Why Investors Shouldn't Be Surprised By Crescita Therapeutics Inc.'s (TSE:CTX) 33% Share Price Surge

Crescita Therapeutics Inc. (TSE:CTX) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

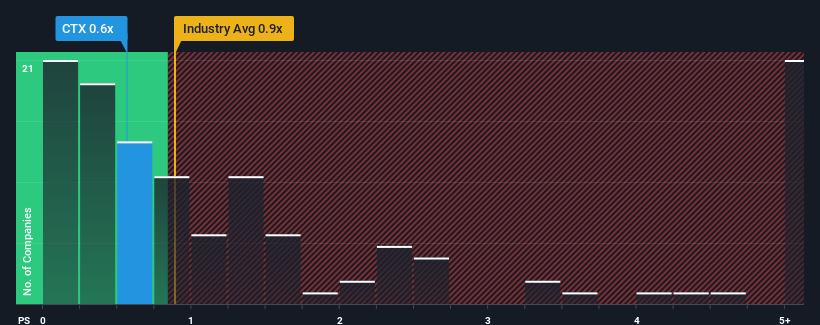

Although its price has surged higher, you could still be forgiven for feeling indifferent about Crescita Therapeutics' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Crescita Therapeutics

What Does Crescita Therapeutics' Recent Performance Look Like?

For example, consider that Crescita Therapeutics' financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Crescita Therapeutics' earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Crescita Therapeutics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why Crescita Therapeutics' P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Crescita Therapeutics' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, Crescita Therapeutics' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - Crescita Therapeutics has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Crescita Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CTX

Crescita Therapeutics

A dermatology company, provides non-prescription skincare products and prescription drug products in Canada, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives