TSX Growth Companies With High Insider Ownership Delivering Up To 25 Percent Return On Equity

Reviewed by Simply Wall St

In the current Canadian market landscape, concerns about tariffs and their potential impact on economic growth are front and center. However, despite these uncertainties, the fundamental backdrop remains supportive with above-trend growth and historically low unemployment rates. In such an environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company in its long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Robex Resources (TSXV:RBX) | 25.4% | 130.7% |

| Orla Mining (TSX:OLA) | 11.5% | 43.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.5% | 77.6% |

| Allied Gold (TSX:AAUC) | 17.7% | 71.9% |

| Almonty Industries (TSX:AII) | 16.6% | 53% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.2% | 26% |

| Flow Beverage (TSX:FLOW) | 28.0% | 93.8% |

| CHAR Technologies (TSXV:YES) | 10.8% | 60.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

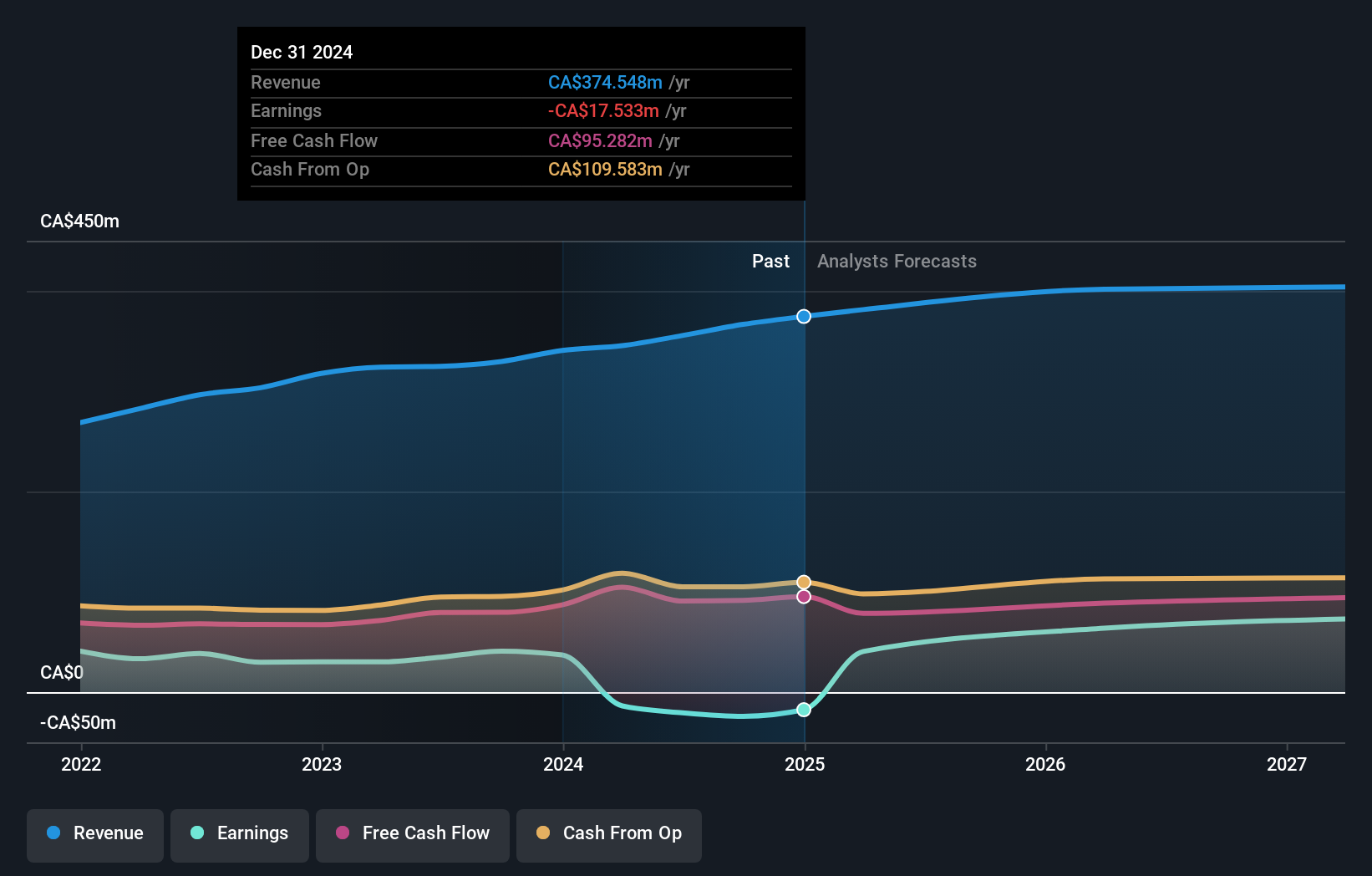

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market cap of CA$8.07 billion.

Operations: The company's revenue is primarily generated from its apparel segment, which amounts to CA$2.52 billion.

Insider Ownership: 18.6%

Return On Equity Forecast: 26% (2027 estimate)

Aritzia's earnings are projected to grow significantly at 45.1% annually, outpacing the Canadian market. Despite recent substantial insider selling, the company's revenue is expected to grow faster than the market at 16.4% per year. Aritzia trades at a significant discount to its estimated fair value and recently reported strong financial results with increased sales and net income for Q3 2024. The company also completed a CAD 5.9 million share buyback but filed for a CAD 66.36 million equity offering recently.

- Get an in-depth perspective on Aritzia's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Aritzia implies its share price may be too high.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$579.36 million.

Operations: The company's revenue is derived from two main segments: Radio, generating CA$131.18 million, and Broadcasting and Commercial Music, contributing CA$243.37 million.

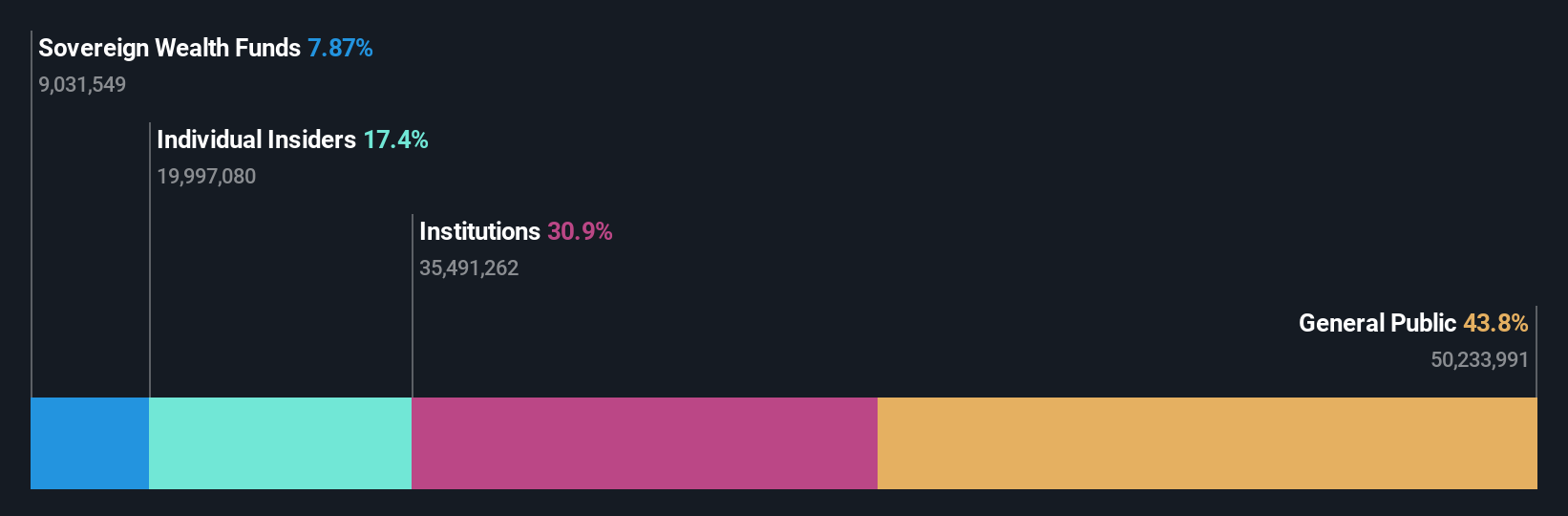

Insider Ownership: 25.7%

Return On Equity Forecast: 24% (2027 estimate)

Stingray Group is forecast to achieve profitability within three years, surpassing average market growth expectations. Recent insider activity shows more shares bought than sold over the past quarter. Despite a slower revenue growth forecast of 4.5% annually, Stingray trades significantly below its estimated fair value and has reported improved financial results with increased sales and net income for Q3 2024. The company recently raised funds through a private placement and expanded its credit facility to $500 million for operational liquidity.

- Click here and access our complete growth analysis report to understand the dynamics of Stingray Group.

- Our valuation report here indicates Stingray Group may be undervalued.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

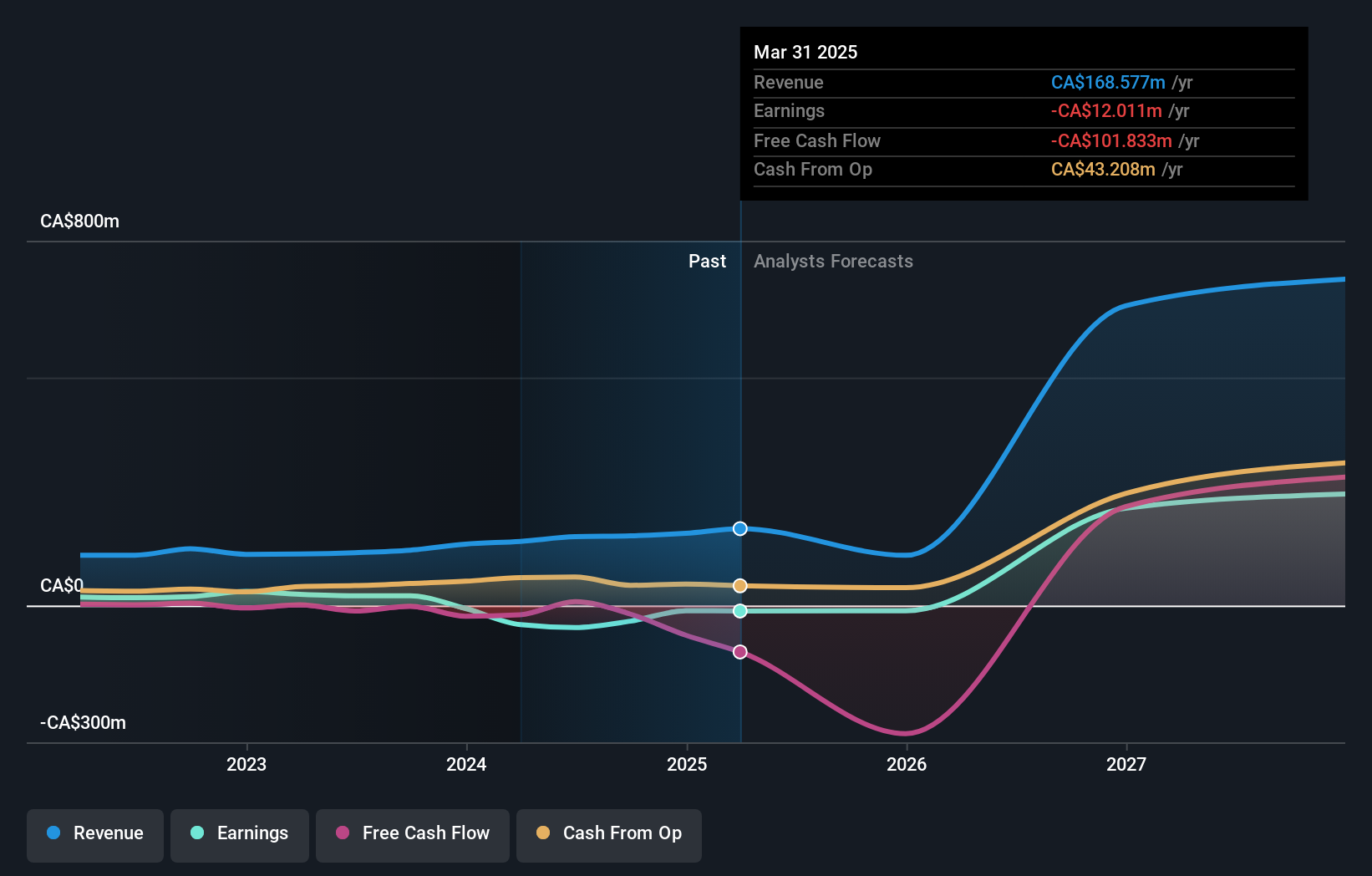

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$390.82 million.

Operations: The company generates revenue from its mining operations focused on gold, amounting to CA$152.71 million.

Insider Ownership: 25.4%

Return On Equity Forecast: 23% (2027 estimate)

Robex Resources is poised for substantial growth, with revenue expected to increase by over 50% annually, outpacing the Canadian market. The company recently secured a US$105 million debt facility to finance its Kiniero Gold Project in Guinea. Despite past shareholder dilution, Robex trades significantly below its estimated fair value and aims for profitability within three years. Recent equity offerings raised C$29.57 million, supporting ongoing project developments and potential resource expansions.

- Navigate through the intricacies of Robex Resources with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Robex Resources' share price might be on the cheaper side.

Next Steps

- Click through to start exploring the rest of the 32 Fast Growing TSX Companies With High Insider Ownership now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives