As the Canadian market continues to navigate a landscape shaped by evolving economic trends, investors are increasingly focused on identifying growth opportunities that align with their long-term financial goals. In this context, companies with high insider ownership often stand out as they can indicate confidence in the company's potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Allied Gold (TSX:AAUC) | 22.8% | 86.5% |

| Artemis Gold (TSXV:ARTG) | 30% | 60.7% |

| Almonty Industries (TSX:AII) | 17.7% | 60.7% |

| VersaBank (TSX:VBNK) | 13.2% | 40.6% |

| Enterprise Group (TSX:E) | 39.8% | 56.3% |

| Aritzia (TSX:ATZ) | 16.1% | 59.7% |

| Profound Medical (TSX:PRN) | 12.4% | 58.9% |

| CHAR Technologies (TSXV:YES) | 10.7% | 58.3% |

Here's a peek at a few of the choices from the screener.

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use in the United States, with a market cap of CA$2.74 billion.

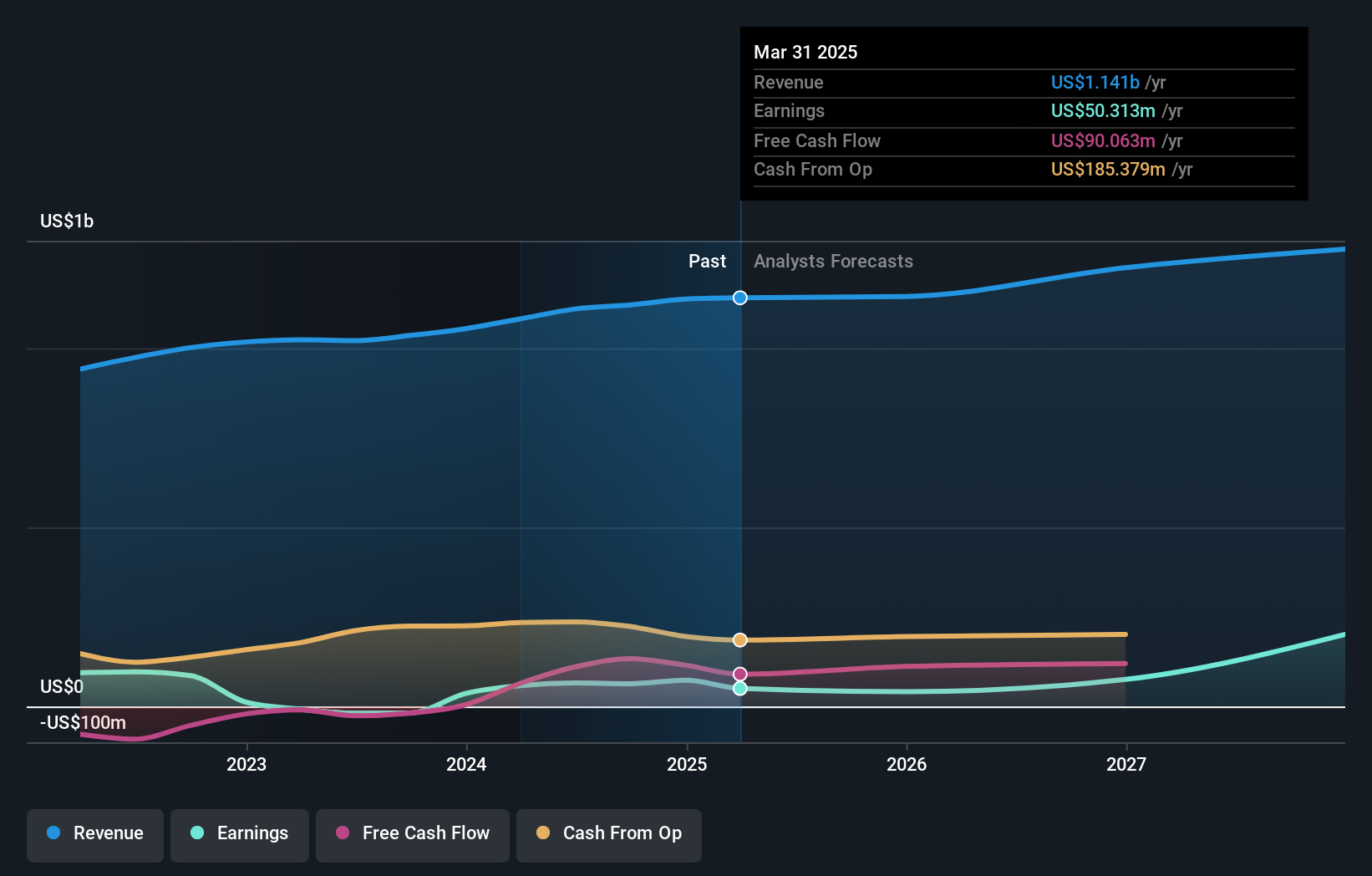

Operations: The company's revenue segments include $823.68 million from retail and $619.12 million from consumer packaged goods.

Insider Ownership: 10.1%

Green Thumb Industries demonstrates strong growth potential as its earnings are expected to increase significantly, outpacing the Canadian market. The company has become profitable this year, with revenue forecasted to grow faster than the market average. Despite a low future Return on Equity projection, insider activity shows more buying than selling recently. Green Thumb continues expanding its retail presence with new dispensaries and is actively pursuing strategic acquisitions, supported by a solid balance sheet and recent debt refinancing.

- Get an in-depth perspective on Green Thumb Industries' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Green Thumb Industries' current price could be quite moderate.

First National Financial (TSX:FN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: First National Financial Corporation, with a market cap of CA$2.47 billion, operates in Canada where it originates, underwrites, and services commercial and residential mortgages through its subsidiaries.

Operations: The company's revenue segments include CA$215.53 million from commercial mortgages and CA$423.75 million from residential mortgages in Canada.

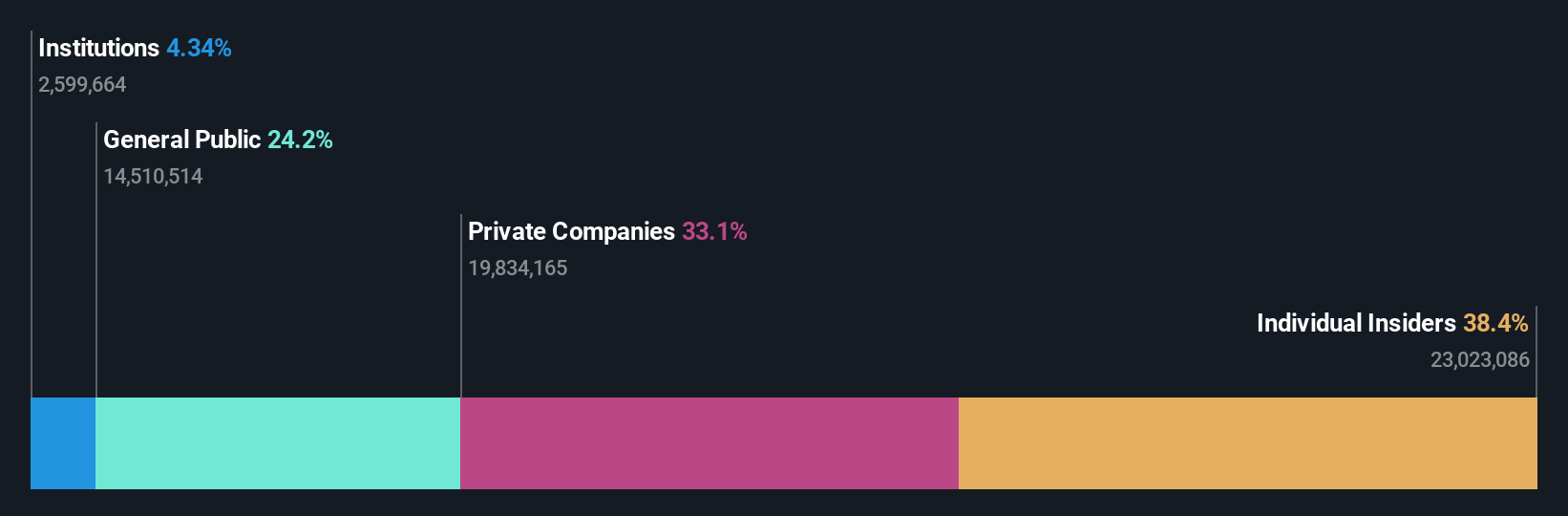

Insider Ownership: 38.4%

First National Financial shows moderate growth potential with earnings forecasted to grow at 15.86% annually, slightly above the Canadian market average. The company benefits from substantial insider buying recently, indicating confidence in its prospects. Although revenue growth is expected to be slower than 20% per year, it still surpasses the broader market's pace. Despite a dip in recent quarterly earnings, First National maintains a reliable dividend yield and trades below estimated fair value, attracting investor interest.

- Take a closer look at First National Financial's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of First National Financial shares in the market.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$392.99 million.

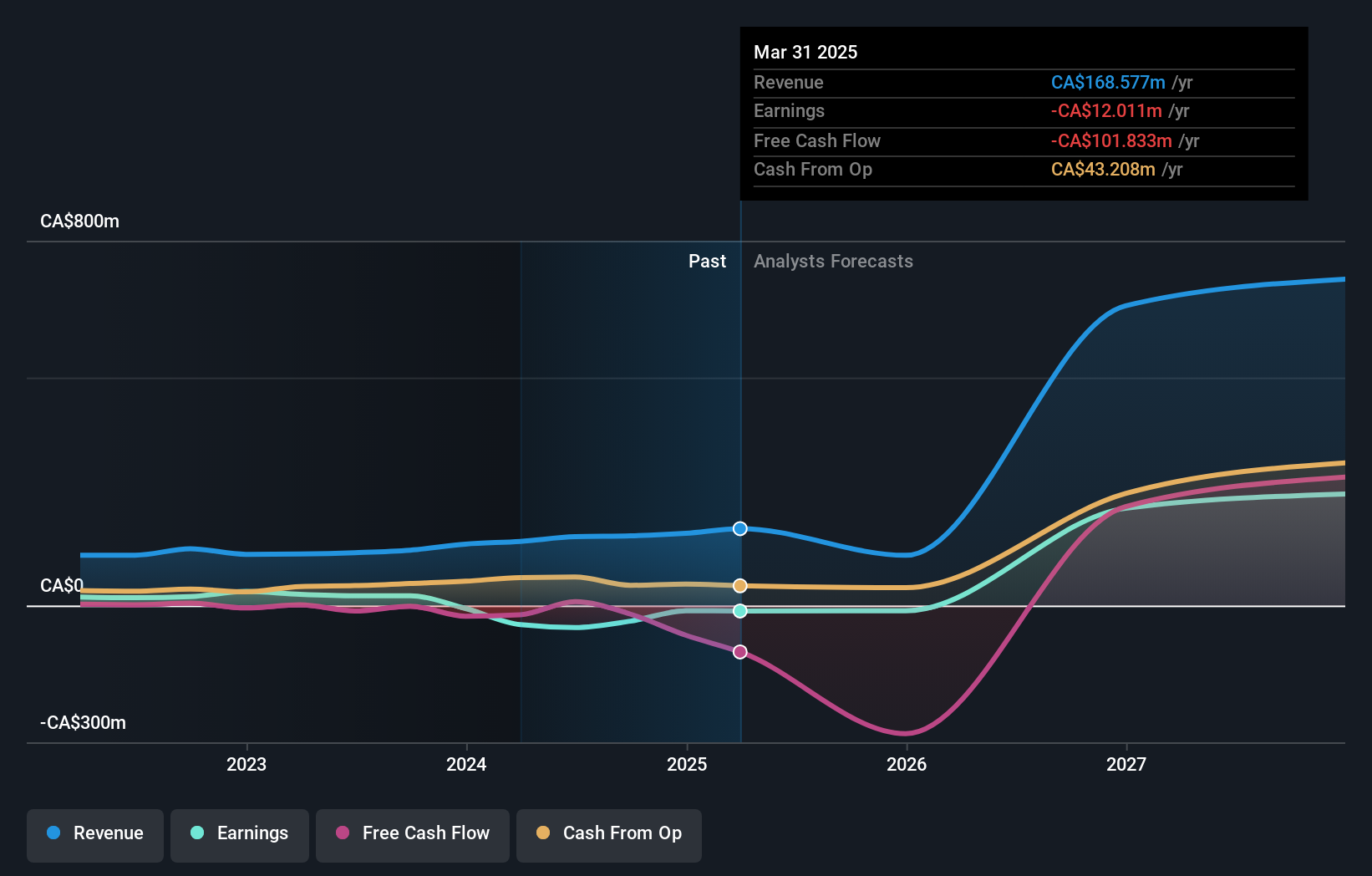

Operations: The company generates revenue from its mining operations, specifically through the production of gold, amounting to CA$152.71 million.

Insider Ownership: 28.2%

Robex Resources demonstrates strong growth potential with forecasted revenue growth of 51% annually, significantly outpacing the Canadian market. The company is expected to become profitable within three years, reflecting robust earnings growth projections. Despite recent shareholder dilution, Robex trades at a substantial discount to its estimated fair value and presents good relative value compared to peers. Recent earnings reports show improved quarterly net income, and ongoing development at the Kiniero Gold Project supports future expansion prospects.

- Unlock comprehensive insights into our analysis of Robex Resources stock in this growth report.

- Our valuation report here indicates Robex Resources may be undervalued.

Key Takeaways

- Discover the full array of 36 Fast Growing TSX Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.