Does Shaw Communications (TSE:SJR.B) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Shaw Communications Inc. (TSE:SJR.B) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Shaw Communications

What Is Shaw Communications's Net Debt?

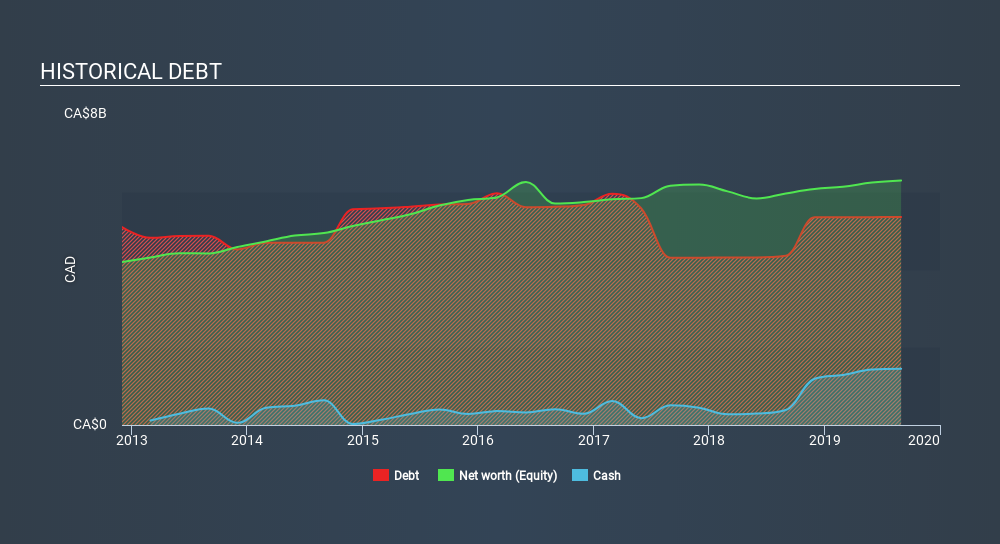

As you can see below, at the end of August 2019, Shaw Communications had CA$5.35b of debt, up from CA$4.35b a year ago. Click the image for more detail. On the flip side, it has CA$1.45b in cash leading to net debt of about CA$3.90b.

A Look At Shaw Communications's Liabilities

Zooming in on the latest balance sheet data, we can see that Shaw Communications had liabilities of CA$2.83b due within 12 months and liabilities of CA$6.53b due beyond that. Offsetting this, it had CA$1.45b in cash and CA$362.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$7.55b.

Shaw Communications has a very large market capitalization of CA$14.1b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Shaw Communications has net debt worth 1.9 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.3 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. We saw Shaw Communications grow its EBIT by 4.3% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Shaw Communications can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Shaw Communications recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for and improvement.

Our View

We'd go so far as to say Shaw Communications's conversion of EBIT to free cash flow was disappointing. Having said that, its ability to grow its EBIT isn't such a worry. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Shaw Communications stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Shaw Communications insiders have sold any shares recently. You click here to find out if insiders have sold recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SJR.B

Shaw Communications

Shaw Communications Inc. operates as a connectivity company in North America.

Established dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)