There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, North Peak Resources (CVE:NPR) stock is up 222% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky North Peak Resources' cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for North Peak Resources

Does North Peak Resources Have A Long Cash Runway?

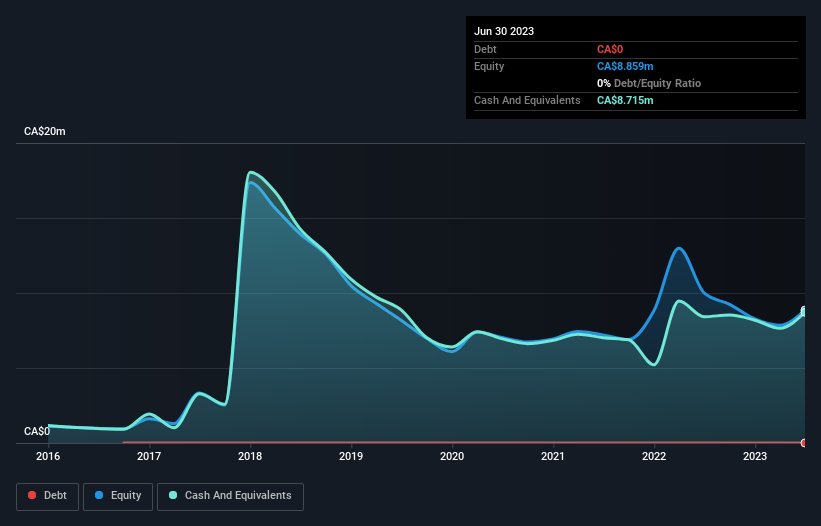

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2023, North Peak Resources had CA$8.7m in cash, and was debt-free. Looking at the last year, the company burnt through CA$2.2m. So it had a cash runway of about 3.9 years from June 2023. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Is North Peak Resources' Cash Burn Changing Over Time?

North Peak Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 45% reduction in cash burn year on year does suggest the company can continue operating for quite some time. North Peak Resources makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For North Peak Resources To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for North Peak Resources to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

North Peak Resources' cash burn of CA$2.2m is about 5.4% of its CA$41m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is North Peak Resources' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about North Peak Resources' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn reduction was also very reassuring. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for North Peak Resources (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if North Peak Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NPR

North Peak Resources

Operates as a gold exploration and development company.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)