- Canada

- /

- Interactive Media and Services

- /

- TSXV:EQ

Shareholders Will Likely Find EQ Inc.'s (CVE:EQ) CEO Compensation Acceptable

Key Insights

- EQ to hold its Annual General Meeting on 21st of May

- Salary of CA$275.0k is part of CEO Geoff Rotstein's total remuneration

- Total compensation is 62% below industry average

- EQ's three-year loss to shareholders was 18% while its EPS grew by 25% over the past three years

The performance at EQ Inc. (CVE:EQ) has been rather lacklustre of late and shareholders may be wondering what CEO Geoff Rotstein is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 21st of May. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for EQ

Comparing EQ Inc.'s CEO Compensation With The Industry

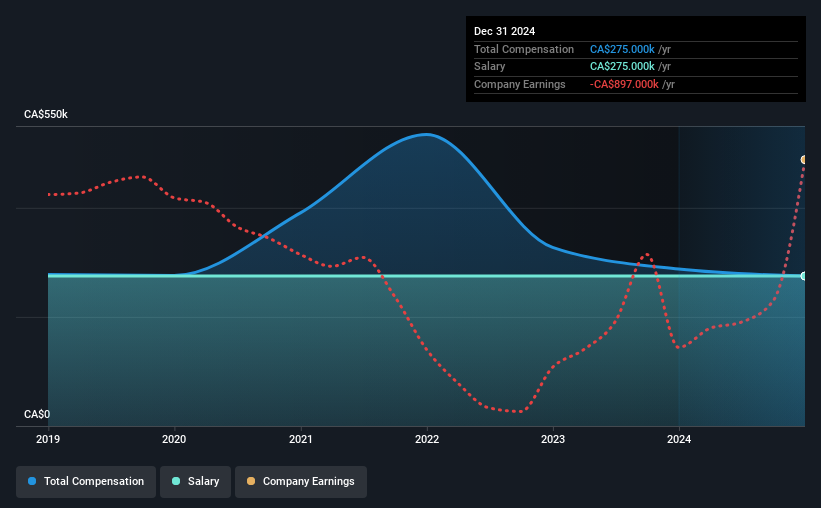

According to our data, EQ Inc. has a market capitalization of CA$70m, and paid its CEO total annual compensation worth CA$275k over the year to December 2024. We note that's a small decrease of 4.4% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$275k.

For comparison, other companies in the Canada Interactive Media and Services industry with market capitalizations below CA$280m, reported a median total CEO compensation of CA$718k. Accordingly, EQ pays its CEO under the industry median. Furthermore, Geoff Rotstein directly owns CA$4.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$275k | CA$275k | 100% |

| Other | - | CA$13k | - |

| Total Compensation | CA$275k | CA$288k | 100% |

On an industry level, around 16% of total compensation represents salary and 84% is other remuneration. Speaking on a company level, EQ prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

EQ Inc.'s Growth

Over the past three years, EQ Inc. has seen its earnings per share (EPS) grow by 25% per year. In the last year, its revenue is down 1.1%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has EQ Inc. Been A Good Investment?

Since shareholders would have lost about 18% over three years, some EQ Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

EQ rewards its CEO solely through a salary, ignoring non-salary benefits completely. The loss to shareholders over the past three years is certainly concerning. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key question may be why the fundamentals have not yet been reflected into the share price. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for EQ (2 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EQ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EQ

Fair value with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)