- Canada

- /

- Metals and Mining

- /

- TSXV:RDU

TSX Penny Stock Insights: Galleon Gold Among 3 Noteworthy Picks

Reviewed by Simply Wall St

The Canadian stock market has experienced significant volatility, with the TSX reaching new all-time highs despite earlier declines driven by U.S. policy shifts and trade tensions. As investors navigate these fluctuating conditions, identifying stocks with strong financial fundamentals becomes crucial. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer affordability and growth potential when backed by robust balance sheets.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.84 | CA$263.71M | ✅ 4 ⚠️ 1 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.04 | CA$105.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$512.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.33 | CA$181.2M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Galleon Gold (TSXV:GGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Galleon Gold Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and the United States with a market cap of CA$21.77 million.

Operations: Galleon Gold Corp. currently does not report any revenue segments.

Market Cap: CA$21.77M

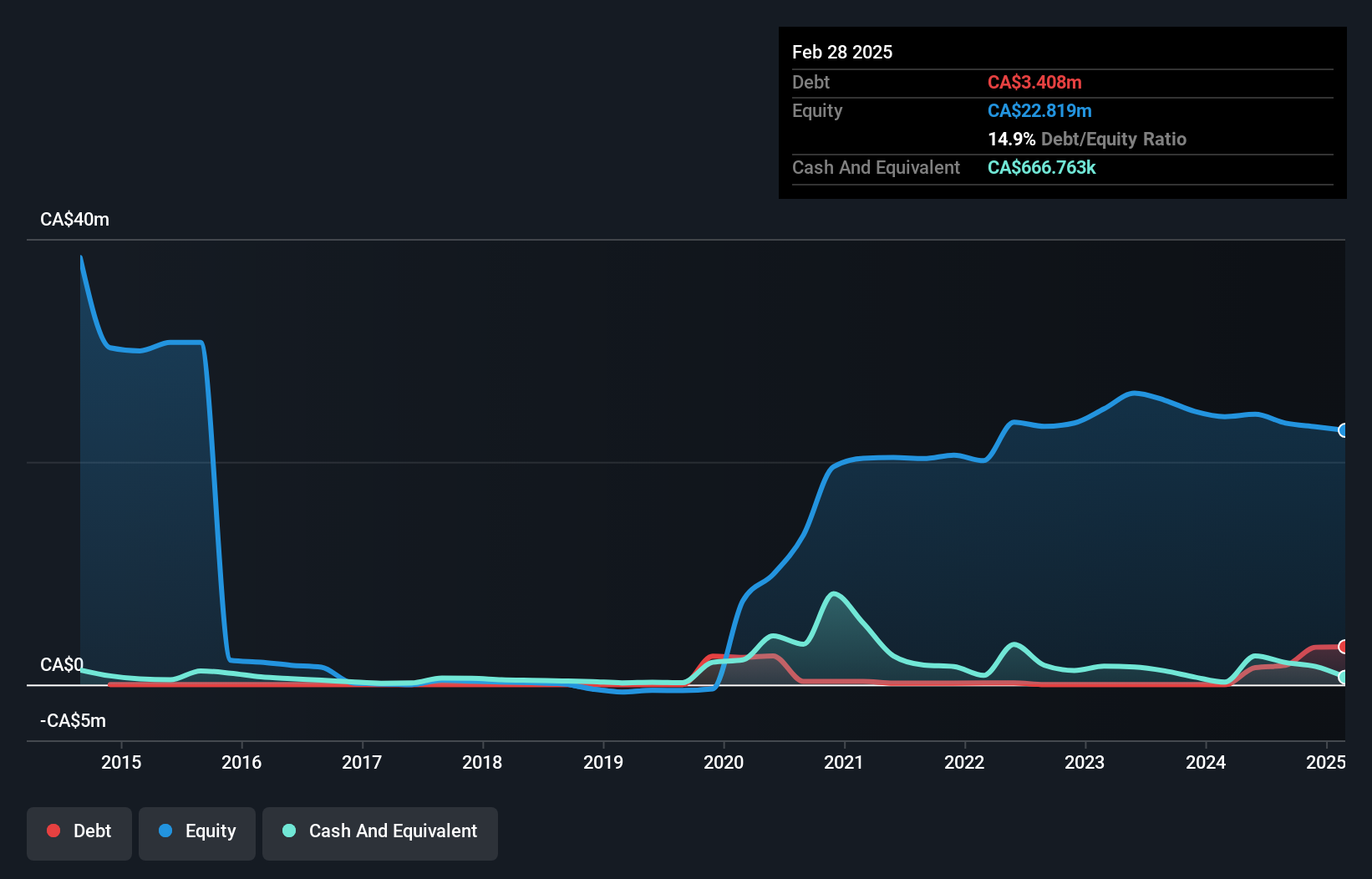

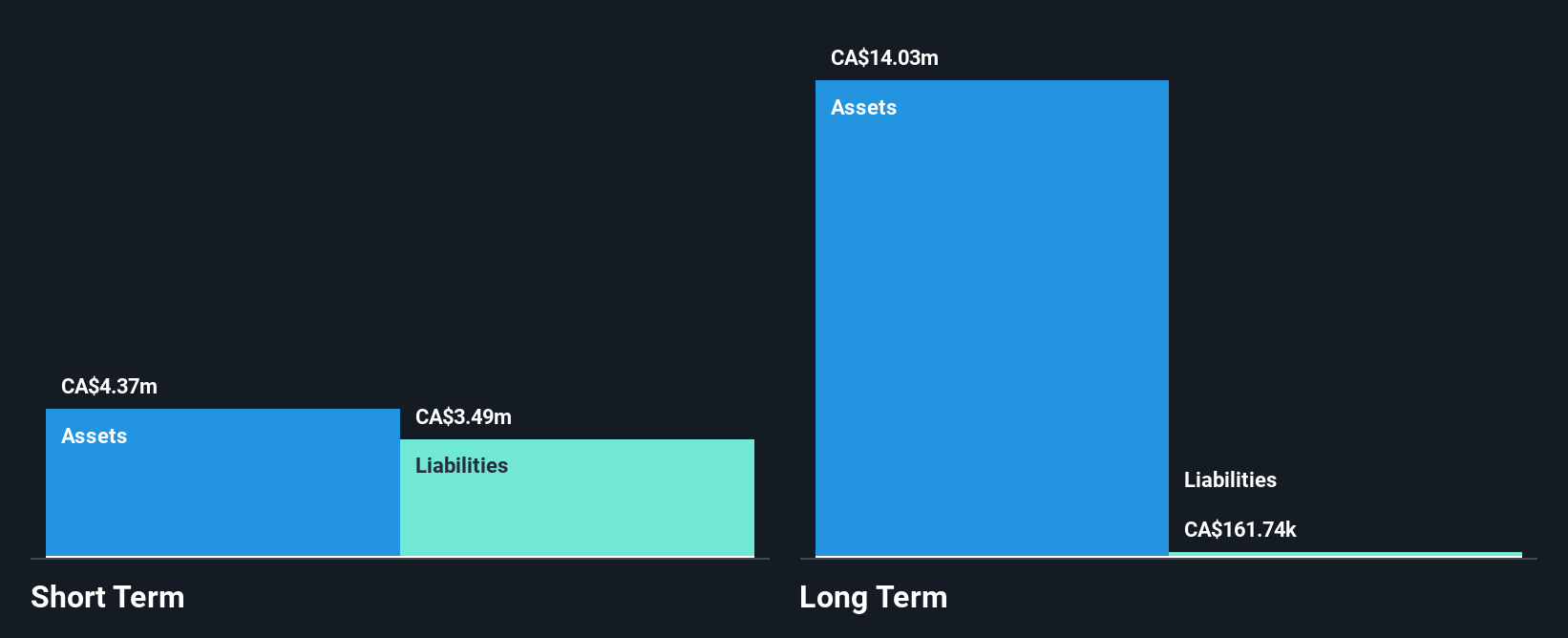

Galleon Gold Corp., with a market cap of CA$21.77 million, is pre-revenue and focused on mineral exploration and development. The company has reduced its losses by 14.5% annually over the past five years, although it remains unprofitable. Its net debt to equity ratio is satisfactory at 12%, but short-term assets do not cover liabilities. Recent developments include a CA$7 million private placement to support ongoing projects like the West Cache Gold Project in Ontario, where site preparations are underway following necessary permits for timber harvesting and construction planning activities initiated earlier this year.

