will reach breakeven. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for Charlotte's Web Holdings that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CWEB

Charlotte's Web Holdings

Engages in the farming, manufacturing, marketing, and sale of hemp-derived cannabidiol (CBD) and other botanical-based wellness products.

Low risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026