- Canada

- /

- Metals and Mining

- /

- TSXV:RDS

Discover TSX Penny Stocks: Lion Copper and Gold Plus 2 More Hidden Gems

Reviewed by Simply Wall St

Amidst ongoing tariff tensions and political uncertainties, the Canadian market has shown resilience with the TSX posting a modest gain of 0.2% for the year despite broader global challenges. In such a cautious market atmosphere, identifying stocks with strong financial foundations becomes crucial for investors seeking potential growth opportunities. While 'penny stocks' might seem like an outdated term, they still offer significant potential when backed by solid fundamentals. Below, we explore three penny stocks that exemplify financial strength and growth potential in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.605 | CA$167.44M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.84 | CA$444.19M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.83 | CA$79.67M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$604.82M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.05 | CA$39.14M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.89 | CA$79.64M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$30.09M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.66 | CA$3.51B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.84 | CA$383.82M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lion Copper and Gold (CNSX:LEO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lion Copper and Gold Corp. is a mineral exploration company focused on acquiring, exploring, and developing copper projects in the United States, with a market cap of CA$36.99 million.

Operations: Lion Copper and Gold Corp. does not report any revenue segments.

Market Cap: CA$36.99M

Lion Copper and Gold Corp., with a market cap of CA$36.99 million, remains a pre-revenue entity focused on its Yerington Copper Project in Nevada. Recent advancements include a Pre-Feasibility Study (PFS) funded by Nuton LLC, enhancing copper recovery through innovative technologies. Despite having more cash than debt, the company faces challenges with short-term liabilities exceeding assets and increased debt-to-equity ratio over five years. Management changes indicate a new team dynamic, while volatility persists in share price movements. The company has sufficient cash runway for over three years but remains unprofitable with declining earnings trends.

- Take a closer look at Lion Copper and Gold's potential here in our financial health report.

- Explore historical data to track Lion Copper and Gold's performance over time in our past results report.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. is involved in acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$348.36 million.

Operations: Avino Silver & Gold Mines Ltd. does not report specific revenue segments.

Market Cap: CA$348.36M

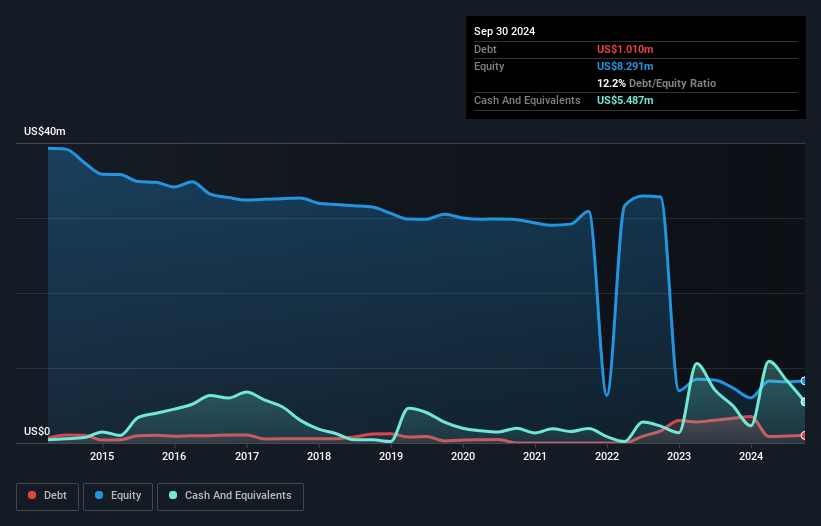

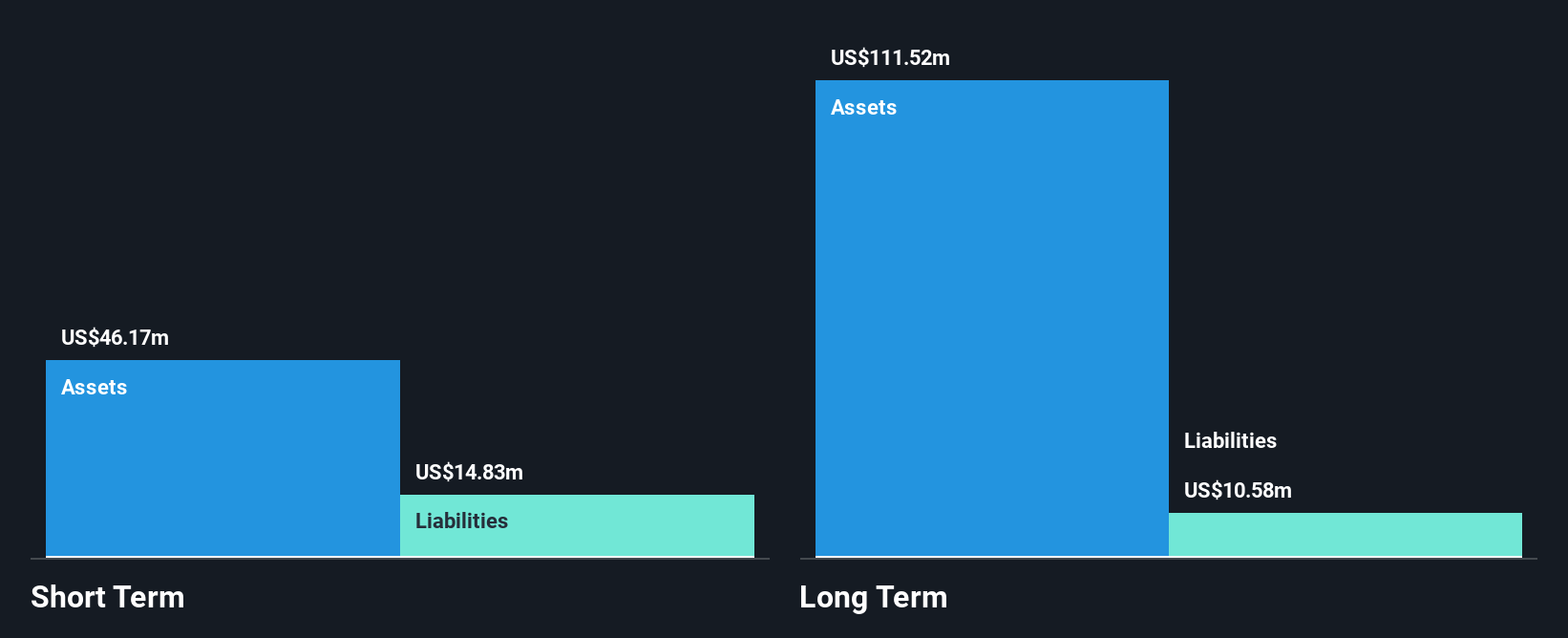

Avino Silver & Gold Mines Ltd., with a market cap of CA$348.36 million, has demonstrated robust financial health and operational progress. The company reported US$66.18 million in sales for 2024, showing significant growth from the previous year, alongside net income rising to US$8.1 million. Avino's strong balance sheet is underscored by its cash reserves of approximately $26 million and no debt beyond equipment leases, supporting its development plans at La Preciosa—a key asset with substantial silver resources in Mexico. Earnings have grown substantially over the past year, outpacing industry averages significantly and reflecting high-quality management execution.

- Navigate through the intricacies of Avino Silver & Gold Mines with our comprehensive balance sheet health report here.

- Examine Avino Silver & Gold Mines' earnings growth report to understand how analysts expect it to perform.

Radisson Mining Resources (TSXV:RDS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Radisson Mining Resources Inc. is a gold exploration company focused on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$108.96 million.

Operations: Radisson Mining Resources Inc. has not reported any specific revenue segments as it is primarily engaged in the exploration and development of gold mining properties in Canada.

Market Cap: CA$108.96M

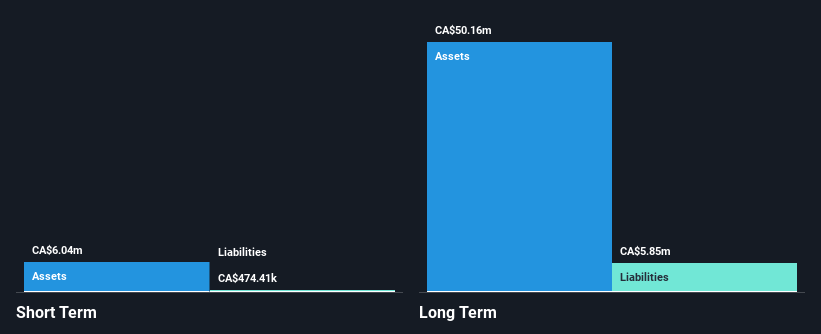

Radisson Mining Resources Inc., with a market cap of CA$108.96 million, is focused on expanding its gold exploration efforts at the O'Brien Gold Project in Quebec. Recent drill results have shown high-grade mineralization, notably 242 g/t Au over 1 metre, indicating potential for significant resource expansion beyond current estimates of 0.50 million ounces indicated and 0.45 million ounces inferred. The company remains pre-revenue and unprofitable, with short-term assets covering liabilities but limited cash runway requiring additional capital raising efforts. Management's tenure is relatively short, suggesting a new team navigating these exploratory phases amidst ongoing metallurgical studies and drilling programs.

- Dive into the specifics of Radisson Mining Resources here with our thorough balance sheet health report.

- Learn about Radisson Mining Resources' historical performance here.

Key Takeaways

- Unlock our comprehensive list of 936 TSX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Radisson Mining Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RDS

Radisson Mining Resources

A gold exploration company, engages in the acquisition, exploration, and development of mining properties in Canada.

Excellent balance sheet low.

Market Insights

Community Narratives