- Canada

- /

- Capital Markets

- /

- CNSX:HODL

Spotlight On 3 TSX Penny Stocks With Market Caps Over CA$20M

Reviewed by Simply Wall St

As we move into 2025, the Canadian market is navigating a landscape shaped by rising government bond yields and political changes, with investors keenly observing how these factors might impact their portfolios. In this context, penny stocks—despite their somewhat outdated name—continue to capture attention for their potential to offer value and growth opportunities in smaller or newer companies. This article explores three TSX-listed penny stocks that stand out for their financial strength, potentially offering stability and upside in today's evolving market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.47 | CA$122.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.58 | CA$989.91M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$647.54M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.27 | CA$226.4M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Copper Road Resources (TSXV:CRD) | CA$0.02 | CA$975.24k | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.82 | CA$178.64M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Sol Strategies (CNSX:HODL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sol Strategies Inc. invests in cryptocurrencies and blockchain technologies with a market cap of CA$452.32 million.

Operations: The company's revenue segment primarily involves investments in cryptocurrencies and blockchain technology, amounting to -CA$0.73 million.

Market Cap: CA$452.32M

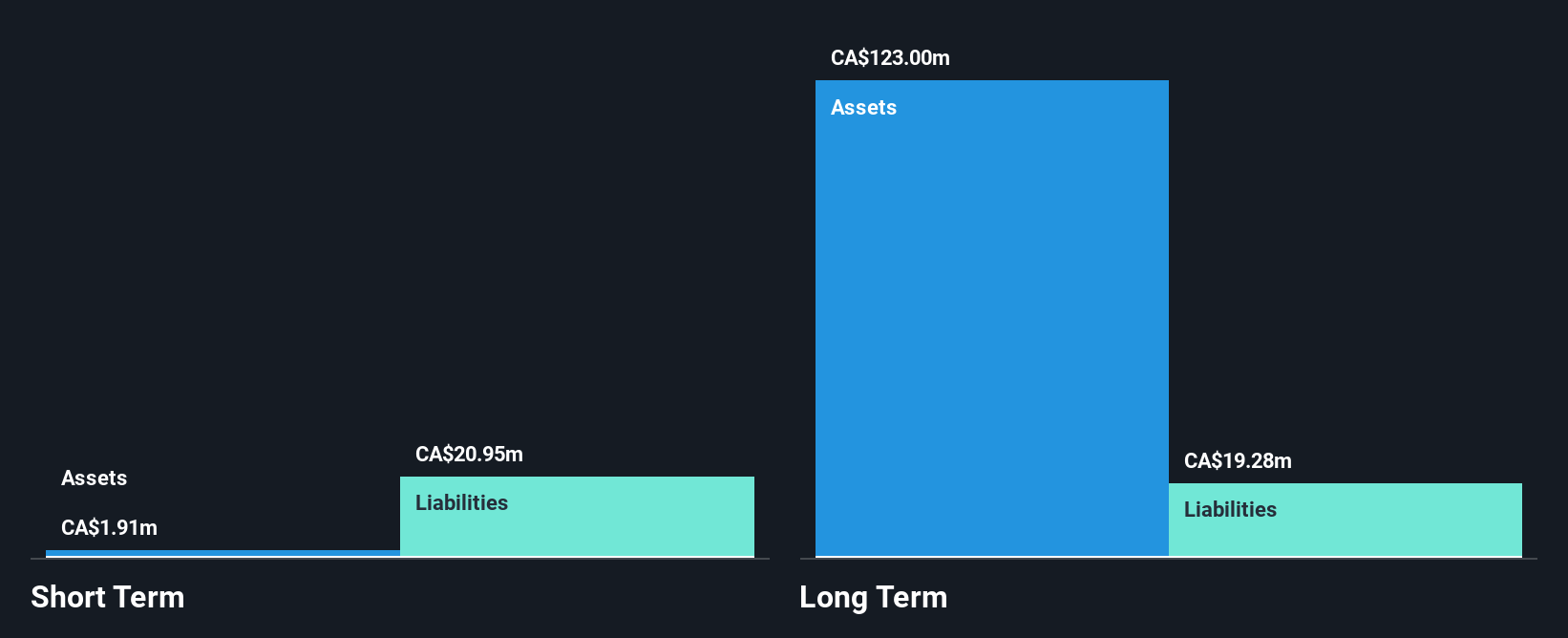

Sol Strategies Inc., with a market cap of CA$452.32 million, is a pre-revenue company focusing on cryptocurrency and blockchain investments. Despite its unprofitability and negative return on equity, the company remains debt-free with no long-term liabilities. Recent strategic moves include securing CA$27.5 million through private placements led by ParaFi Capital, which could support future growth initiatives. The appointment of Max Kaplan as Head of Staking may enhance operational capabilities in cryptocurrency infrastructure. However, increased volatility in share price and significant insider selling over the past quarter highlight potential risks for investors considering this stock.

- Navigate through the intricacies of Sol Strategies with our comprehensive balance sheet health report here.

- Gain insights into Sol Strategies' historical outcomes by reviewing our past performance report.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company involved in acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$131.50 million.

Operations: The company generates revenue of $64.26 million from its oil and gas exploration and production activities.

Market Cap: CA$131.5M

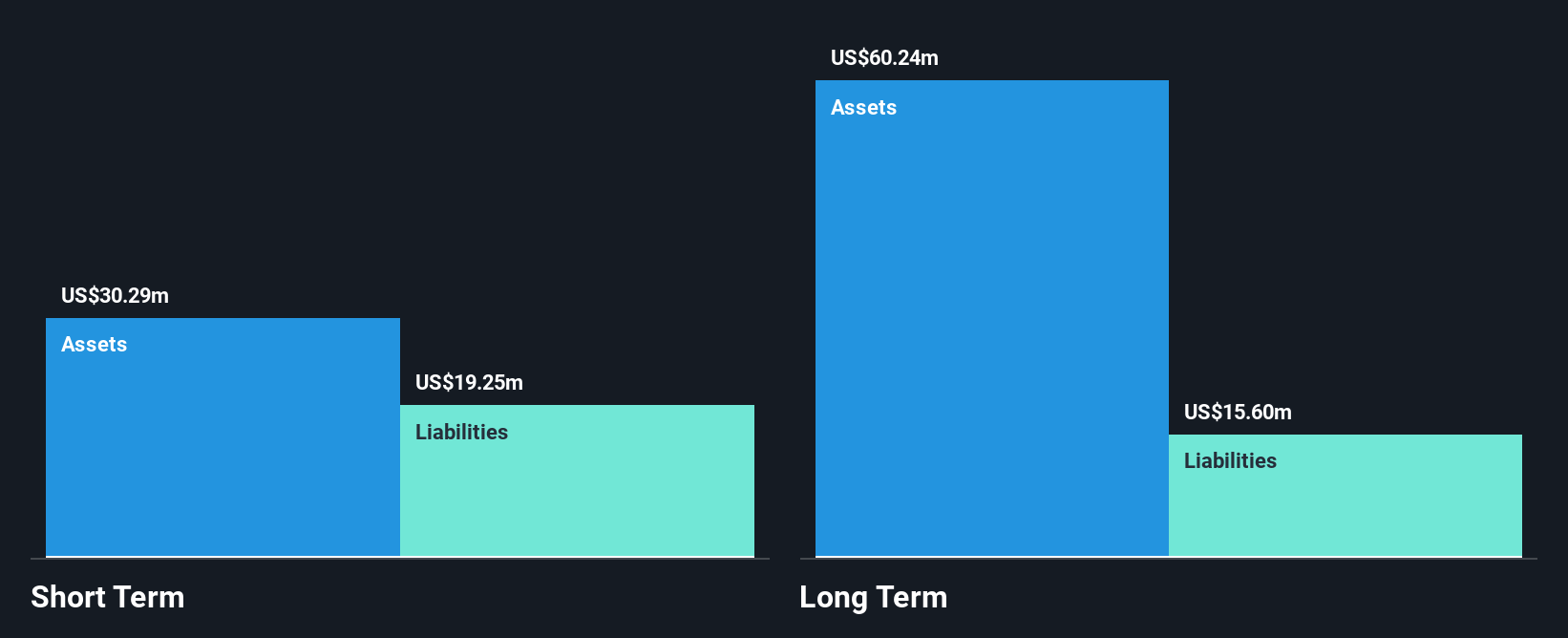

Arrow Exploration Corp., with a market cap of CA$131.50 million, demonstrates key strengths and challenges typical in penny stocks. The company is debt-free, which reduces financial risk and enhances operational flexibility. Despite achieving profitability over the past five years, recent earnings growth has been negative, impacting its return on equity (1.1%). Operationally, Arrow's production activities in Colombia have shown promising results with the AB-1 well confirming productive potential. Recent production updates indicate robust output levels aligning with expectations, supported by a strong cash position of US$19.1 million as of January 2025. However, fluctuating profit margins may pose concerns for investors evaluating long-term stability.

- Dive into the specifics of Arrow Exploration here with our thorough balance sheet health report.

- Understand Arrow Exploration's earnings outlook by examining our growth report.

Black Swan Graphene (TSXV:SWAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Swan Graphene Inc. is involved in the production and commercialization of patented graphene products for industrial sectors in Canada, with a market cap of CA$25.65 million.

Operations: No revenue segments are reported for Black Swan Graphene Inc.

Market Cap: CA$25.65M

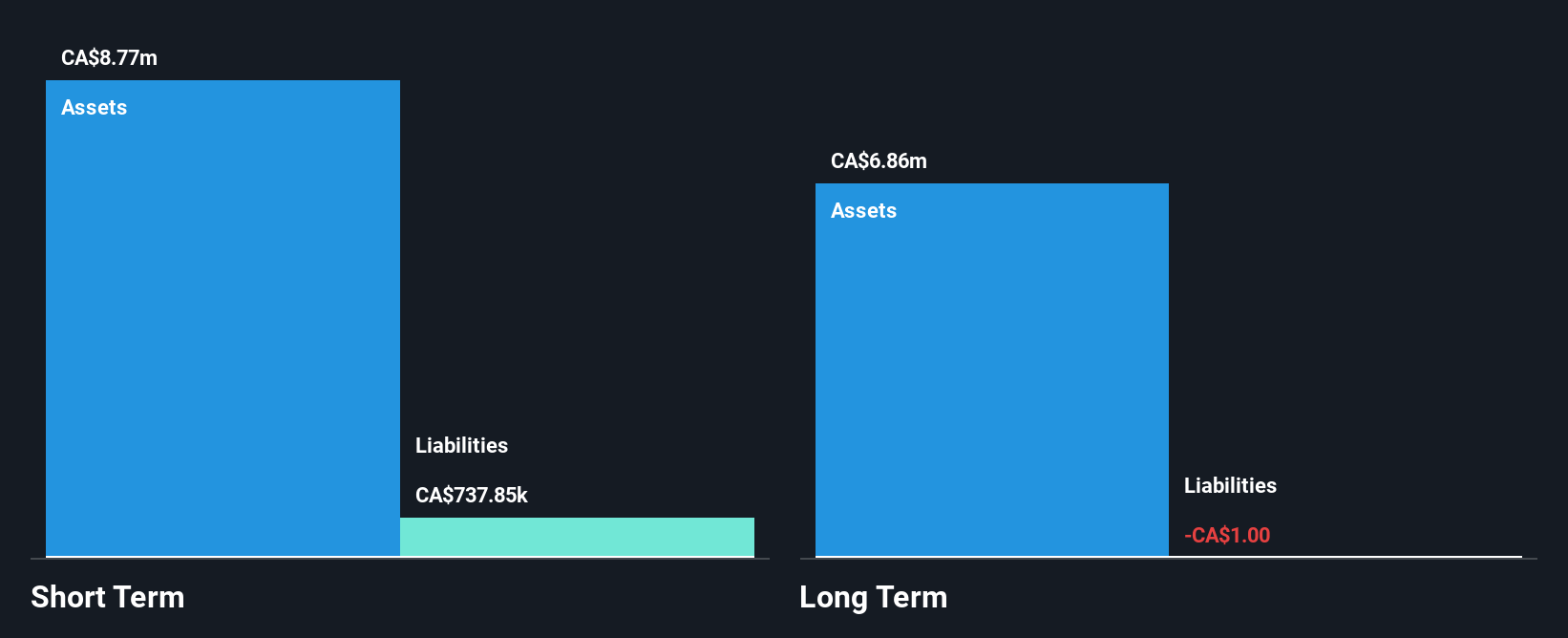

Black Swan Graphene Inc., with a market cap of CA$25.65 million, presents typical features of penny stocks, such as being pre-revenue and unprofitable. The company is debt-free and has no long-term liabilities, which enhances its financial stability. Despite a negative return on equity of -44.23%, Black Swan's short-term assets significantly exceed its liabilities, providing a comfortable liquidity position. Recent board changes include the addition of Rory Godinho, who brings extensive capital markets experience that could aid in raising growth capital. Earnings reports show reduced net losses compared to the previous year, indicating potential operational improvements.

- Click here to discover the nuances of Black Swan Graphene with our detailed analytical financial health report.

- Assess Black Swan Graphene's future earnings estimates with our detailed growth reports.

Make It Happen

- Embark on your investment journey to our 929 TSX Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:HODL

Flawless balance sheet slight.