- Canada

- /

- Metals and Mining

- /

- TSXV:NILI

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Canadian market is navigating a period of uncertainty, with the Bank of Canada cutting rates amid concerns over potential U.S. tariffs and a slight contraction in GDP for November, though a rebound is anticipated. In such a climate, investors may find opportunities in penny stocks—an investment area that remains relevant despite its historical connotations. These stocks often represent smaller or emerging companies with potential value and growth prospects, especially when backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$998.61M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.69 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$120.99M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$224.43M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.53 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.82 | CA$175.73M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$134.8M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Solaris Resources (TSX:SLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solaris Resources Inc. is involved in the exploration of mineral properties and has a market capitalization of approximately CA$760.28 million.

Operations: Solaris Resources Inc. does not report any revenue segments as it is focused on the exploration of mineral properties.

Market Cap: CA$760.28M

Solaris Resources Inc., with a market cap of approximately CA$760.28 million, remains pre-revenue as it focuses on mineral exploration. Recent strategic leadership changes include the appointment of Richard Hughes as CFO and Matthew Rowlinson as CEO, both bringing extensive industry experience. The company has initiated a private placement to raise CAD 350,000 and is progressing in its Warintza Project with significant infrastructure developments. Despite having sufficient short-term assets to cover liabilities and more cash than debt, Solaris faces challenges with increasing losses and high debt-to-equity ratio over recent years, highlighting potential risks for investors in this volatile sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Solaris Resources.

- Explore Solaris Resources' analyst forecasts in our growth report.

Surge Battery Metals (TSXV:NILI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Surge Battery Metals Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in North America, with a market cap of CA$60.23 million.

Operations: No revenue segments have been reported for this exploration stage company.

Market Cap: CA$60.23M

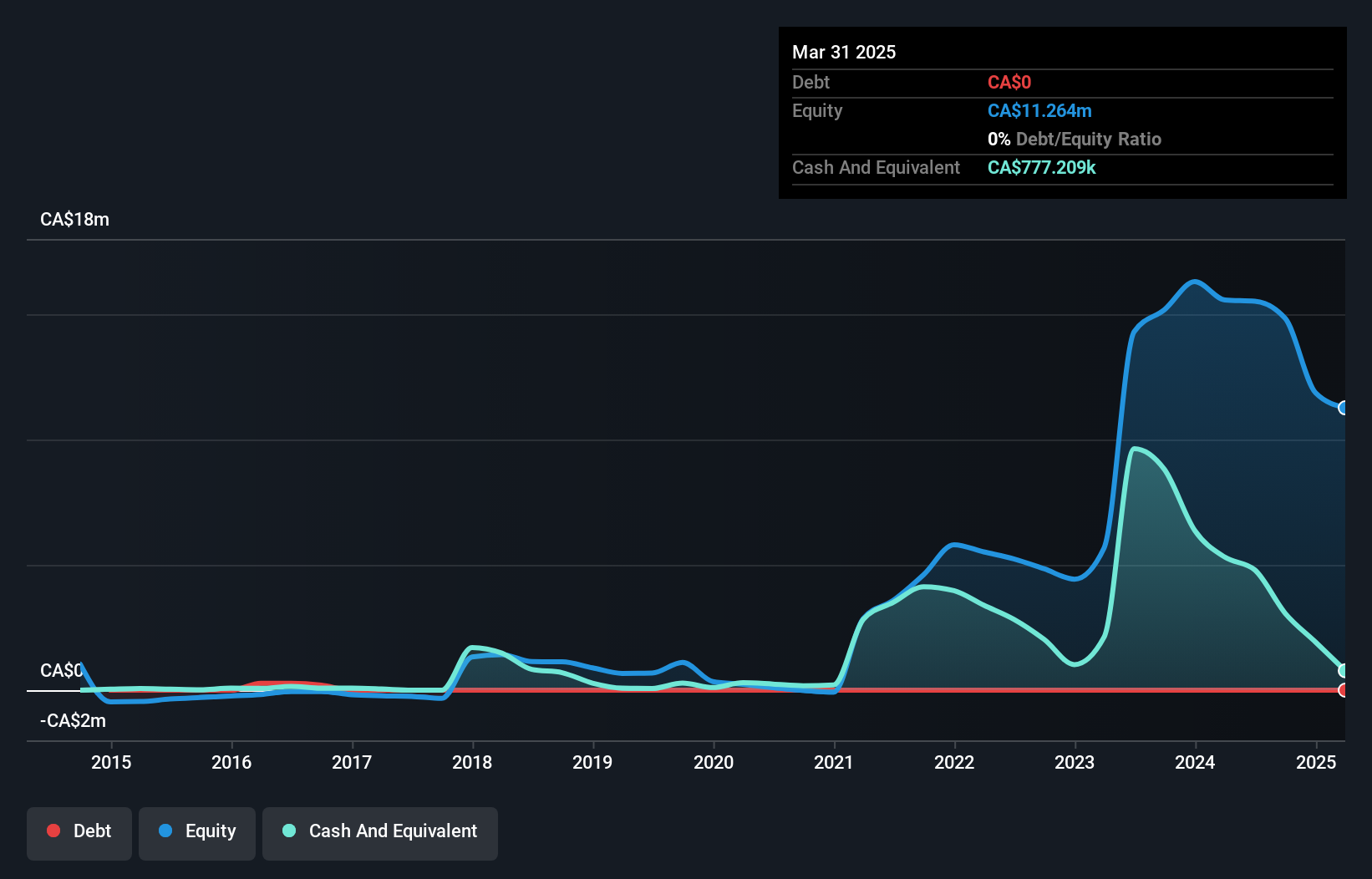

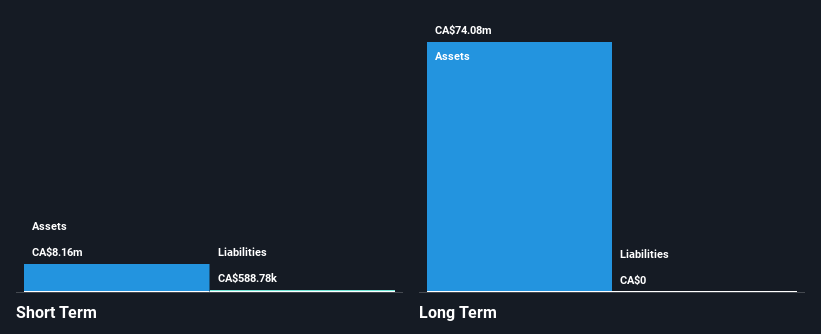

Surge Battery Metals Inc., with a market cap of CA$60.23 million, is in the exploration stage and remains pre-revenue. The company recently reported a reduced net loss of CA$1.93 million for Q3 2024, down from CA$3.33 million the previous year, indicating some improvement in financial performance despite ongoing losses. Notably, its Nevada North Lithium Project has entered an important phase with the National Environmental Policy Act's public comment period underway for expanded drilling operations in 2025, which could significantly impact future mineral extraction capabilities and provide critical data on lithium availability and environmental impacts within its project area.

- Jump into the full analysis health report here for a deeper understanding of Surge Battery Metals.

- Gain insights into Surge Battery Metals' past trends and performance with our report on the company's historical track record.

Silver Tiger Metals (TSXV:SLVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Tiger Metals Inc. is involved in the exploration and evaluation of mineral properties in Mexico, with a market capitalization of CA$124.38 million.

Operations: Silver Tiger Metals Inc. does not currently report any revenue segments.

Market Cap: CA$124.38M

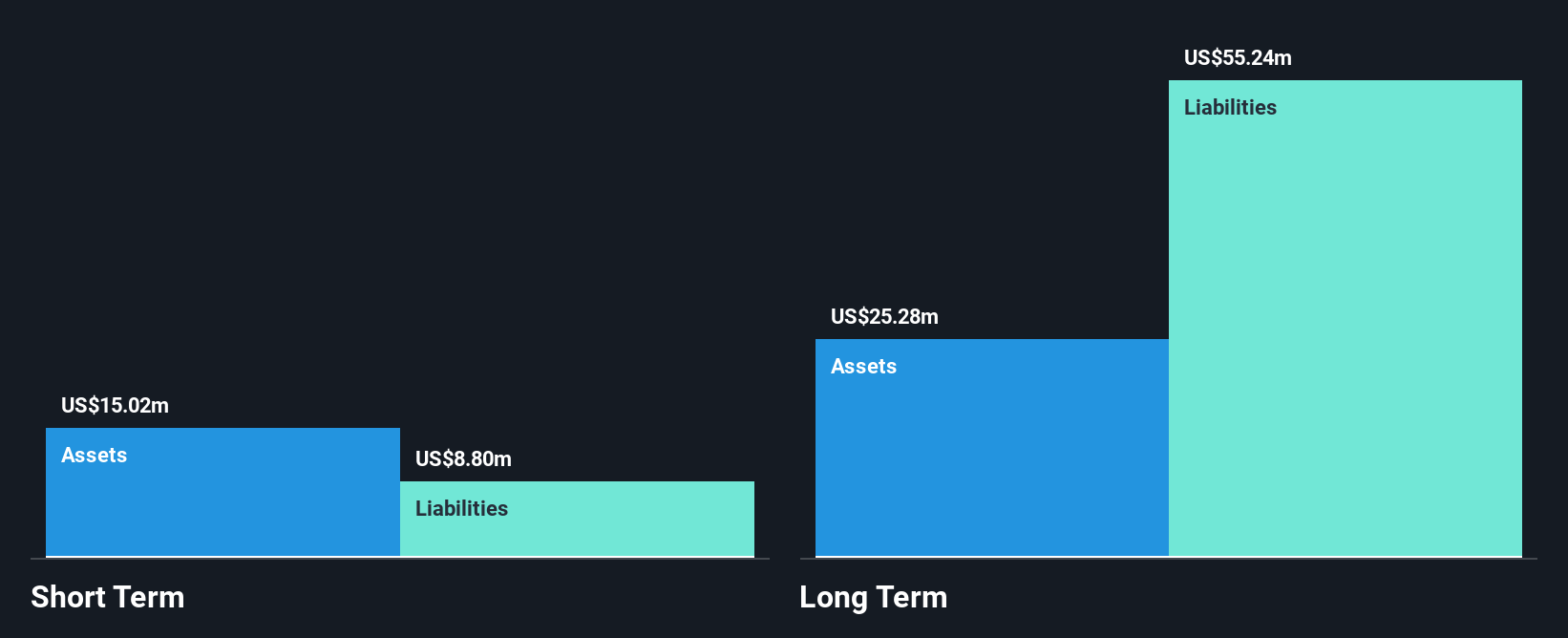

Silver Tiger Metals Inc., with a market cap of CA$124.38 million, is pre-revenue and focused on its El Tigre Project in Mexico. Recent developments include a Preliminary Feasibility Study revealing an after-tax net present value of $222 million and a 10-year mine life, although initial capital costs are projected at $86.8 million. The company remains debt-free but faces financial challenges with less than one year of cash runway if current free cash flow trends persist. Despite being unprofitable, earnings are forecast to grow significantly, highlighting potential future opportunities amidst current fiscal constraints.

- Click to explore a detailed breakdown of our findings in Silver Tiger Metals' financial health report.

- Review our growth performance report to gain insights into Silver Tiger Metals' future.

Key Takeaways

- Click this link to deep-dive into the 929 companies within our TSX Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NILI

Surge Battery Metals

An exploration stage company, acquires, explores, and develops mineral properties in North America.

Flawless balance sheet low.

Market Insights

Community Narratives