- Canada

- /

- Entertainment

- /

- TSXV:GAME

Slammed 29% GameSquare Holdings, Inc. (CVE:GAME) Screens Well Here But There Might Be A Catch

GameSquare Holdings, Inc. (CVE:GAME) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

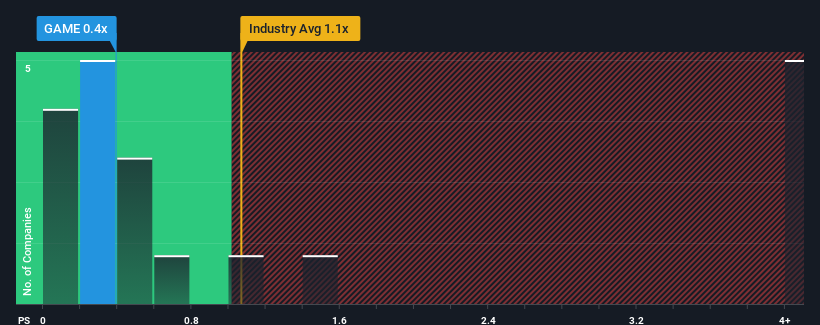

In spite of the heavy fall in price, it's still not a stretch to say that GameSquare Holdings' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Canada, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for GameSquare Holdings

What Does GameSquare Holdings' P/S Mean For Shareholders?

GameSquare Holdings could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think GameSquare Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is GameSquare Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, GameSquare Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 76%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 46% per year over the next three years. With the industry only predicted to deliver 9.9% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that GameSquare Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

GameSquare Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that GameSquare Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with GameSquare Holdings, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on GameSquare Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GAME

GameSquare Holdings

Operates as a vertically integrated digital media, entertainment, and technology company.

Undervalued with high growth potential.

Market Insights

Community Narratives