- Canada

- /

- Metals and Mining

- /

- TSX:TSL

Top TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of fluctuating bond yields and evolving interest rate expectations, investors are keenly observing how these factors might influence stock valuations. Penny stocks, though often considered a niche investment category, continue to offer intriguing opportunities for growth, particularly within smaller or newer companies. By focusing on those with strong financial health and potential for long-term growth, investors can uncover promising prospects in this often overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.53 | CA$976.85M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$401.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$122.01M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.73 | CA$651.02M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$222.46M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$179.61M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.00 | CA$137.56M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

GoGold Resources (TSX:GGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoGold Resources Inc. focuses on the exploration, development, and production of silver, gold, and copper primarily in Mexico with a market cap of CA$467.93 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to $36.50 million.

Market Cap: CA$467.93M

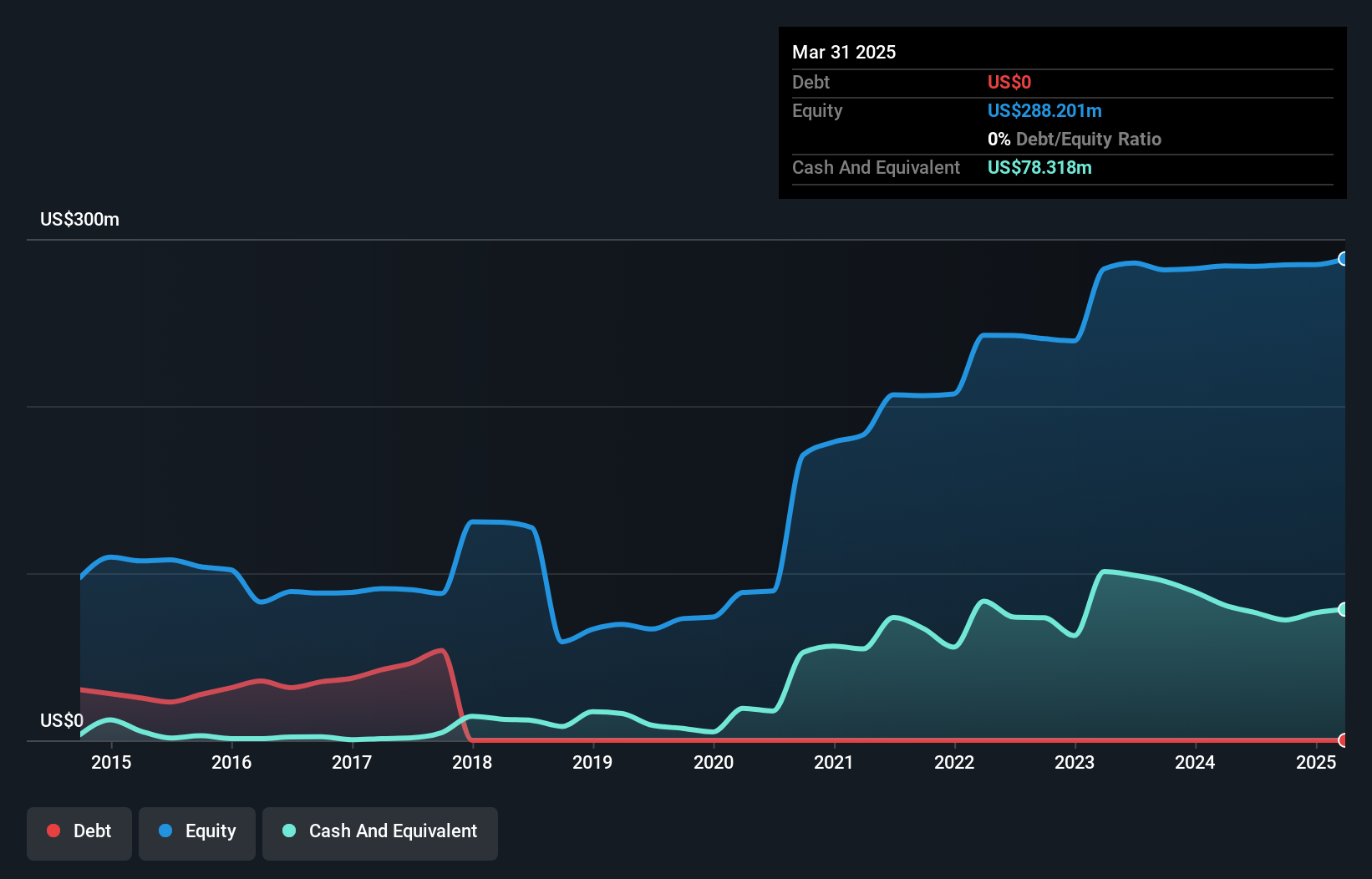

GoGold Resources has shown a significant turnaround, becoming profitable with net income of US$1.58 million for the year ended September 2024, up from a loss the previous year. The company reported sales of US$36.5 million and maintains a strong balance sheet with short-term assets exceeding both short- and long-term liabilities. A recent feasibility study for its Los Ricos South Project suggests potential operational advancements, enhancing its mining capabilities in Mexico. Despite low return on equity at 0.6% and earnings impacted by one-off gains, GoGold remains debt-free with experienced management steering growth prospects forward.

- Unlock comprehensive insights into our analysis of GoGold Resources stock in this financial health report.

- Review our growth performance report to gain insights into GoGold Resources' future.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. provides equipment and technologies for tubular running operations to enhance wellbore integrity and data collection in the energy industry, with a market cap of CA$73.39 million.

Operations: The Energy Products & Services segment generated CA$71.99 million in revenue.

Market Cap: CA$73.39M

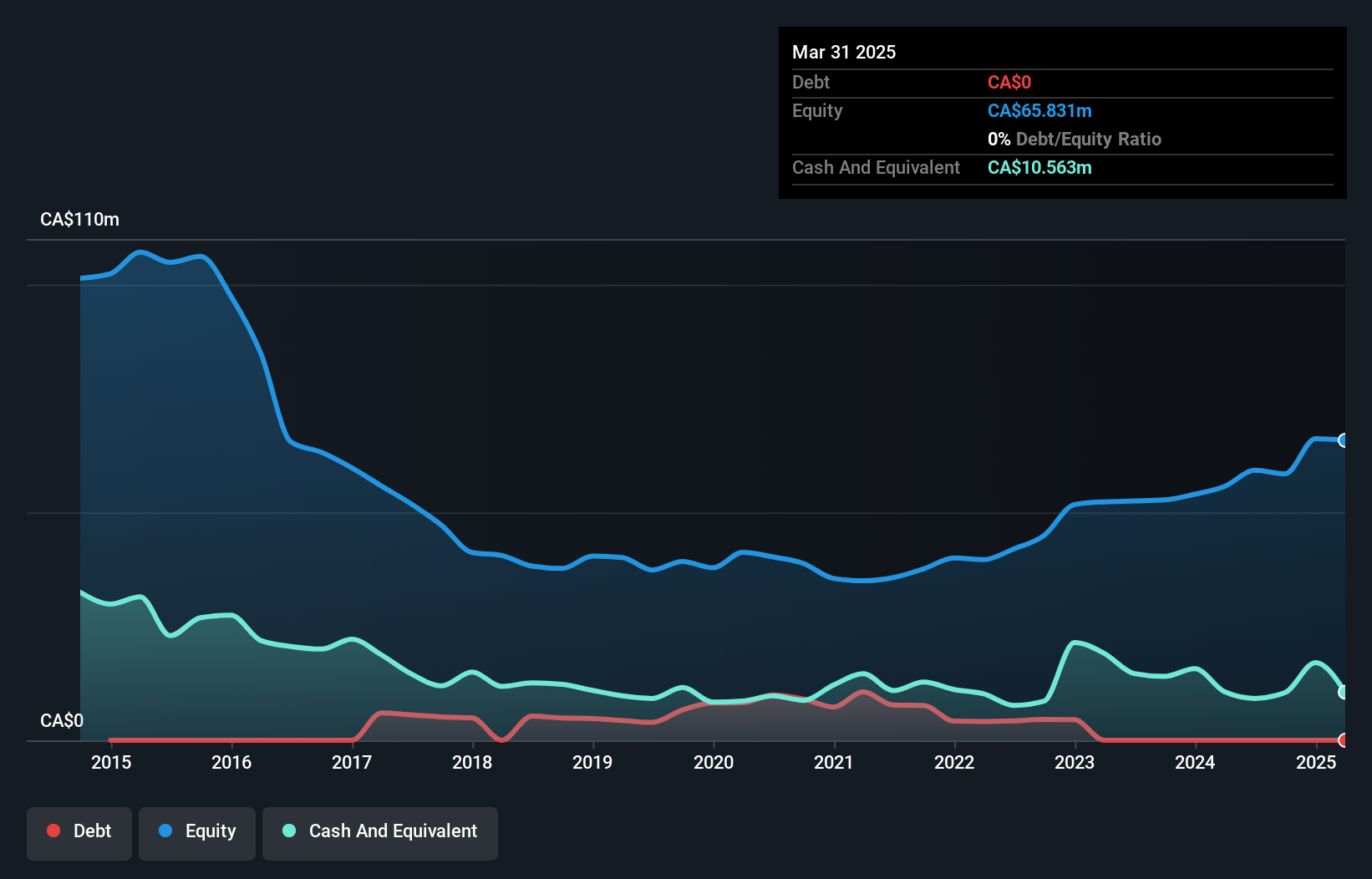

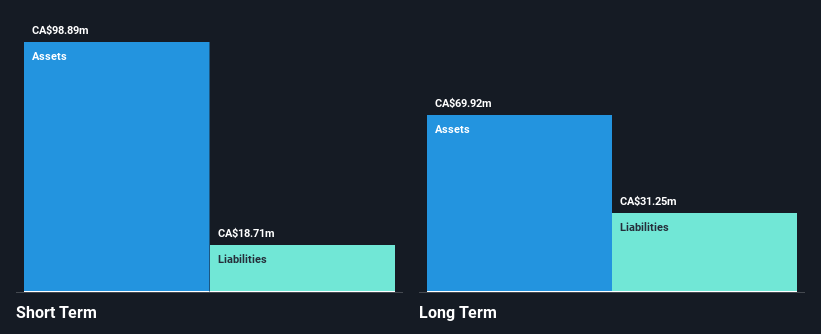

McCoy Global Inc. operates without debt, enhancing its financial stability in the penny stock space. Despite a decline in quarterly sales to CA$15.84 million and net income to CA$0.516 million, the company remains profitable with high-quality earnings and a stable balance sheet, as short-term assets cover both short- and long-term liabilities. The management team's experience supports operational consistency, although recent profit margins have decreased from 16.3% to 10.1%. McCoy trades below estimated fair value and has forecasted revenue growth of 9.03% annually, but its dividend sustainability remains questionable given limited free cash flow coverage.

- Click to explore a detailed breakdown of our findings in McCoy Global's financial health report.

- Explore McCoy Global's analyst forecasts in our growth report.

Tree Island Steel (TSX:TSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tree Island Steel Ltd. manufactures and sells steel wire and fabricated steel wire products in Canada, the United States, and internationally, with a market cap of CA$77.79 million.

Operations: The company's revenue is primarily derived from its Steel Wire Products Industry segment, which generated CA$208.93 million.

Market Cap: CA$77.79M

Tree Island Steel Ltd. operates in the steel wire products industry with a market cap of CA$77.79 million, facing challenges due to its current unprofitability and negative return on equity of -2.07%. Despite this, the company maintains financial stability with no debt and short-term assets exceeding both short- and long-term liabilities. Recent strategic moves include a share repurchase program and consistent dividend payouts, although dividends are not well-covered by earnings or free cash flow. The board's average tenure of 15.6 years suggests seasoned oversight amidst ongoing efforts to reduce losses over time by 10.3% annually over the past five years.

- Navigate through the intricacies of Tree Island Steel with our comprehensive balance sheet health report here.

- Examine Tree Island Steel's past performance report to understand how it has performed in prior years.

Summing It All Up

- Navigate through the entire inventory of 936 TSX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tree Island Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSL

Tree Island Steel

Manufactures and sells steel wire and fabricated steel wire products in Canada, the United States, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives