The Canadian market is navigating a complex landscape, with recent tariff threats and political uncertainties contributing to a cautious investor sentiment. Despite these challenges, opportunities still exist for those willing to explore niche areas like penny stocks. Often representing smaller or newer companies, penny stocks can offer affordability and growth potential when backed by strong financials. In the context of today's market dynamics, let's examine several promising penny stocks that could stand out for their financial strength and long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.61 | CA$168.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.80 | CA$454.52M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.87 | CA$78.41M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$577.33M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$39.87M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.91 | CA$70.12M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$31.16M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.33 | CA$3.17B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market cap of CA$170.67 million.

Operations: The company's revenue from its Building Products segment amounts to $174.31 million.

Market Cap: CA$170.67M

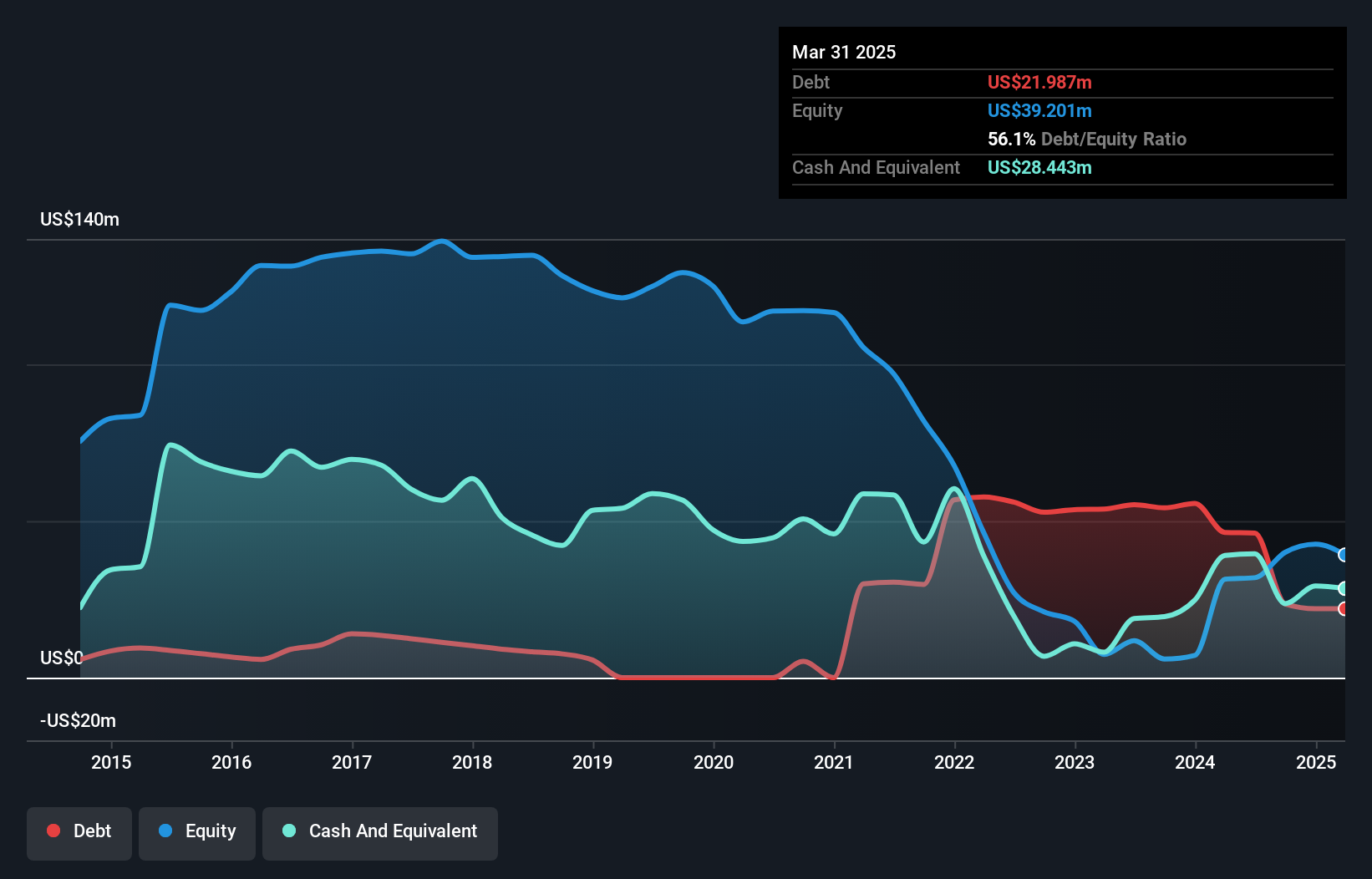

DIRTT Environmental Solutions, with a market cap of CA$170.67 million, has recently become profitable, reporting a net income of US$14.77 million for 2024 compared to a loss the previous year. The company's strong financial position is underscored by its short-term assets exceeding both long-term and short-term liabilities and having more cash than debt. DIRTT's return on equity stands at a high 34.7%, though its interest payments are not well covered by EBIT. Revenue is expected to grow between US$194 million and US$209 million in 2025, reflecting steady growth prospects in the building products segment.

- Navigate through the intricacies of DIRTT Environmental Solutions with our comprehensive balance sheet health report here.

- Understand DIRTT Environmental Solutions' earnings outlook by examining our growth report.

Helium Evolution (TSXV:HEVI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helium Evolution Incorporated focuses on the exploration and production of helium in southern Saskatchewan, with a market cap of CA$19.21 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$19.21M

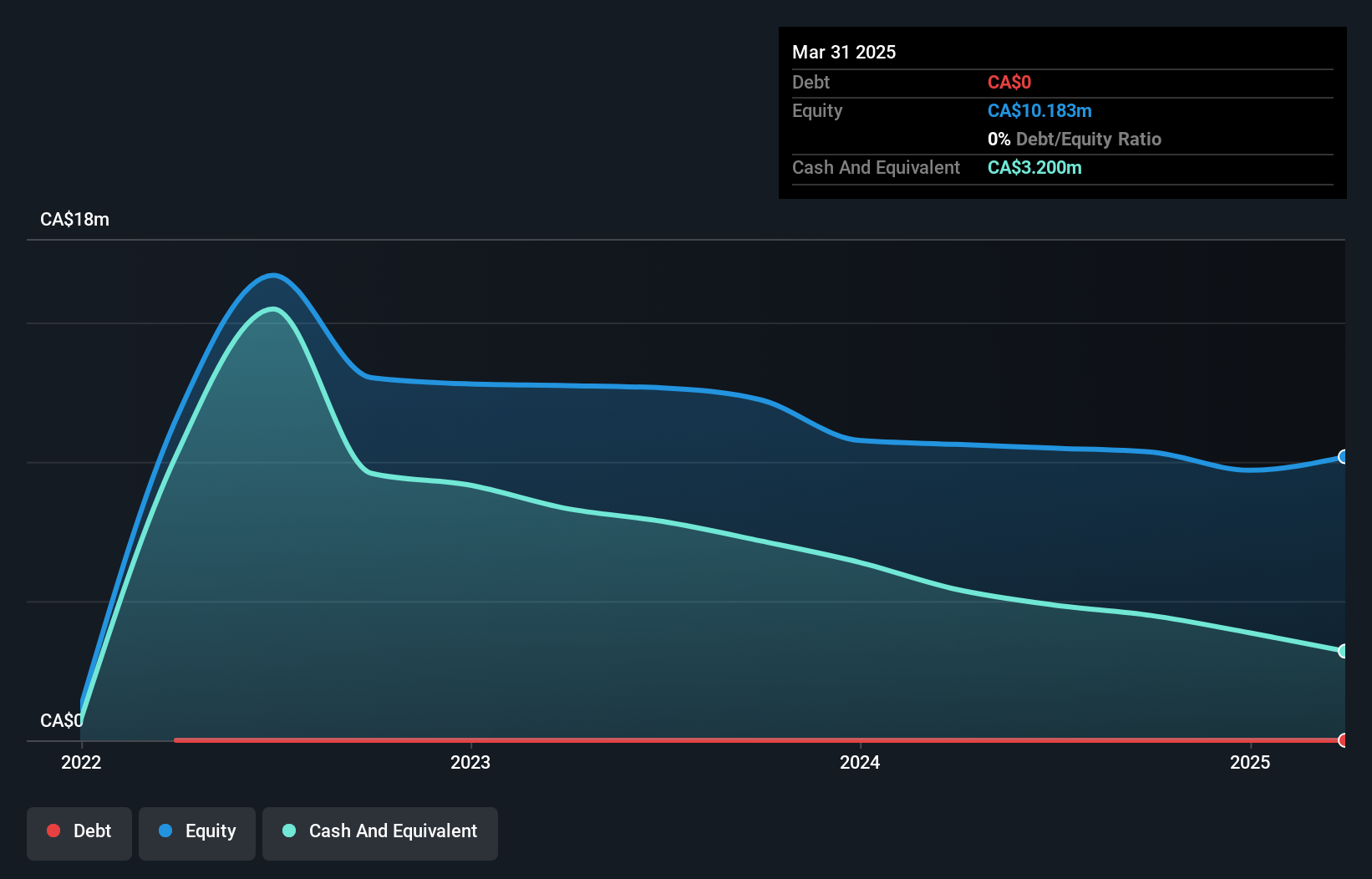

Helium Evolution Incorporated, with a market cap of CA$19.21 million, is currently pre-revenue and focuses on helium exploration in Saskatchewan. Recent developments include a private placement to raise CA$2.71 million and plans for production facilities by late 2025. Preliminary test results from multiple wells show promising helium content significantly above the commercial threshold, indicating strong potential for efficient recovery and processing. The company maintains a debt-free balance sheet with short-term assets exceeding liabilities, providing some financial stability despite its unprofitable status and high share price volatility over the past three months.

- Click here to discover the nuances of Helium Evolution with our detailed analytical financial health report.

- Assess Helium Evolution's previous results with our detailed historical performance reports.

New Found Gold (TSXV:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador, and Ontario, with a market cap of CA$473.40 million.

Operations: New Found Gold Corp. does not have any reported revenue segments.

Market Cap: CA$473.4M

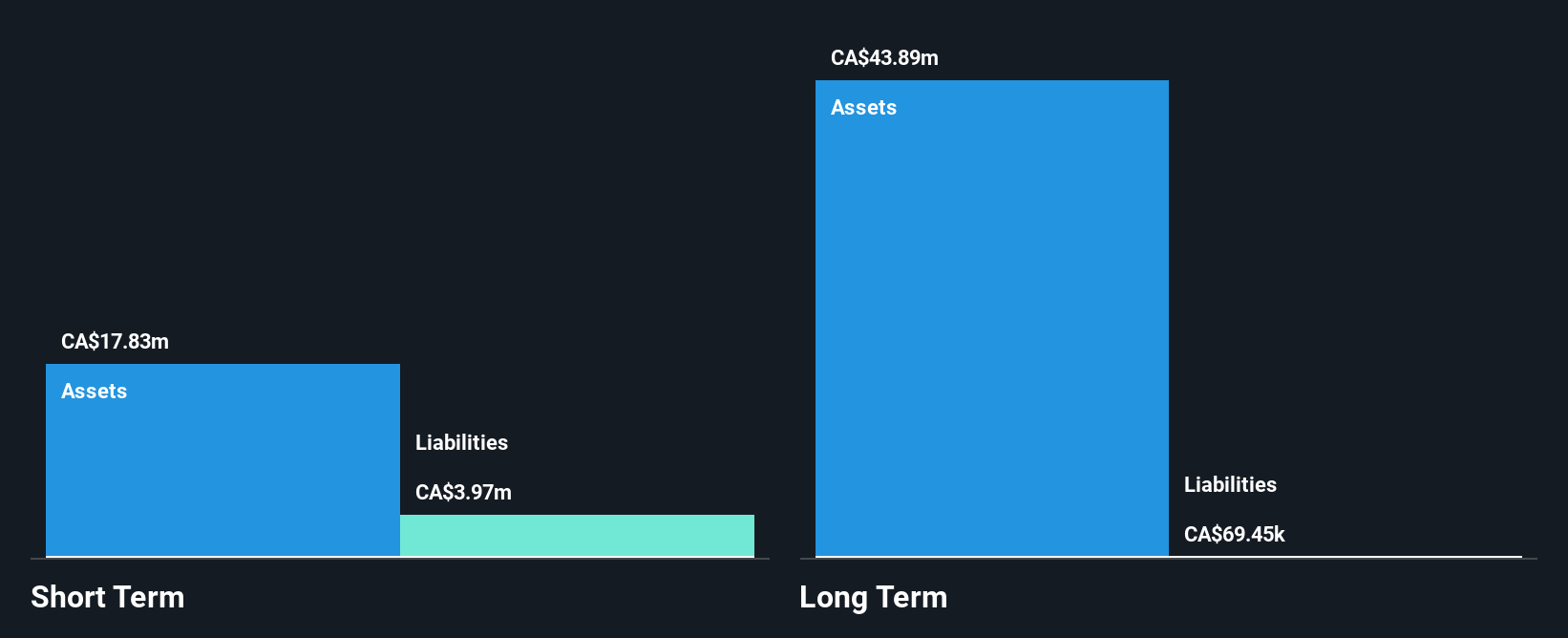

New Found Gold Corp., with a market cap of CA$473.40 million, is pre-revenue and focuses on mineral exploration in Newfoundland and Labrador. The company recently announced promising drill results from its Queensway Gold Project, highlighting high-grade gold intersections at the Golden Dome Zone. Despite having no revenue streams, New Found maintains a debt-free balance sheet with short-term assets exceeding liabilities. Recent executive changes include appointing Keith Boyle as CEO and Chad Williams to the board, both bringing significant mining industry experience. However, the company faces challenges with less than a year of cash runway based on current free cash flow levels.

- Jump into the full analysis health report here for a deeper understanding of New Found Gold.

- Gain insights into New Found Gold's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Dive into all 937 of the TSX Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DRT

DIRTT Environmental Solutions

Operates as an interior construction company in Canada.

Good value with adequate balance sheet.

Market Insights

Community Narratives