- Navigate through the intricacies of Galleon Gold with our comprehensive balance sheet health report here.

- Gain insights into Galleon Gold's historical outcomes by reviewing our past performance report.

Radius Gold (TSXV:RDU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radius Gold Inc. is involved in the acquisition and exploration of mineral properties, with a market cap of CA$16.67 million.

Operations: Radius Gold Inc. does not report any revenue segments, focusing instead on the acquisition and exploration of mineral properties.

Market Cap: CA$16.67M

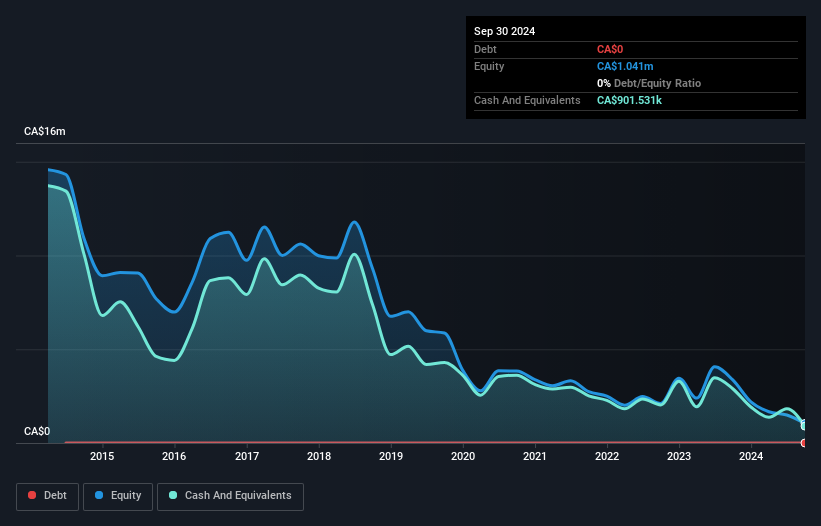

Radius Gold Inc., with a market cap of CA$16.67 million, remains pre-revenue while focusing on exploration activities, notably at the Tierra Roja copper project in Peru. The company is debt-free and has a stable cash runway for over a year. Recent developments include securing drilling permits and identifying promising drill targets through geophysical surveys and geological mapping at Tierra Roja. Despite its unprofitability, Radius has reduced losses by 8.7% annually over five years without significant shareholder dilution. The management team is experienced, averaging 13.6 years in tenure, which may support ongoing strategic initiatives amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in Radius Gold's financial health report.

- Learn about Radius Gold's historical performance here.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd., with a market cap of CA$157.07 million, focuses on the research and development of graphene and related nanomaterials in Canada.

Operations: The company's revenue is derived from its Biotech segment, which generated CA$0.79 million, and its Intellectual Property Development segment, contributing CA$0.08 million.

Market Cap: CA$157.07M

Zentek Ltd., with a market cap of CA$157.07 million, is pre-revenue and focuses on graphene and nanomaterials R&D. Recent announcements highlight the potential of its ZenGUARD™ Enhanced Air Filters, which have shown promising results in viral filtration efficiency tests. Zentek has secured purchase orders from clients like the Forensic Services and Coroner's Complex in Toronto, signaling early market traction. However, financial challenges persist as indicated by an auditor's going concern doubts despite raising CA$2 million through private placements to bolster liquidity. Management remains experienced with an average tenure of 2.6 years amidst ongoing strategic efforts.

- Get an in-depth perspective on Zentek's performance by reading our balance sheet health report here.

- Gain insights into Zentek's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Navigate through the entire inventory of 445 TSX Penny Stocks here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RDU

Radius Gold

Engages in the acquisition and exploration of mineral properties.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)