- Canada

- /

- Personal Products

- /

- TSXV:LOVE

3 TSX Penny Stocks With Market Caps Larger Than CA$10M

Reviewed by Simply Wall St

As we approach the end of 2025, Canadian markets have shown robust performance with the TSX delivering solid gains, supported by favorable economic indicators and central bank policies. For investors exploring beyond established names, penny stocks—often smaller or newer companies—remain a relevant area of interest. Despite their historical connotations, these stocks can offer unique growth opportunities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.19 | CA$55.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.46 | CA$249.69M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.30 | CA$123.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.46 | CA$4.01M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$51.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.30 | CA$831.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.14 | CA$153.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.06 | CA$197.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 389 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cannara Biotech (TSXV:LOVE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cannara Biotech Inc. and its subsidiaries focus on the indoor cultivation, processing, and sale of cannabis and cannabis-derivative products in Canada, with a market cap of CA$161.32 million.

Operations: The company generates revenue primarily from its cannabis operations, which account for CA$103.02 million, and additionally from real estate operations totaling CA$3.84 million.

Market Cap: CA$161.32M

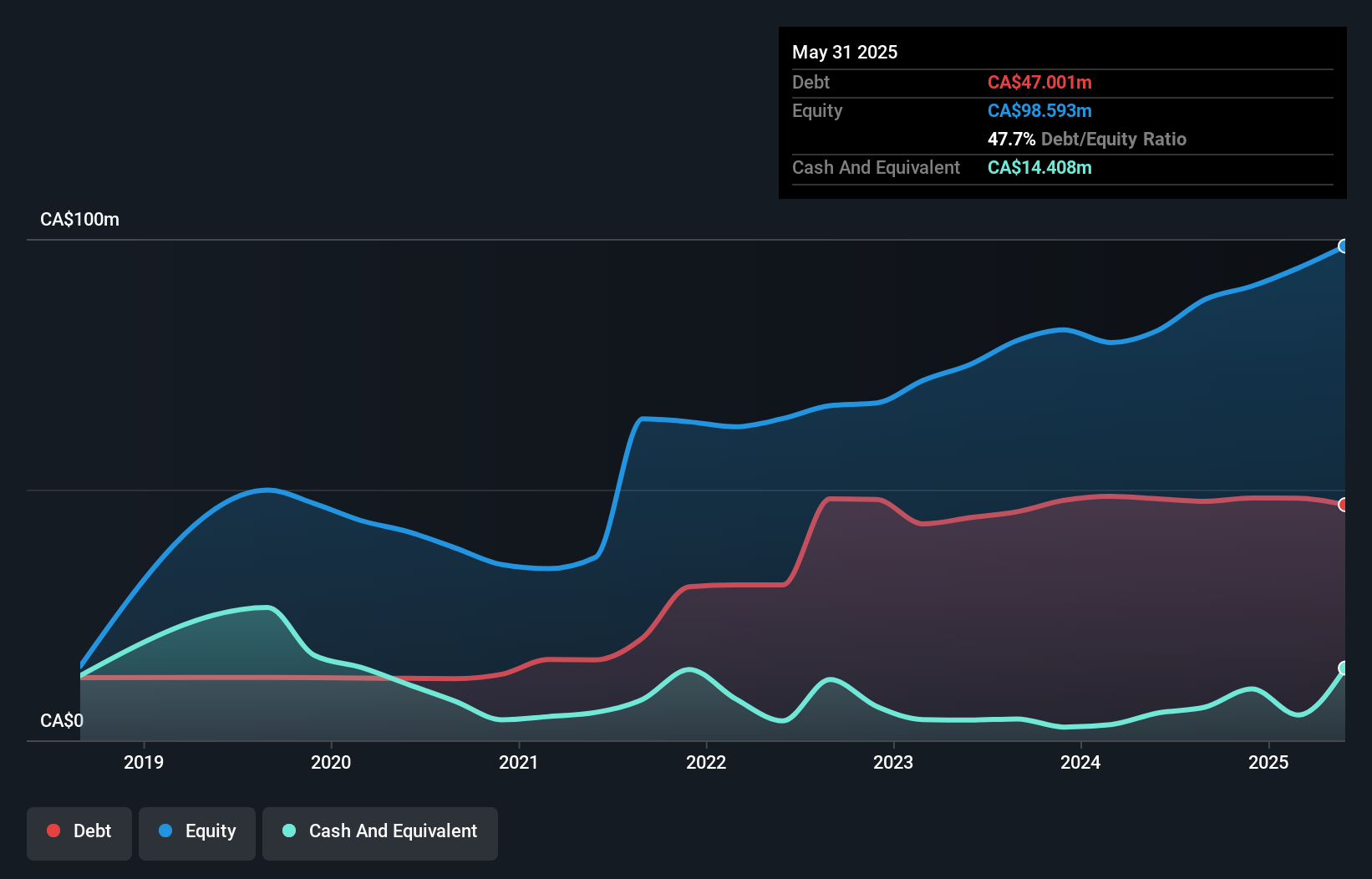

Cannara Biotech Inc. reported robust financial performance for the year ending August 31, 2025, with revenue rising to CA$107.32 million from CA$82.15 million the previous year and net income doubling to CA$13.08 million. This growth reflects strong cannabis operations despite a slight decline in real estate sales. The recent inclusion in the S&P/TSX Venture Composite Index may enhance visibility among investors, although the passing of esteemed board member Jack M. Kay could impact leadership dynamics temporarily. As a penny stock, Cannara's steady earnings improvement and market presence are noteworthy for potential investors seeking exposure in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Cannara Biotech.

- Evaluate Cannara Biotech's prospects by accessing our earnings growth report.

Monument Mining (TSXV:MMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Monument Mining Limited is involved in the production, exploration, and development of precious metals across Canada, Australia, and Malaysia with a market cap of CA$362.58 million.

Operations: The company generates revenue from its gold mine operations amounting to $111.67 million.

Market Cap: CA$362.58M

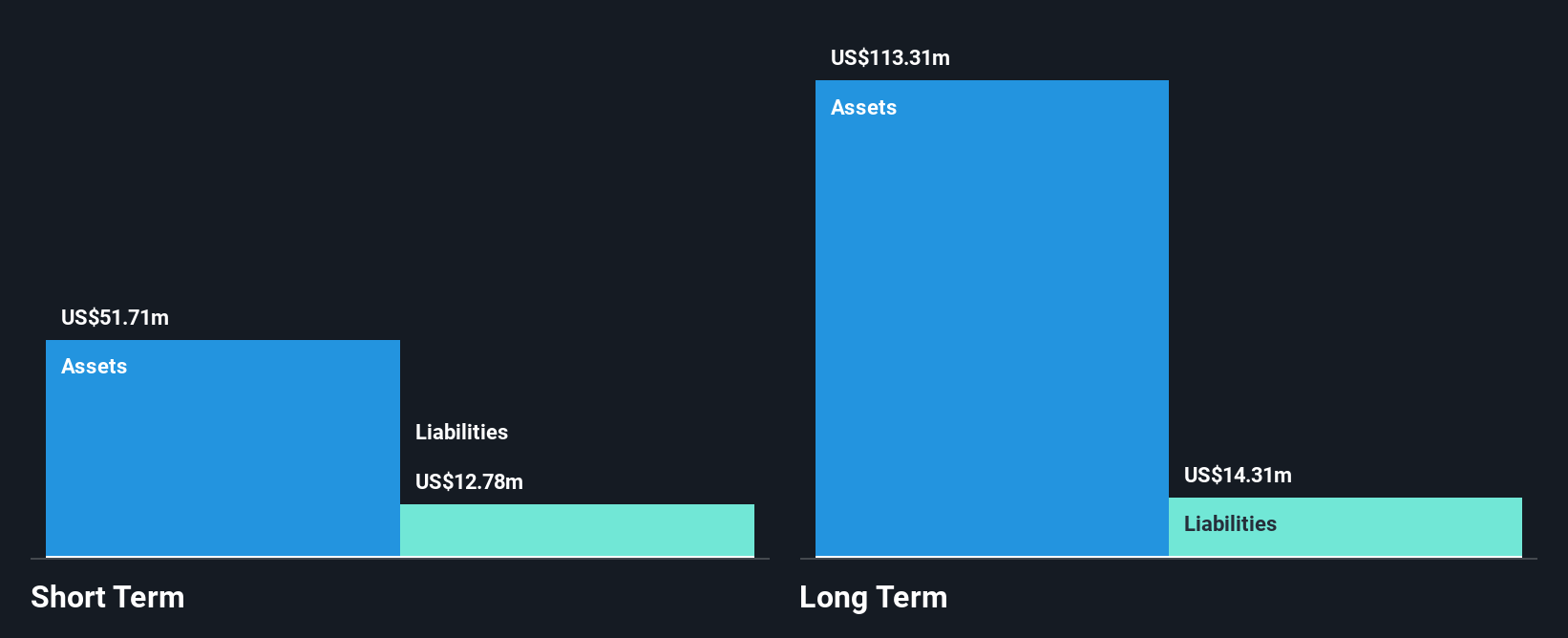

Monument Mining Limited has demonstrated significant financial growth, with earnings surging 372.9% over the past year, surpassing industry averages. The company reported quarterly sales of US$32.4 million and a net income of US$10.5 million, reflecting improved profitability and strong gold production results from its Selinsing Gold Mine expansion efforts in Malaysia. Despite high share price volatility, Monument's financial health is robust with no debt and substantial asset coverage for liabilities. Recent successful drill results at Buffalo Reef/Felda indicate potential for further resource expansion, positioning Monument favorably within the penny stock landscape in Canada’s mining sector.

- Jump into the full analysis health report here for a deeper understanding of Monument Mining.

- Assess Monument Mining's future earnings estimates with our detailed growth reports.

PJX Resources (TSXV:PJX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PJX Resources Inc. is involved in the acquisition, exploration, and development of mineral resource properties in Canada, with a market cap of CA$17.76 million.

Operations: PJX Resources Inc. does not report any revenue segments as it focuses on the acquisition, exploration, and development of mineral resource properties in Canada.

Market Cap: CA$17.76M

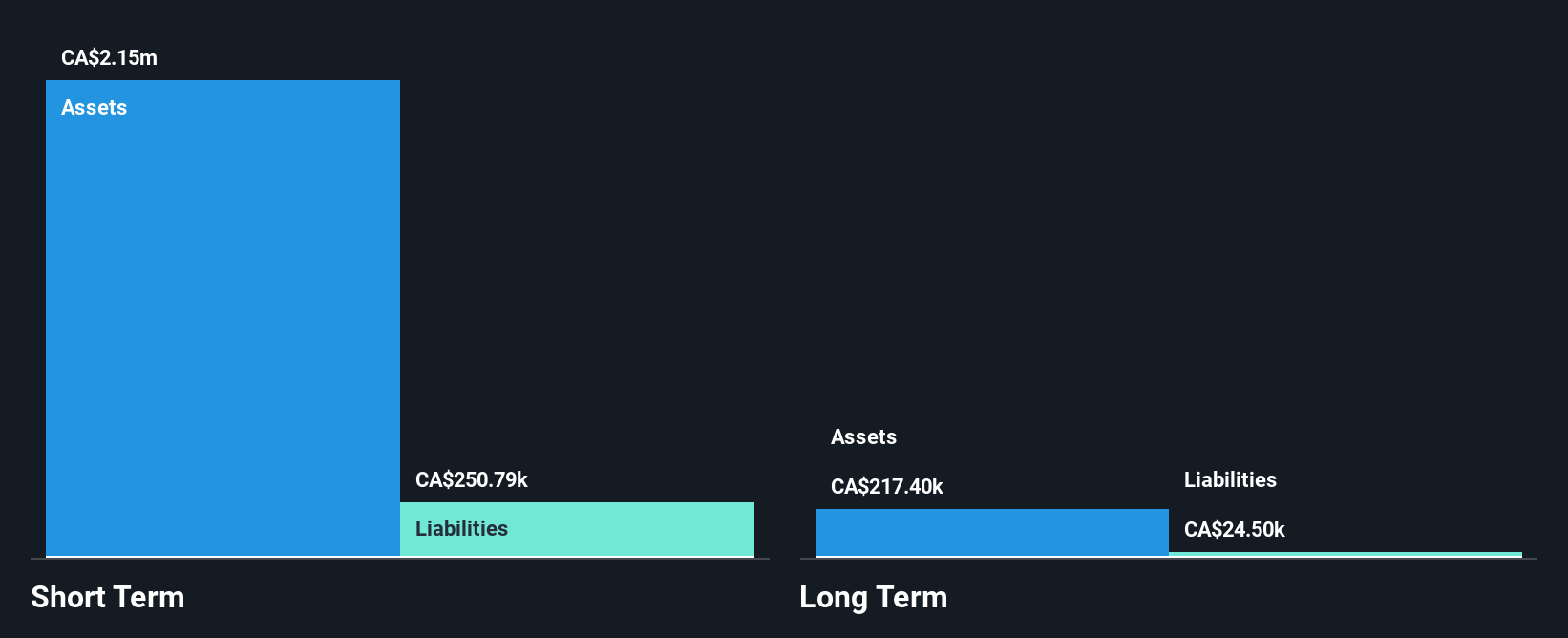

PJX Resources Inc., with a market cap of CA$17.76 million, is pre-revenue and remains unprofitable, reporting a net loss of CA$1.33 million for the third quarter of 2025. Despite its financial challenges, PJX is debt-free and maintains sufficient short-term assets (CA$2.2M) to cover both short-term (CA$250.8K) and long-term liabilities (CA$24.5K). However, the company faces high weekly volatility compared to most Canadian stocks and has less than a year of cash runway based on current free cash flow trends. The seasoned board provides stability amidst these financial pressures.

- Get an in-depth perspective on PJX Resources' performance by reading our balance sheet health report here.

- Understand PJX Resources' track record by examining our performance history report.

Key Takeaways

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 386 more companies for you to explore.Click here to unveil our expertly curated list of 389 TSX Penny Stocks.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LOVE

Cannara Biotech

Engages in the indoor cultivation, processing, and sale of cannabis and cannabis-derivative products in Canada.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion