- Canada

- /

- Metals and Mining

- /

- TSXV:VLC

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape with potential tariff impacts that could influence inflation and economic growth, highlighting the importance of portfolio diversification in 2025. Amid these conditions, penny stocks remain an intriguing investment area due to their unique mix of affordability and growth potential. While often associated with smaller or newer companies, those backed by solid financials can offer investors promising opportunities for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$129.13M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$434.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$656.3M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$25.79M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$411.5M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$181.56M | ★★★★★☆ |

Click here to see the full list of 941 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Argentina Lithium & Energy (TSXV:LIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argentina Lithium & Energy Corp., a junior mineral exploration company, focuses on acquiring, exploring, and evaluating natural resource properties in the Americas and Argentina, with a market cap of CA$10.73 million.

Operations: Currently, there are no revenue segments reported for the company.

Market Cap: CA$10.73M

Argentina Lithium & Energy Corp., with a market cap of CA$10.73 million, remains pre-revenue and unprofitable, reporting increased net losses over the past year. Despite its financial challenges, the company has promising exploration results from its Rincon West Project in Argentina, revealing lithium concentrations between 277 to 379 mg/l over a significant interval. The management team is experienced with an average tenure of 8.3 years. Although highly volatile and lacking revenue streams, Argentina Lithium is debt-free and has raised additional capital to support ongoing operations amidst its exploratory focus on lithium resources.

- Get an in-depth perspective on Argentina Lithium & Energy's performance by reading our balance sheet health report here.

- Learn about Argentina Lithium & Energy's historical performance here.

Stampede Drilling (TSXV:SDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stampede Drilling Inc. provides oilfield services to the oil and natural gas industry in North America, with a market cap of CA$36.16 million.

Operations: The company generates revenue of CA$82.62 million from its contract drilling services within the oil and natural gas sector in North America.

Market Cap: CA$36.16M

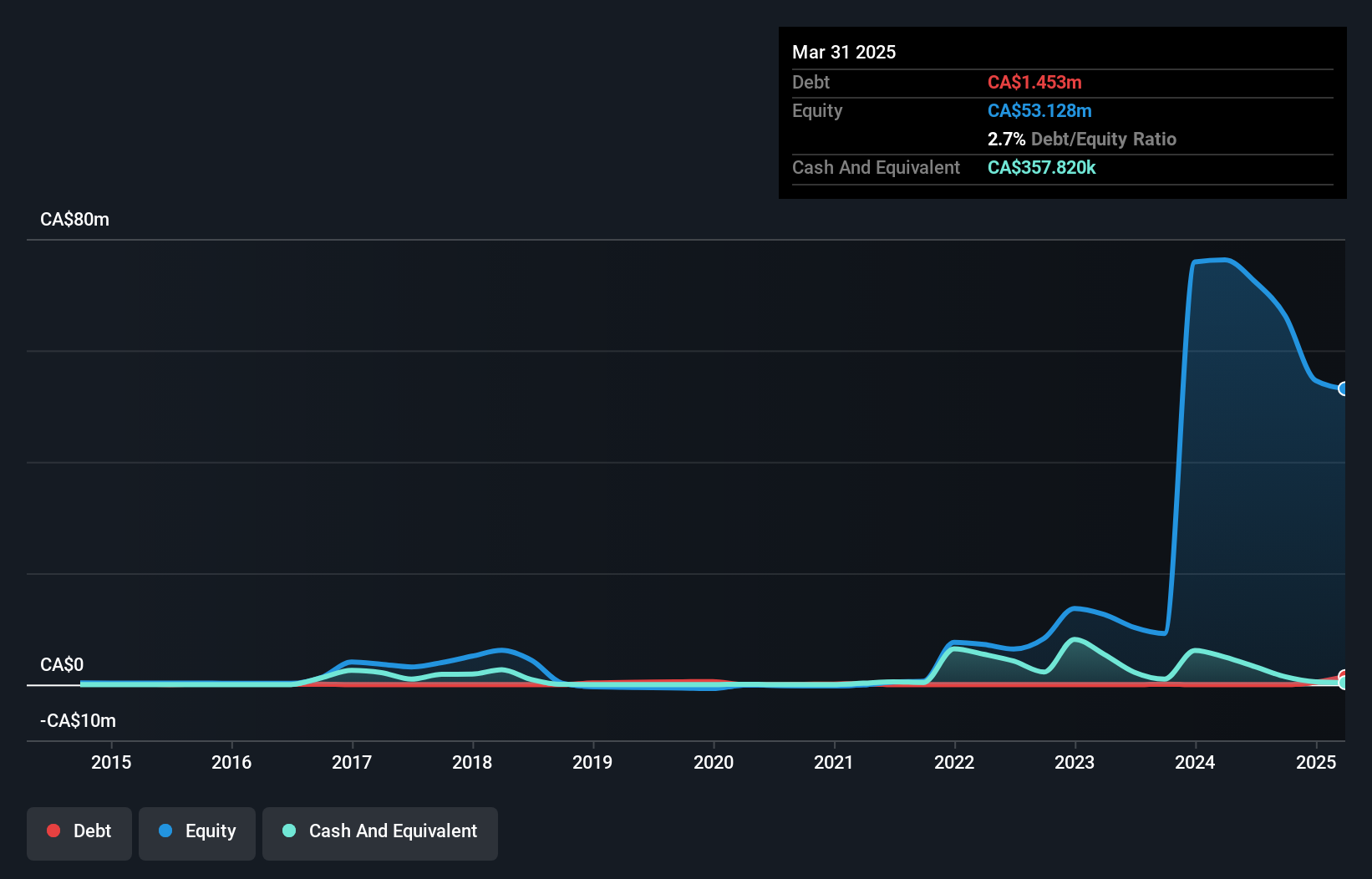

Stampede Drilling Inc., with a market cap of CA$36.16 million, reported a decline in net income for the third quarter of 2024 compared to the previous year, reflecting challenges in maintaining profitability amidst fluctuating revenue streams. Despite this, the company has demonstrated stable weekly volatility and satisfactory debt management, with its operating cash flow covering 82.5% of its debt. The seasoned management team and experienced board provide strategic oversight as Stampede trades at a significant discount to estimated fair value while maintaining good relative value within its industry peer group.

- Click here to discover the nuances of Stampede Drilling with our detailed analytical financial health report.

- Assess Stampede Drilling's future earnings estimates with our detailed growth reports.

Velocity Minerals (TSXV:VLC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Velocity Minerals Ltd. focuses on acquiring, exploring, evaluating, developing, and investing in mineral resource properties in Bulgaria with a market cap of CA$30.56 million.

Operations: Velocity Minerals Ltd. does not report any specific revenue segments.

Market Cap: CA$30.56M

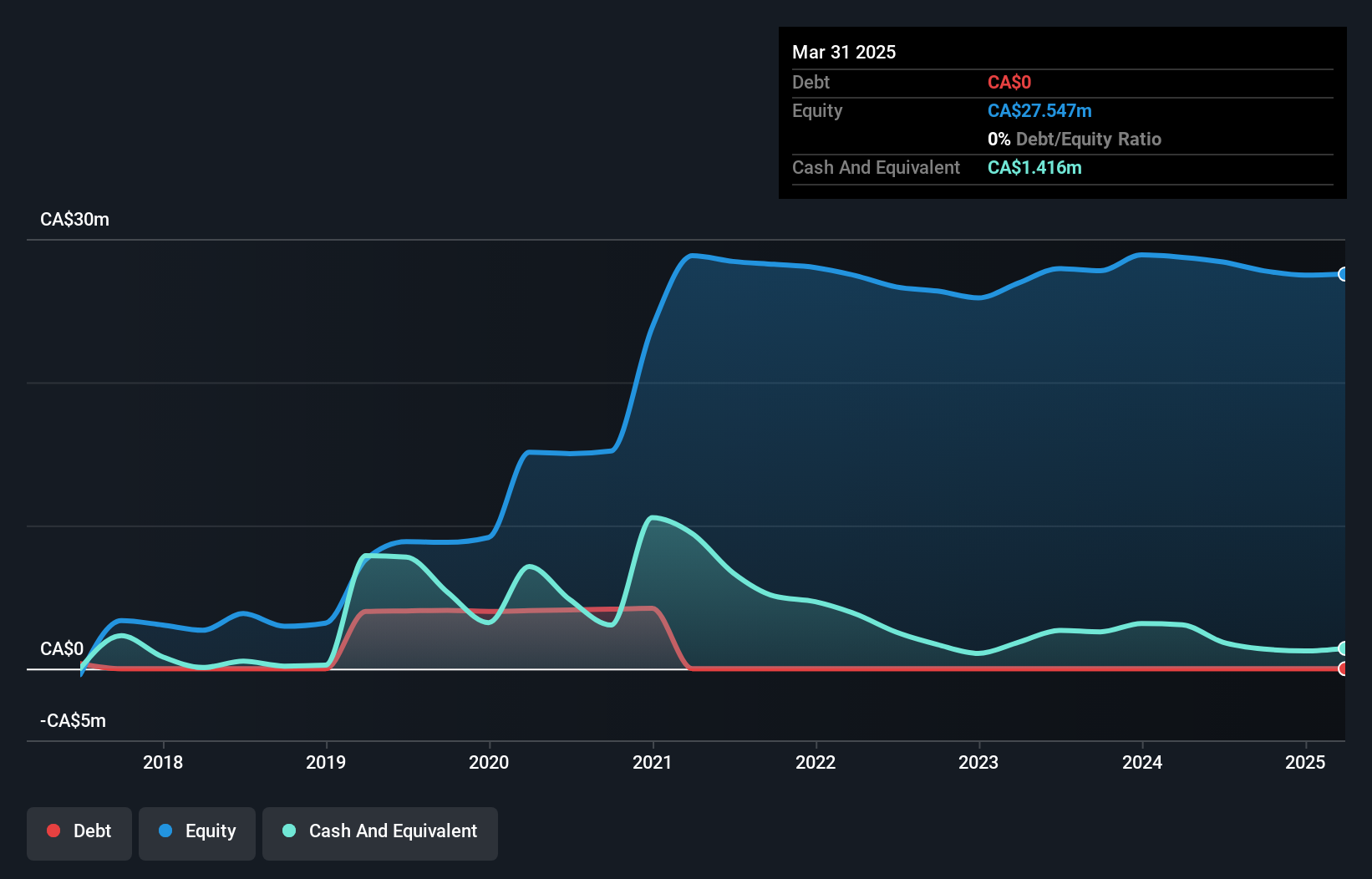

Velocity Minerals Ltd., with a market cap of CA$30.56 million, is pre-revenue and focuses on mineral resources in Bulgaria. The company reported a net loss for the third quarter of 2024, highlighting ongoing financial challenges. Despite having less than a year of cash runway and being unprofitable, Velocity has managed to reduce its losses by 3.5% annually over the past five years and remains debt-free with short-term assets exceeding liabilities. The management team is experienced, which could be beneficial as they navigate these financial hurdles while maintaining stable weekly volatility over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Velocity Minerals.

- Evaluate Velocity Minerals' historical performance by accessing our past performance report.

Where To Now?

- Explore the 941 names from our TSX Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Velocity Minerals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VLC

Velocity Minerals

Engages in the acquisition, exploration, evaluation, development, and investment in mineral resource properties in Bulgaria.

Adequate balance sheet low.

Market Insights

Community Narratives