- Canada

- /

- Metals and Mining

- /

- TSXV:TM

It's Down 33% But Trigon Metals Inc. (CVE:TM) Could Be Riskier Than It Looks

Trigon Metals Inc. (CVE:TM) shares have had a horrible month, losing 33% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

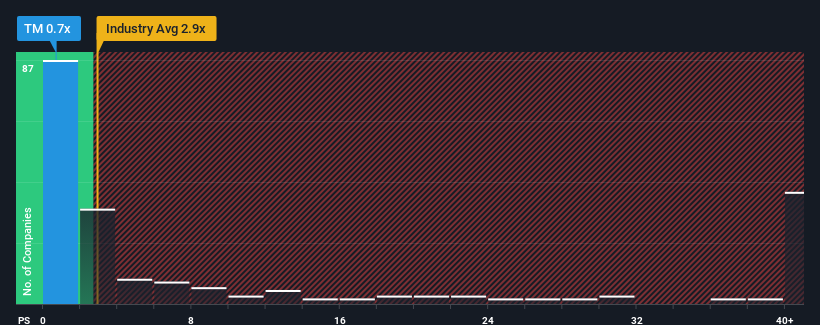

Since its price has dipped substantially, Trigon Metals may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.9x and even P/S higher than 24x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Trigon Metals

How Trigon Metals Has Been Performing

Trigon Metals certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Trigon Metals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Trigon Metals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 114% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Trigon Metals is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in Trigon Metals have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Trigon Metals currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Trigon Metals (2 are concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Trigon Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TM

Trigon Metals

Engages in the acquisition, exploration, development, and maintenance of mines and mineral properties in the African continent.

Medium-low risk with weak fundamentals.

Market Insights

Community Narratives