Is Curaleaf's Expanded Credit Facility Reshaping the Investment Case for Curaleaf Holdings (TSX:CURA)?

Reviewed by Sasha Jovanovic

- Curaleaf Holdings recently amended its credit agreement with Needham Bank, expanding its revolving credit facility from US$40 million to US$100 million and extending its maturity up to five years.

- This move gives Curaleaf greater financial flexibility, allowing it to pay down higher-interest acquisition debt and support growth efforts amid ongoing transformation in the cannabis industry.

- We'll explore how expanded access to lower-cost financing may influence Curaleaf's investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Curaleaf Holdings Investment Narrative Recap

To be a Curaleaf shareholder, you need to believe that regulatory breakthroughs in key international markets and expanding access to lower-cost capital can support the company’s effort to return to profitable growth, despite recent revenue declines and industry-wide pricing pressure. The new US$100 million revolving credit facility may help reduce costly acquisition debt and give Curaleaf better short-term flexibility, but does not alter the biggest risk for the business: margin erosion from oversupply and heavy competition in core markets.

Among Curaleaf’s recent moves, the September 2025 expansion into a new dispensary in New Albany, Ohio, stands out. Growing its retail footprint complements the company’s access to additional credit and speaks to a continued focus on strengthening its U.S. market position, which is crucial given ongoing pricing and regulatory headwinds facing the industry.

By contrast, investors should be aware that access to capital does not fully address the risk posed by persistent pressure on gross margins from…

Read the full narrative on Curaleaf Holdings (it's free!)

Curaleaf Holdings is projected to reach $1.5 billion in revenue and $38.9 million in earnings by 2028. This implies an annual revenue growth rate of 4.3% and a $305.8 million increase in earnings from the current level of -$266.9 million.

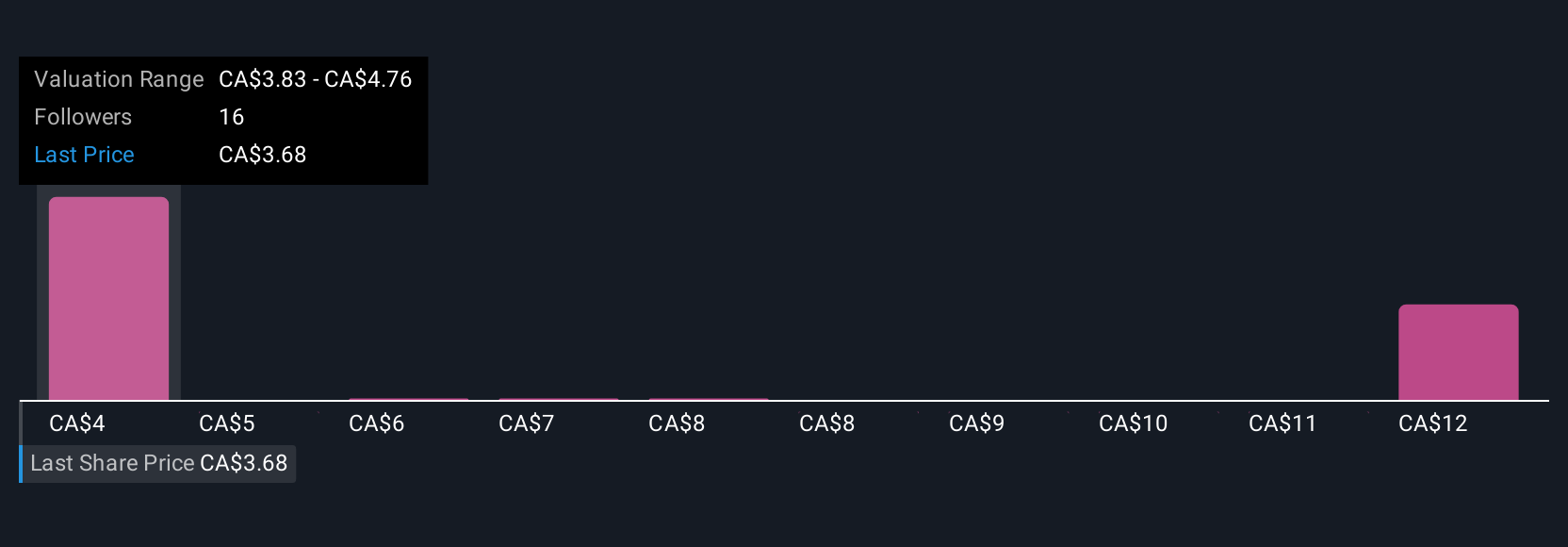

Uncover how Curaleaf Holdings' forecasts yield a CA$4.06 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members estimate Curaleaf’s fair value between US$4.06 and US$13.30, reflecting wide variation in expectations. With ongoing pricing pressure and competition shaping profit outlooks, you can compare these conflicting views and see where your analysis fits in.

Explore 5 other fair value estimates on Curaleaf Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Curaleaf Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Curaleaf Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curaleaf Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives