- Canada

- /

- Metals and Mining

- /

- TSXV:SIG

Is Sitka Gold's (TSXV:SIG) Industry Backing the Key to Its Junior Explorer Ambitions?

Reviewed by Sasha Jovanovic

- In recent weeks, junior gold explorer Sitka Gold has gained attention as sector momentum picks up following CEO changes at major producers, a proposed Anglo American and Teck Resources merger, and global copper supply disruptions after a mudslide at the Grasberg mine.

- Sitka Gold stands out for its substantial land holdings, large-scale drilling plans, and robust support from leading industry partners amid heightened interest in junior explorers.

- We’ll examine how strong backing from major industry players and large-scale exploration programs shape Sitka Gold’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Sitka Gold's Investment Narrative?

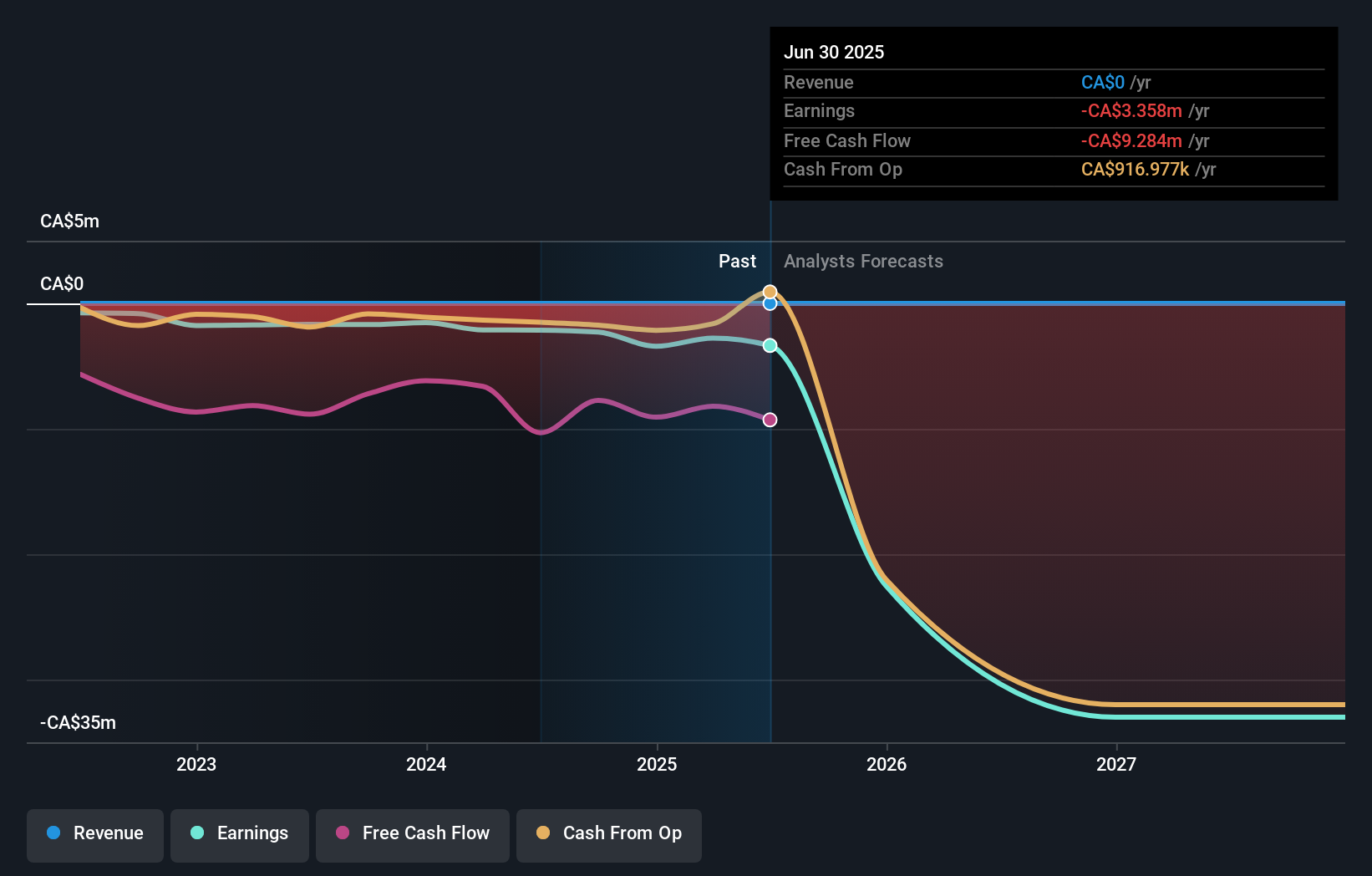

Owning Sitka Gold comes down to believing in the upside of discovery and sector-wide tailwinds, despite near-term operational and market risks. Recent CEO changes at major producers and copper supply disruptions have energized gold equities, drawing investor focus to junior explorers like Sitka Gold. While the Anglo American and Teck Resources merger could reshape industry consolidation and drive more interest into smaller players, Sitka’s immediate catalysts still center around drill results, expansion progress at RC Gold, and ongoing financing activities. The recent surge in share price reflects this renewed attention, but with Sitka still unprofitable and reliant on raising capital, key risks remain, especially dilution and funding gaps if sentiment shifts or results disappoint. The major news events may amplify broader sector interest, but Sitka’s fundamental risks and drivers largely remain unchanged for now.

Yet, with such momentum, dilution risk is something investors shouldn’t ignore.

Exploring Other Perspectives

Explore another fair value estimate on Sitka Gold - why the stock might be worth just CA$1.75!

Build Your Own Sitka Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sitka Gold research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Sitka Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sitka Gold's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SIG

Sitka Gold

Engages in the exploration of mineral resource properties in Canada and the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)