Curaleaf Holdings (TSX:CURA): Is the Stock Overvalued After Its Recent 42% Rally?

Reviewed by Kshitija Bhandaru

Curaleaf Holdings (TSX:CURA) stock has been on investors’ radar lately thanks to some significant moves in its share price over the past month, surging 42%. This activity has drawn attention to how the cannabis giant is positioned in today’s market.

See our latest analysis for Curaleaf Holdings.

The recent surge in Curaleaf’s share price caps off a rollercoaster year, as investors have warmed up to the company’s renewed growth outlook and shifting sentiment in cannabis. While its 1-year total shareholder return sits at 12%, the jump of over 100% in its share price so far this year suggests building momentum and changing risk perceptions around the business.

If Curaleaf’s latest rally has you thinking bigger, use this as a springboard to discover fast growing stocks with high insider ownership.

With shares rallying and analyst targets trailing the current price, the big question is whether Curaleaf Holdings is still undervalued or if markets are already baking future growth into its valuation. Is there a real buying opportunity here?

Most Popular Narrative: 14% Overvalued

Curaleaf’s current share price has outpaced the narrative’s fair value estimate, suggesting that sentiment may be running ahead of fundamentals. This backdrop highlights the importance of understanding what is fueling analyst perspectives and their implications for investors.

Rapid expansion and regulatory breakthroughs in international markets, notably the strong sequential and yearly growth in Germany, new entry into Turkey (an 87-million-person underpenetrated market), and advancements such as the first medically certified EU device, meaningfully increase Curaleaf's total addressable market, diversify revenue streams beyond the saturated U.S. market, and are likely to drive sustained long-term revenue growth.

Want the real story behind this valuation? The narrative bets big on international expansion and a major profit turnaround. The growth and margin forecasts behind this number might surprise even cannabis industry veterans. Just how bullish are these assumptions? Click in to find out what’s driving this headline price target.

Result: Fair Value of $4.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and unpredictable regulatory timelines could quickly slow Curaleaf’s growth story and valuation momentum.

Find out about the key risks to this Curaleaf Holdings narrative.

Another View: DCF Model Suggests Deep Value

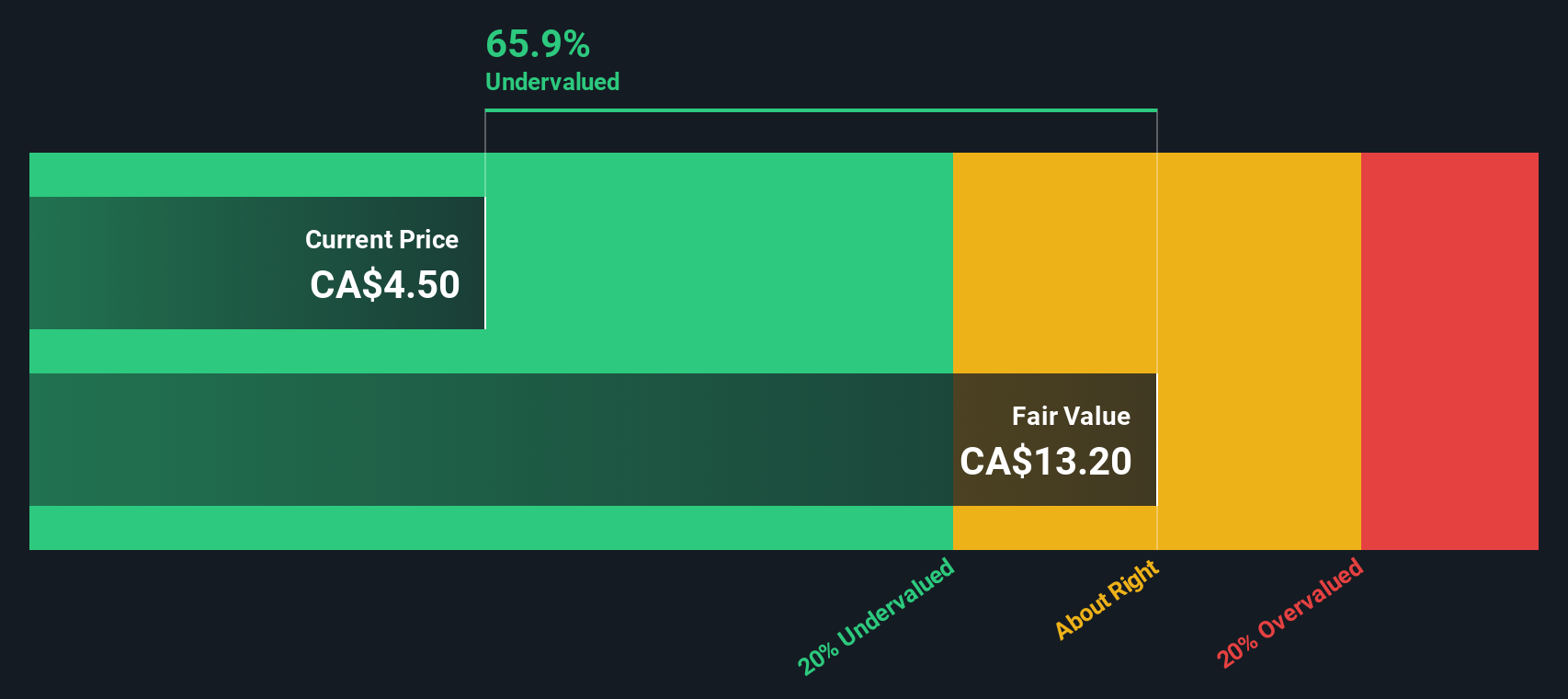

While analyst price targets imply Curaleaf may be fully valued, our SWS DCF model points in the opposite direction. According to this approach, Curaleaf is trading at a steep 65% discount to its estimated fair value. That’s a dramatic difference. Can both perspectives be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Curaleaf Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Curaleaf Holdings Narrative

If you see things differently or just want to dig into the numbers yourself, you can easily build your own perspective in just a few minutes, then Do it your way.

A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your portfolio to just one sector when Simply Wall Street’s powerful screener can help you uncover high-potential stocks other investors are missing? Don’t wait, great opportunities go quickly. See what else could boost your returns today.

- Unlock income potential with these 18 dividend stocks with yields > 3%, featuring companies offering robust yields above 3% for growing your passive earnings.

- Catch the next tech wave by tapping into these 26 quantum computing stocks, where groundbreaking advances in computing may fuel outsized gains.

- Stay ahead of the curve with these 24 AI penny stocks, spotlighting innovative businesses transforming entire industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives