- Canada

- /

- Metals and Mining

- /

- TSXV:ALTA

3 Promising Penny Stocks On TSX With Up To CA$30M Market Cap

Reviewed by Simply Wall St

As the Canadian market navigates global economic shifts, including potential tariff negotiations and interest rate adjustments, investors are keeping a keen eye on opportunities that may arise from these developments. Penny stocks, though an older term, continue to represent a vital segment of the investment landscape by offering access to smaller or newer companies with growth potential. By focusing on those with strong financial health and clear growth trajectories, investors can uncover promising opportunities in this niche market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.36M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$28.21M | ★★★★★★ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Altamira Gold (TSXV:ALTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Altamira Gold Corp. is involved in the acquisition, exploration, development, and mining of mineral properties in Brazil and Canada, with a market cap of CA$29.68 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$29.68M

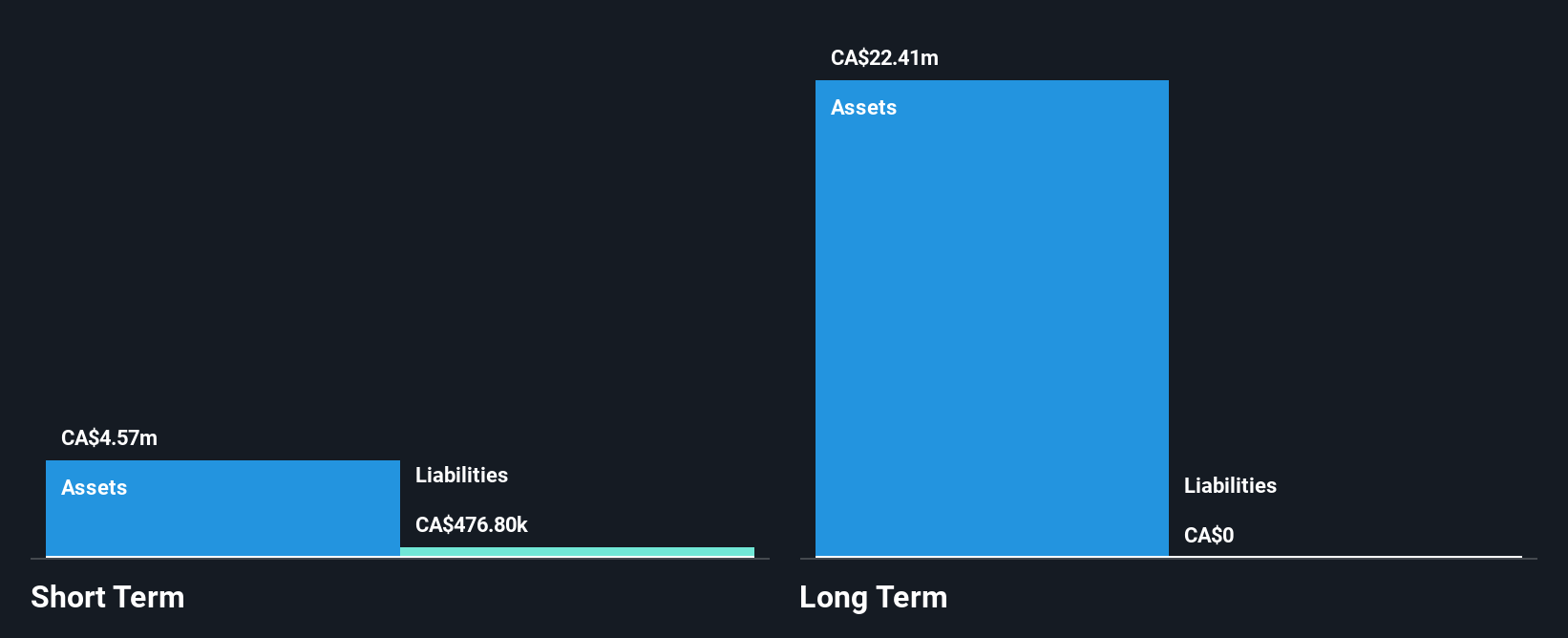

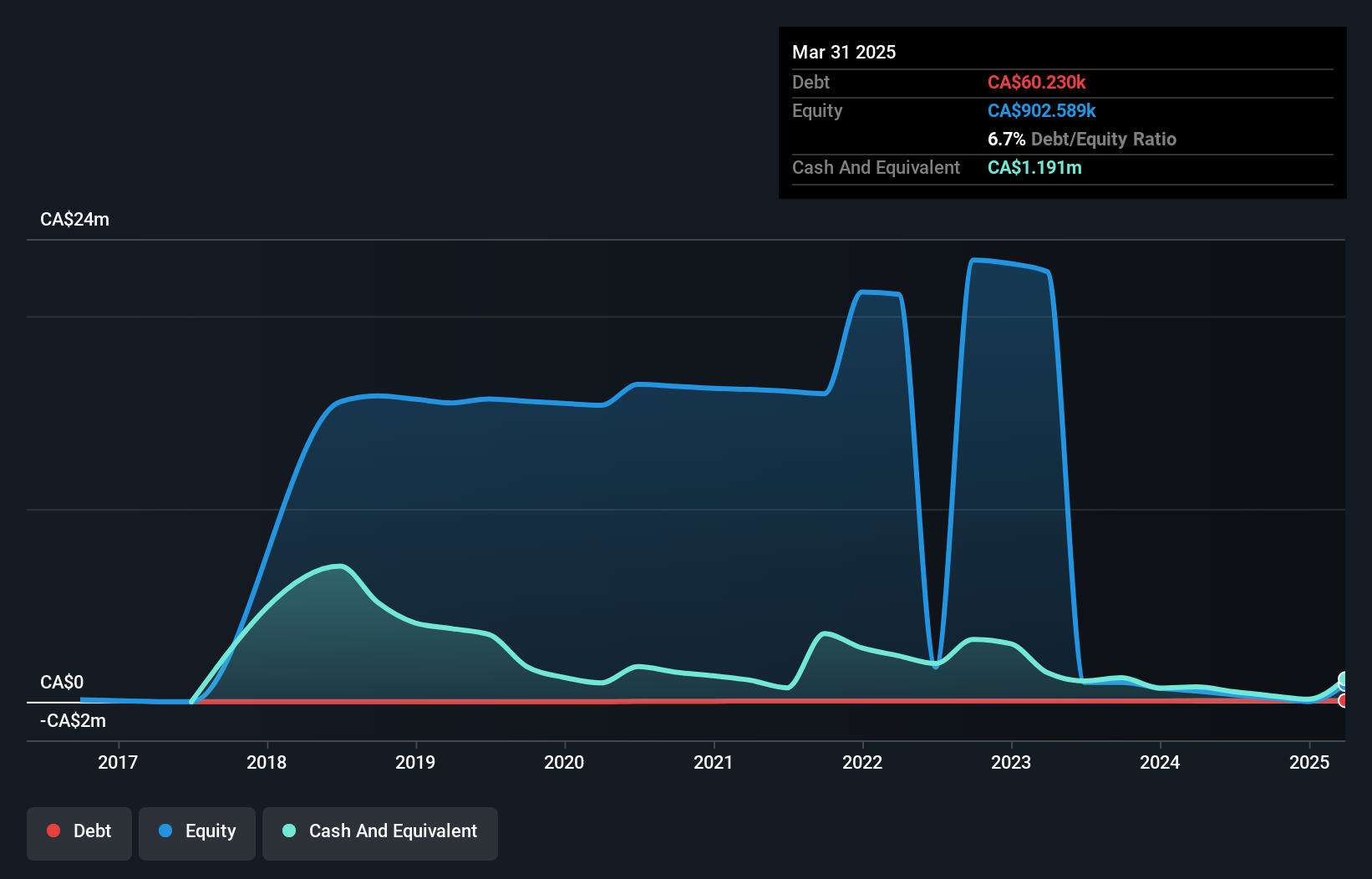

Altamira Gold Corp., with a market cap of CA$29.68 million, is a pre-revenue company focused on gold exploration in Brazil's Cajueiro project. Recent fieldwork has identified promising porphyry-related gold mineralization at the Espirro and Mombaque targets, indicating potential for significant discoveries. Despite being debt-free and having experienced board members, the company faces financial challenges with less than a year of cash runway and increasing losses over five years. The stock remains highly volatile, reflecting its speculative nature as an early-stage mining venture without significant revenue streams yet established.

- Take a closer look at Altamira Gold's potential here in our financial health report.

- Explore historical data to track Altamira Gold's performance over time in our past results report.

Solstice Gold (TSXV:SGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solstice Gold Corp. is involved in the exploration and development of mineral resource properties in Canada, with a market cap of CA$4.02 million.

Operations: Currently, Solstice Gold Corp. does not report any revenue segments.

Market Cap: CA$4.02M

Solstice Gold Corp., with a market cap of CA$4.02 million, is pre-revenue and focused on mineral exploration in Canada. The company recently announced a private placement to raise up to CA$150,000, which could extend its cash runway beyond the current 7 months. Despite an experienced board, Solstice faces challenges such as high share price volatility and a negative return on equity due to ongoing losses. Recent initiatives include an Alpha IP survey at the Strathy Gold Project aiming to identify new drill targets for potential gold deposits, highlighting its speculative nature amid limited financial stability.

- Click to explore a detailed breakdown of our findings in Solstice Gold's financial health report.

- Examine Solstice Gold's past performance report to understand how it has performed in prior years.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico with a market cap of CA$21.83 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$21.83M

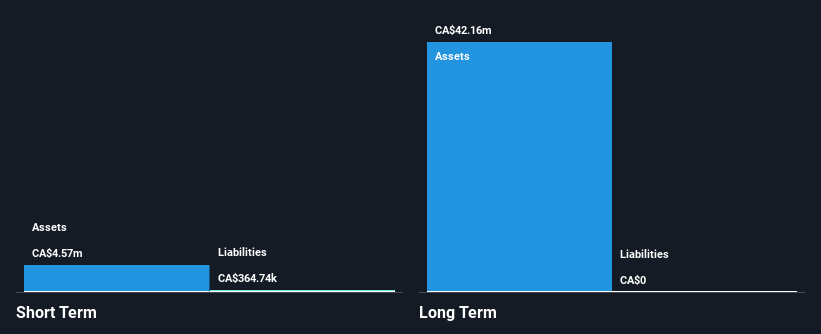

Wealth Minerals Ltd., with a market cap of CA$21.83 million, is pre-revenue and engaged in mineral exploration across several countries. The company recently reported increased losses for the third quarter, reflecting ongoing financial challenges. Despite being debt-free and having experienced management and board members, Wealth Minerals faces high share price volatility and limited cash runway under a year. Its recent application for a Special Lithium Operation Contract (CEOL) in Chile's Ollague Salar could potentially position it within the emerging lithium sector, though this remains speculative amidst its current financial constraints and shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Wealth Minerals.

- Assess Wealth Minerals' previous results with our detailed historical performance reports.

Summing It All Up

- Explore the 963 names from our TSX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALTA

Altamira Gold

Engages in the acquisition, exploration, development, and mining of mineral properties in Brazil and Canada.

Adequate balance sheet slight.

Market Insights

Community Narratives