- Canada

- /

- Oil and Gas

- /

- TSXV:WIL

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Canadian market has experienced notable fluctuations recently, with bond yields reaching six-month highs before retreating, driven by encouraging U.S. inflation data and ongoing economic strength. Amid these conditions, investors are increasingly exploring opportunities beyond large-cap stocks to uncover potential in smaller or newer companies. Penny stocks, though an older term, continue to represent intriguing prospects for growth at lower price points; when coupled with strong fundamentals and resilient balance sheets, they can offer stability and upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.53 | CA$976.85M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$401.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$122.01M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.73 | CA$651.02M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$222.46M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$179.61M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.00 | CA$137.56M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Radio Fuels Energy (CNSX:CAKE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radio Fuels Energy Corp. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral resource properties with a market cap of CA$12.74 million.

Operations: No revenue segments have been reported for the company.

Market Cap: CA$12.74M

Radio Fuels Energy Corp., with a market cap of CA$12.74 million, remains pre-revenue, focusing on mineral exploration without reported revenue segments. Recently, Palisades Goldcorp Ltd. announced plans to acquire the company, exchanging shares and potentially consolidating resources under Palisades’ management team. Despite historical volatility and a lack of seasoned board experience, Radio Fuels has shown financial improvement with recent net income gains compared to previous losses. The acquisition is subject to shareholder and regulatory approvals and aims for completion in February 2025, which could impact future strategic directions for both entities involved.

- Jump into the full analysis health report here for a deeper understanding of Radio Fuels Energy.

- Understand Radio Fuels Energy's track record by examining our performance history report.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. is involved in the exploration and development of critical metals properties in Namibia, with a market cap of CA$8.71 million.

Operations: Namibia Critical Metals Inc. has not reported any revenue segments.

Market Cap: CA$8.71M

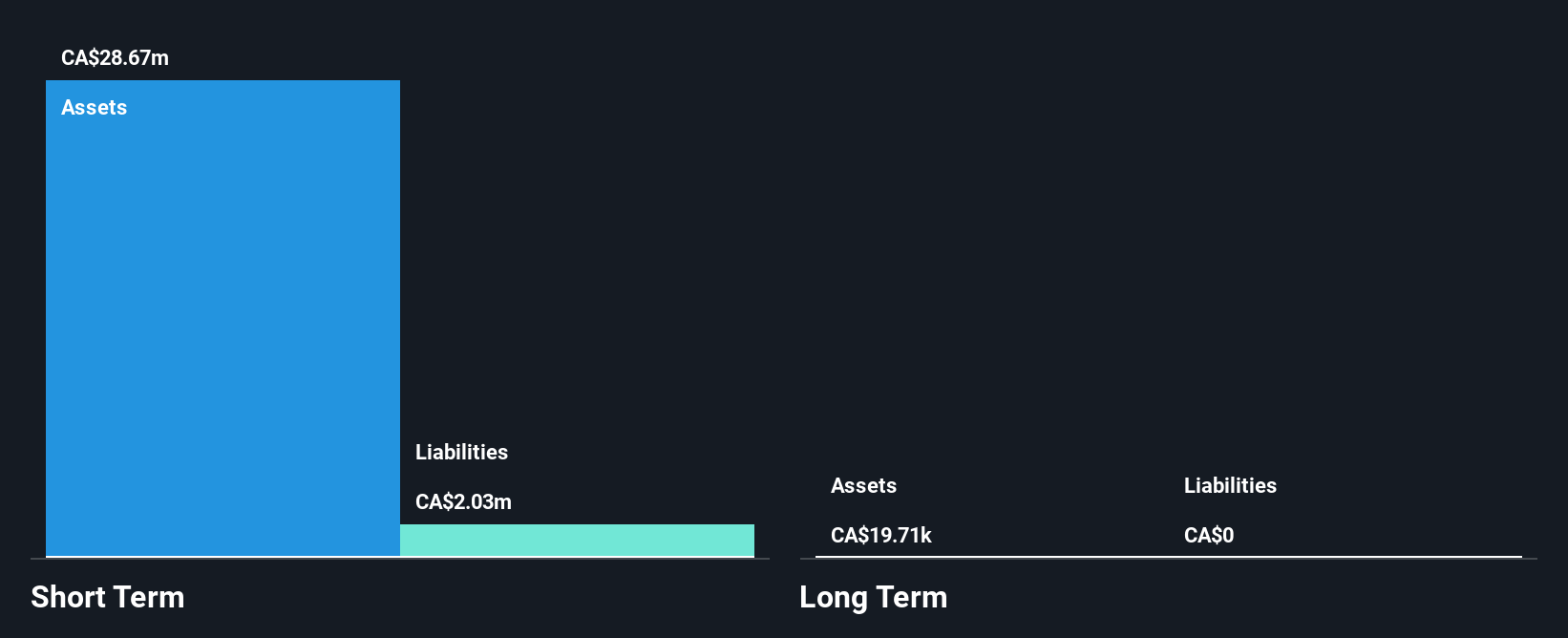

Namibia Critical Metals Inc., with a market cap of CA$8.71 million, is pre-revenue and focuses on critical metals exploration in Namibia. The company has experienced increased losses over the past five years, yet remains debt-free with short-term assets covering liabilities. Recent private placements have bolstered its cash position, offering a temporary runway extension despite high share price volatility. Management and board members are seasoned, averaging 3.8 and 7.6 years in tenure respectively. Although unprofitable with declining earnings, recent capital raises indicate ongoing investor interest amidst challenging financial conditions.

- Navigate through the intricacies of Namibia Critical Metals with our comprehensive balance sheet health report here.

- Evaluate Namibia Critical Metals' historical performance by accessing our past performance report.

Wilton Resources (TSXV:WIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wilton Resources Inc. is a Canadian oil and gas exploration and development company with a market cap of CA$59.39 million.

Operations: The company's revenue is derived from its oil and gas exploration and development segment, amounting to CA$0.0103 million.

Market Cap: CA$59.39M

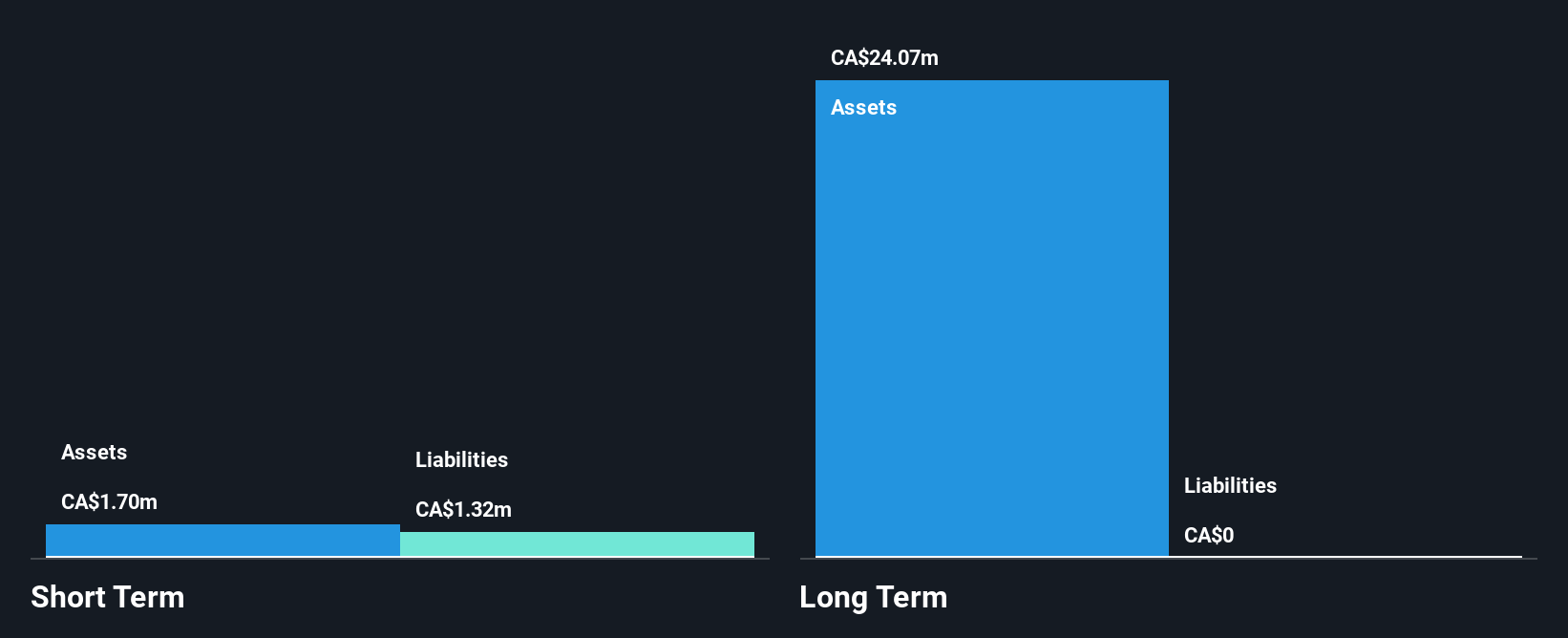

Wilton Resources Inc., with a market cap of CA$59.39 million, is pre-revenue, generating minimal income from its oil and gas exploration activities. Despite being unprofitable, the company has reduced its losses over the past five years by 1.8% annually and remains debt-free with short-term assets exceeding liabilities. The management team and board are highly experienced, averaging 13.4 and 16.3 years in tenure respectively, which may provide stability amidst financial challenges. However, Wilton faces less than a year of cash runway based on current free cash flow levels, highlighting potential liquidity concerns moving forward.

- Click to explore a detailed breakdown of our findings in Wilton Resources' financial health report.

- Gain insights into Wilton Resources' past trends and performance with our report on the company's historical track record.

Where To Now?

- Click this link to deep-dive into the 936 companies within our TSX Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilton Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WIL

Wilton Resources

Operates as an oil and gas exploration and development company in Canada.

Adequate balance sheet low.