- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Thor Explorations (TSXV:THX) Valuation in Focus After Final Guitry Gold Drilling Results and Exploration Update

Reviewed by Kshitija Bhandaru

Thor Explorations (TSXV:THX) just wrapped up its first-ever drilling campaign at the Guitry Gold Project in Côte d'Ivoire, releasing final results that confirm deeper gold mineralisation and indicate there is significant potential for expanding resources.

See our latest analysis for Thor Explorations.

Thor Explorations’ momentum has been hard to miss lately, with the stock’s 1-month share price return of 20% and 90-day share price surge of 76% helping to fuel an extraordinary 389% total shareholder return over the past year. This kind of run points to growing market confidence in its growth prospects. At the same time, new exploration results and ongoing discoveries are further driving optimism for the long term.

If you’re watching how fresh exploration news can catalyze rapid growth, it’s an ideal time to broaden your perspective and discover fast growing stocks with high insider ownership

But after such a remarkable rally, investors have to ask whether Thor Explorations’ current valuation still leaves room for upside or if the market is already pricing in another stage of growth.

Most Popular Narrative: 9% Overvalued

Thor Explorations’ last close price of CA$1.32 currently sits just above the narrative fair value estimate of CA$1.21, making the latest prevailing view in the market one of cautious optimism. The popular narrative weighs future gold price optimism and continued project milestones against potential operational and compliance headwinds.

The market may be overestimating Thor's near-term production growth and revenue diversification, assuming successful and rapid resource conversion and development at both Douta (Senegal) and Côte d'Ivoire. Delays in feasibility studies, permitting, or ramp-up could result in slower-than-projected topline growth.

What kind of upside is really built into that price? There are hidden cash flow assumptions, margin compressions, and a bold leap in projected multiples behind the narrative. Find out which catalyst could swing the numbers next. Read the full story to see what the crowd expects from Thor’s future.

Result: Fair Value of $1.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exploration success and disciplined cost control could defy the analyst consensus and spark even stronger long-term growth for Thor Explorations.

Find out about the key risks to this Thor Explorations narrative.

Another View: Deep Discount from the DCF Model

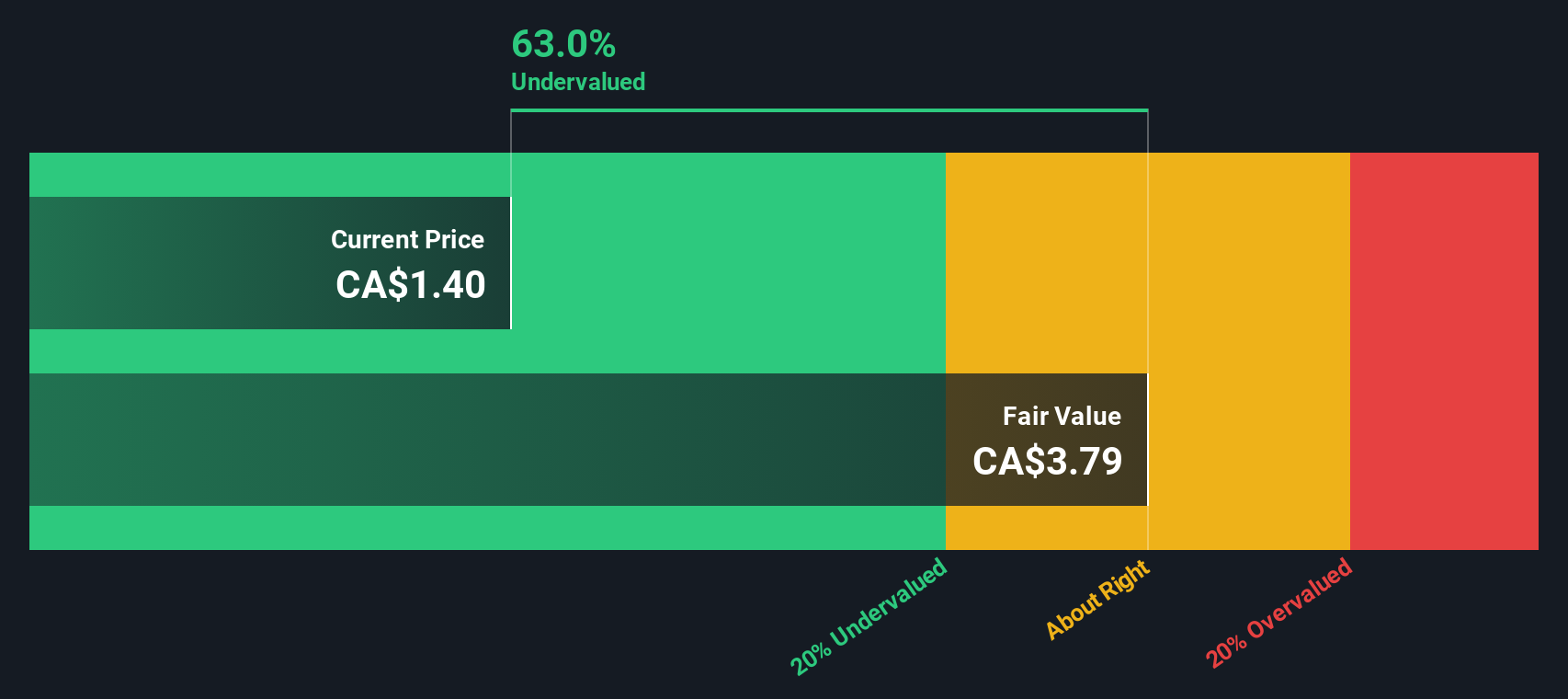

While multiples analysis currently suggests Thor Explorations is overvalued, our DCF model offers a sharply different perspective. According to the SWS DCF model, Thor is trading at a price more than 65% below its estimated fair value. Is the market overlooking a deeper long-term opportunity, or is there something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Thor Explorations Narrative

If you have a different perspective or prefer hands-on research, you can quickly put together your own view with just a few clicks. Do it your way

A great starting point for your Thor Explorations research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great opportunities await beyond Thor Explorations, and the right screener can put you ahead of the pack. Don’t miss today’s standouts and future game-changers just waiting to be found.

- Charge into tomorrow’s megatrends and see which companies are shaping artificial intelligence. Tap into these 24 AI penny stocks for a curated list of innovators.

- Boost your portfolio’s potential by finding stable income opportunities with these 19 dividend stocks with yields > 3%, highlighting stocks offering attractive yields above 3%.

- Secure your edge in digital finance and blockchain technology by reviewing these 79 cryptocurrency and blockchain stocks, and meet the businesses reshaping how the world transacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives