- Canada

- /

- Metals and Mining

- /

- TSXV:WRLG

Why Is West Red Lake Gold Mines (TSXV:WRLG) Down 5.9% After Reporting 34% Higher Gold Output at Madsen?

Reviewed by Sasha Jovanovic

- West Red Lake Gold Mines recently provided a third quarter operational update revealing that its Madsen Mine in Ontario achieved a 34% increase in gold production over the prior quarter, reaching 7,055 ounces and generating gross proceeds of C$33 million at an average realized gold price of US$3,456 per ounce.

- New operational efficiencies, including underground waste storage and the delivery of mine equipment, are supporting a methodical ramp-up toward commercial production projected for early 2026.

- We'll explore how the mine’s increasing ore tonnage and enhanced operational efficiency reshape West Red Lake Gold Mines' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is West Red Lake Gold Mines' Investment Narrative?

For anyone considering West Red Lake Gold Mines, the big picture centers on the successful ramp-up at the Madsen Mine and the company's transition from exploration to meaningful production. The sharp increase in gold output and associated revenue this quarter signals that operational improvements, including underground waste storage and enhanced equipment, are paying off. These updates have important implications for short-term catalysts, notably accelerating the timeline toward commercial production by early 2026, which was the central narrative for both risk and upside in prior analysis. While execution risks remain, especially around operational reliability, further dilution, and a relatively inexperienced board and management team, the recent announcement lessens concerns about the ability to hit near-term volume targets and may shift investor focus toward execution consistency and cost control as next key hurdles. With revenue now material and production trending up, the significance of operational bottlenecks and board inexperience is partly diminished, though not irrelevant.

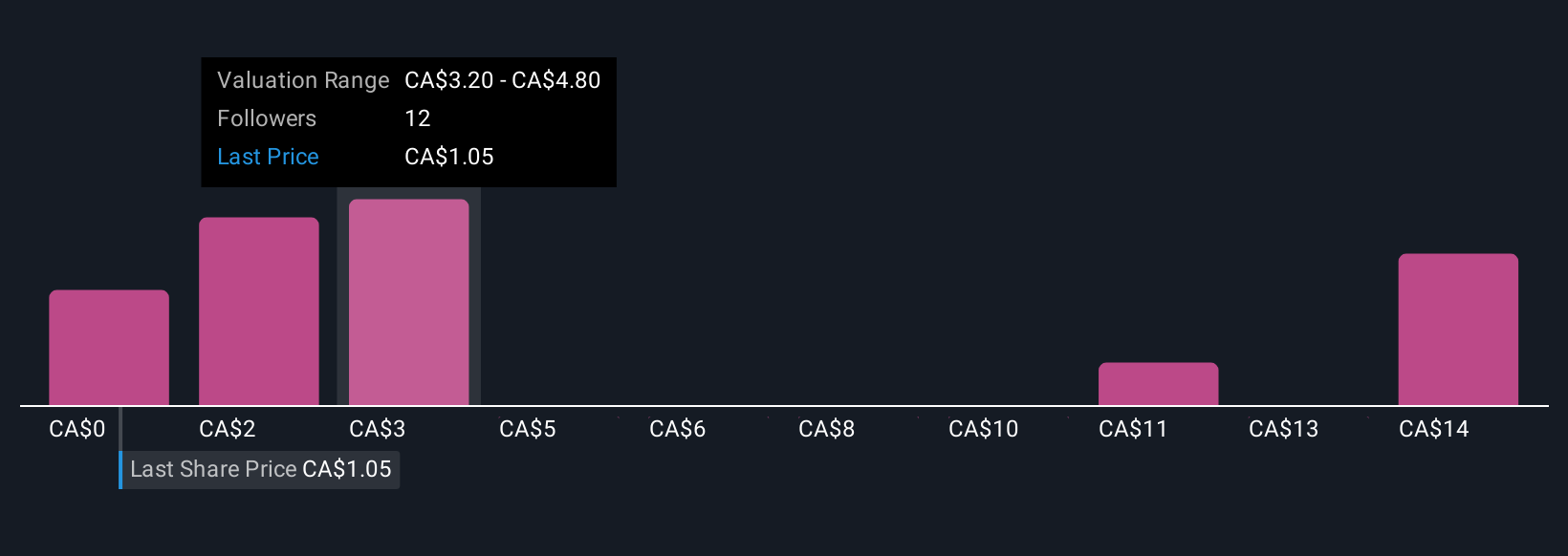

But against this operational progress, uncertainties around further capital needs and board turnover still matter, investors should take note. Our valuation report here indicates West Red Lake Gold Mines may be overvalued.Exploring Other Perspectives

Explore 12 other fair value estimates on West Red Lake Gold Mines - why the stock might be a potential multi-bagger!

Build Your Own West Red Lake Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Red Lake Gold Mines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free West Red Lake Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Red Lake Gold Mines' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if West Red Lake Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WRLG

West Red Lake Gold Mines

Acquires, explores, evaluates, and develops gold properties in Canada.

Exceptional growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)