- Canada

- /

- Metals and Mining

- /

- TSXV:SR

We're Keeping An Eye On Strategic Resources' (CVE:SR) Cash Burn Rate

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Strategic Resources (CVE:SR) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

When Might Strategic Resources Run Out Of Money?

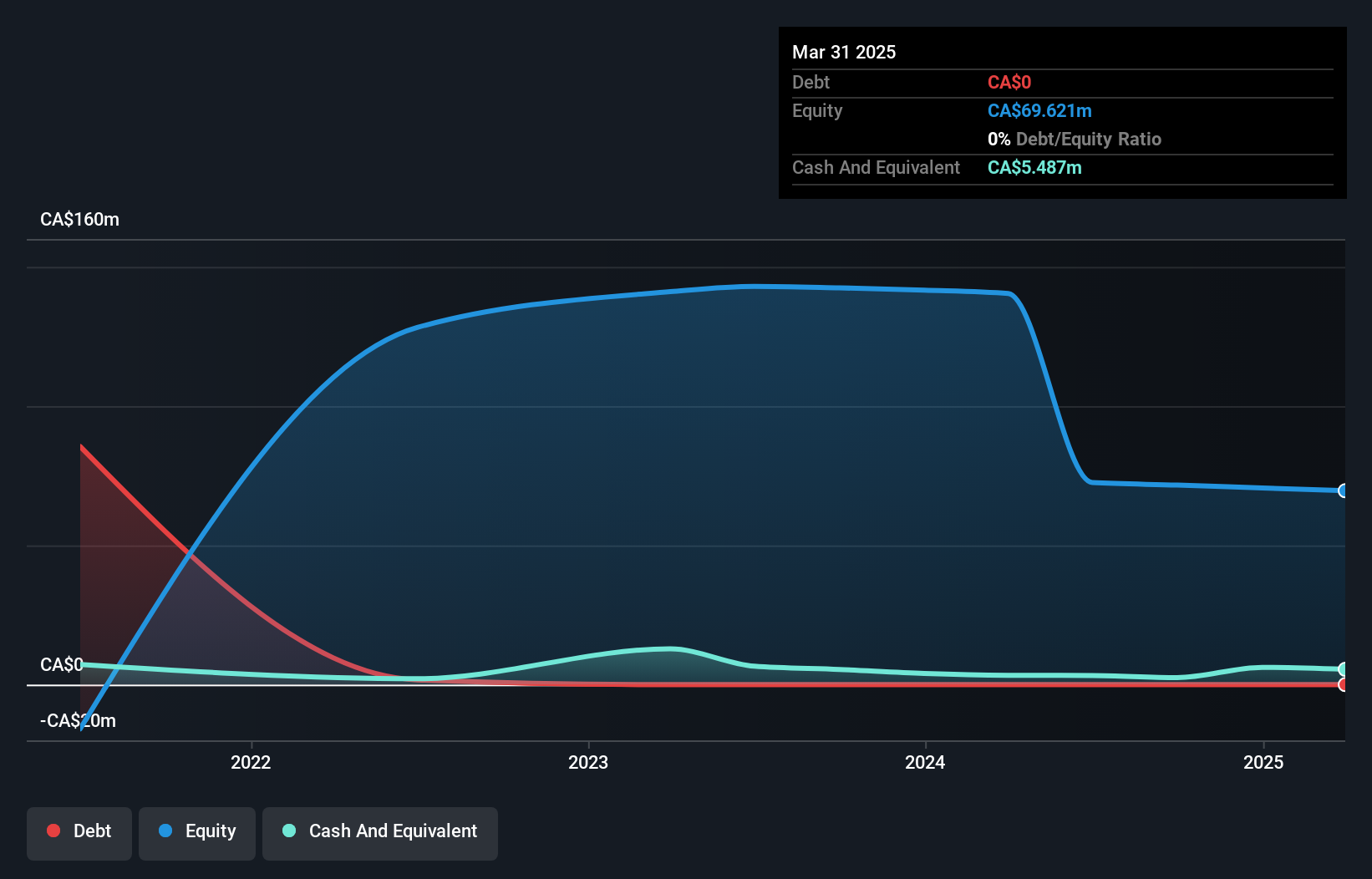

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at March 2025, Strategic Resources had cash of CA$5.5m and no debt. Looking at the last year, the company burnt through CA$4.1m. That means it had a cash runway of around 16 months as of March 2025. Notably, one analyst forecasts that Strategic Resources will break even (at a free cash flow level) in about 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

See our latest analysis for Strategic Resources

How Is Strategic Resources' Cash Burn Changing Over Time?

Strategic Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. While it hardly paints a picture of imminent growth, the fact that it has reduced its cash burn by 27% over the last year suggests some degree of prudence. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Strategic Resources To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Strategic Resources to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Strategic Resources has a market capitalisation of CA$28m and burnt through CA$4.1m last year, which is 15% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Strategic Resources' Cash Burn?

Strategic Resources appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash burn relative to its market cap, while on the other it can also boast very strong cash burn reduction. Shareholders can take heart from the fact that at least one analyst is forecasting it will reach breakeven. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Strategic Resources' situation. On another note, Strategic Resources has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SR

Strategic Resources

Engages in the acquisition, exploration, and development of iron, vanadium, titanium, and other metal properties in Canada and Finland.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)