- Canada

- /

- Metals and Mining

- /

- TSX:DSV

TSX Penny Stocks Spotlight: Cronos Group And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

The Canadian market has experienced a period of sideways consolidation over the past three months, which may act as a corrective force amidst ongoing policy uncertainty and trade worries. In such conditions, investors often seek diversification to balance their portfolios, and penny stocks can offer intriguing opportunities due to their affordability and potential for growth. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still provide value and growth prospects when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.72 | CA$172.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.79 | CA$449.82M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.31M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$0.97 | CA$35.81M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.93 | CA$3.11B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$298.08M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.03 | CA$200.35M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, and marketing of cannabis products in Canada, Israel, and Germany with a market cap of CA$1.13 billion.

Operations: The company generates revenue of $117.62 million from its operations in cultivating, manufacturing, and marketing cannabis and cannabis-derived products.

Market Cap: CA$1.13B

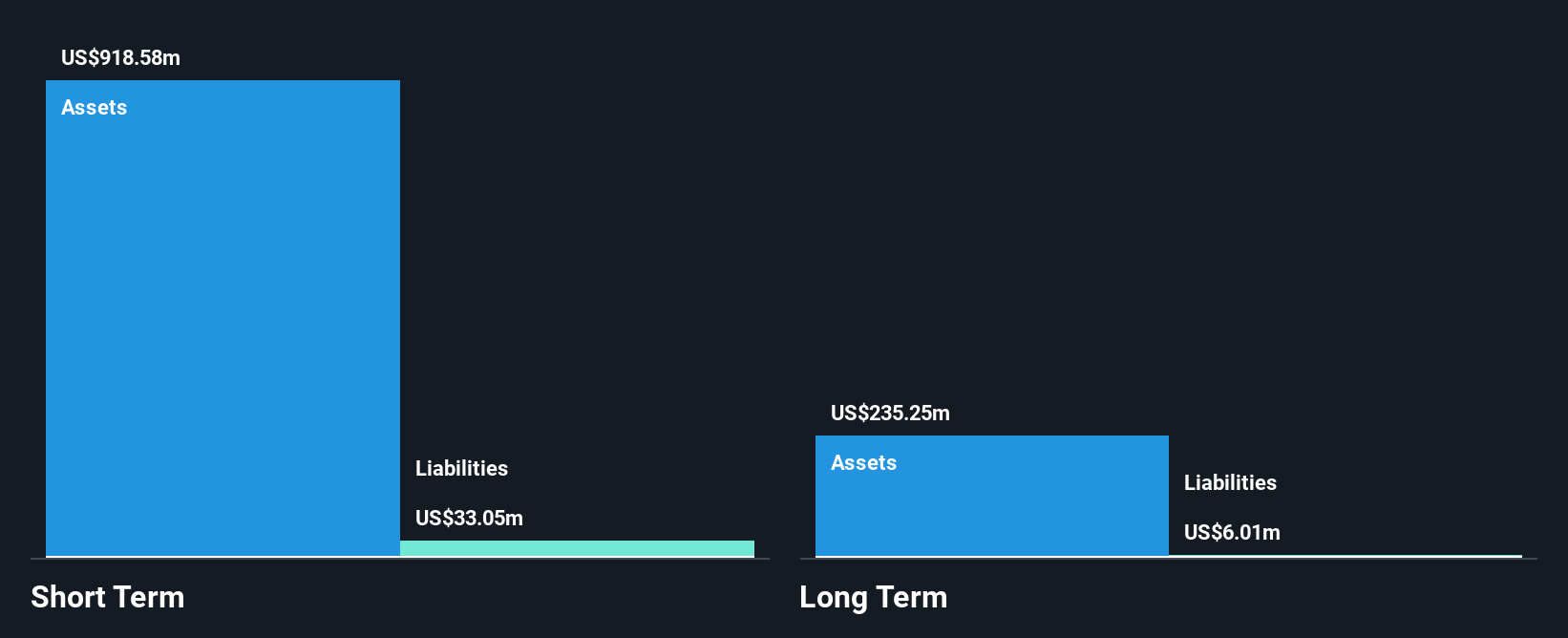

Cronos Group has shown financial improvement, becoming profitable with a net income of US$41.08 million for 2024, reversing a previous year's loss. The company reported full-year revenue of US$117.62 million, indicating growth from the prior year. Despite earnings forecasted to decline by an average of 16.8% annually over the next three years, revenue is expected to grow by 10.53% per year. Cronos remains debt-free and its short-term assets significantly exceed liabilities, although its Return on Equity is low at 3.6%. The management team is experienced; however, the board lacks seasoned members.

- Unlock comprehensive insights into our analysis of Cronos Group stock in this financial health report.

- Examine Cronos Group's earnings growth report to understand how analysts expect it to perform.

Discovery Silver (TSX:DSV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Discovery Silver Corp. is a mineral exploration company focused on the exploration and development of polymetallic mineral deposits, with a market capitalization of CA$632.73 million.

Operations: Discovery Silver Corp. has not reported any revenue segments.

Market Cap: CA$632.73M

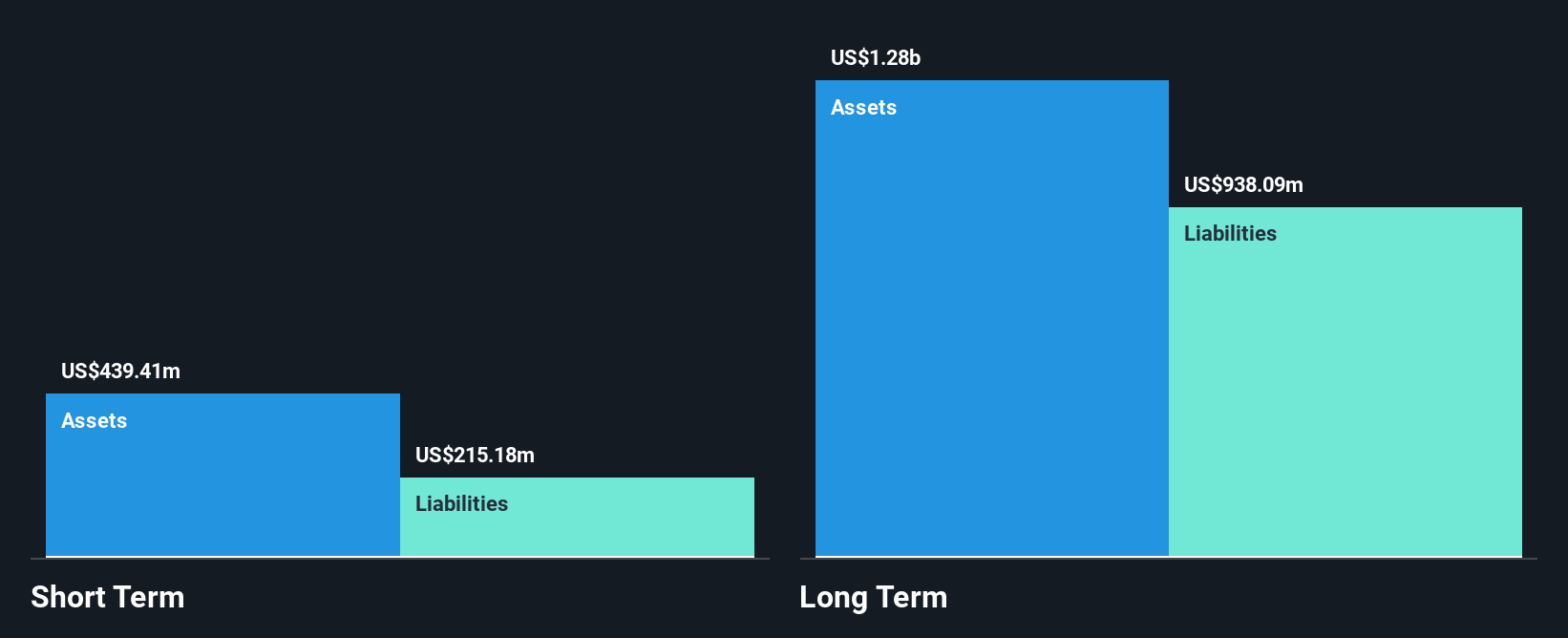

Discovery Silver Corp., a pre-revenue entity with a market cap of CA$632.73 million, maintains financial stability with no debt and short-term assets of CA$37.1 million exceeding liabilities. Despite being unprofitable and experiencing increased losses over the past five years, the company has secured a cash runway for over a year at current free cash flow levels. Recent developments include raising CAD 225 million through equity offerings to support its acquisition strategy, notably the Porcupine Complex in Ontario. Management is experienced with an average tenure of 2.2 years, while its board averages 6.7 years in tenure.

- Click here to discover the nuances of Discovery Silver with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Discovery Silver's future.

Royal Road Minerals (TSXV:RYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Royal Road Minerals Limited is involved in the exploration and development of mineral properties across Saudi Arabia, Morocco, Colombia, and Nicaragua with a market cap of CA$30.56 million.

Operations: Royal Road Minerals Limited has not reported any specific revenue segments.

Market Cap: CA$30.56M

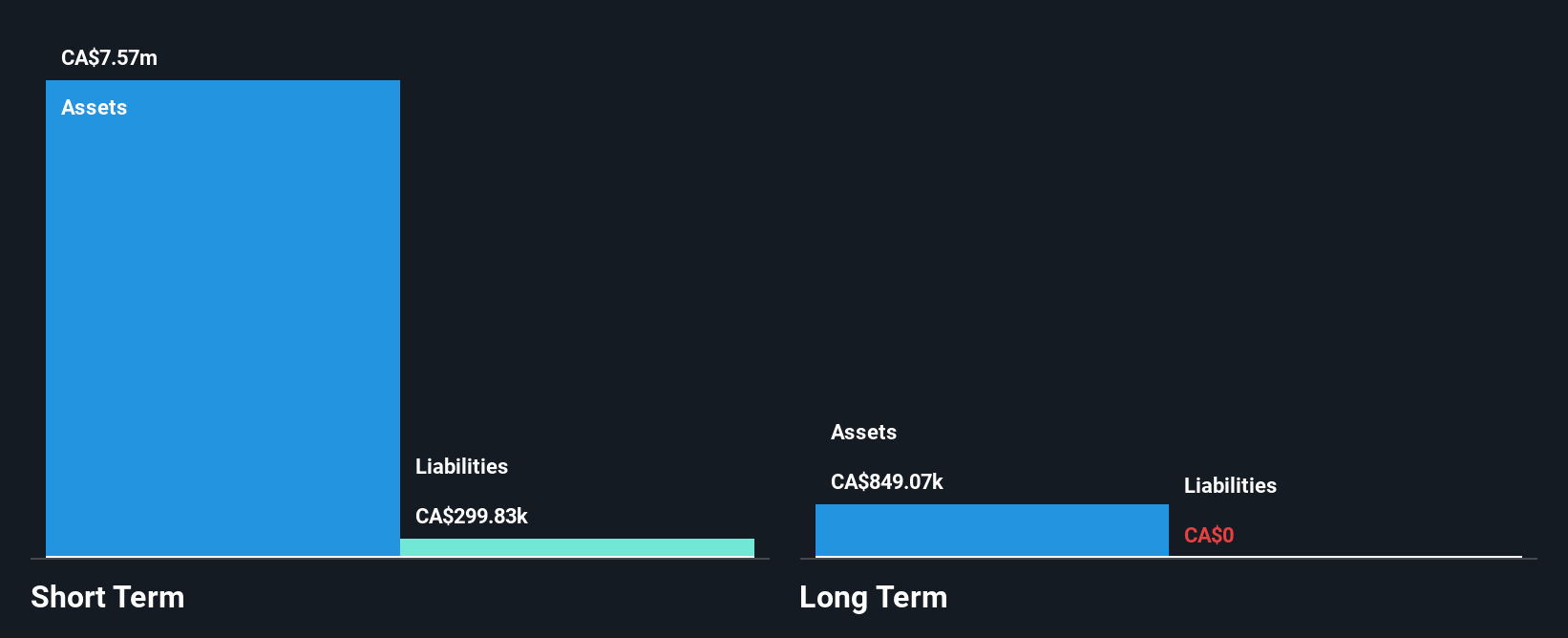

Royal Road Minerals Limited, with a market cap of CA$30.56 million, is pre-revenue and currently unprofitable. The company maintains financial stability with short-term assets of CA$10.5 million surpassing both its short-term liabilities of CA$208.7K and long-term liabilities of CA$11.6K, while being debt-free enhances its financial resilience. Its cash runway extends over three years based on current free cash flow levels, providing a buffer for ongoing operations despite historical losses increasing at 25.6% per year over the past five years. Management and board members are experienced, averaging tenures of 4.3 and 3.3 years respectively.

- Dive into the specifics of Royal Road Minerals here with our thorough balance sheet health report.

- Gain insights into Royal Road Minerals' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click through to start exploring the rest of the 928 TSX Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the exploration and development of polymetallic mineral deposits.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives